- English (PDF)

Globalization: A Brief Overview

By IMF Staff

A perennial challenge facing all of the world's countries, regardless of their level of economic development, is achieving financial stability, economic growth, and higher living standards. There are many different paths that can be taken to achieve these objectives, and every country's path will be different given the distinctive nature of national economies and political systems. The ingredients contributing to China's high growth rate over the past two decades have, for example, been very different from those that have contributed to high growth in countries as varied as Malaysia and Malta. |

Yet, based on experiences throughout the world, several basic principles seem to underpin greater prosperity. These include investment (particularly foreign direct investment), the spread of technology, strong institutions, sound macroeconomic policies, an educated workforce, and the existence of a market economy. Furthermore, a common denominator which appears to link nearly all high-growth countries together is their participation in, and integration with, the global economy.

There is substantial evidence, from countries of different sizes and different regions, that as countries "globalize" their citizens benefit, in the form of access to a wider variety of goods and services, lower prices, more and better-paying jobs, improved health, and higher overall living standards. It is probably no mere coincidence that over the past 20 years, as a number of countries have become more open to global economic forces, the percentage of the developing world living in extreme poverty—defined as living on less than $1 per day—has been cut in half.

As much as has been achieved in connection with globalization, there is much more to be done. Regional disparities persist: while poverty fell in East and South Asia, it actually rose in sub-Saharan Africa. The UN's Human Development Report notes there are still around 1 billion people surviving on less than $1 per day—with 2.6 billion living on less than $2 per day. Proponents of globalization argue that this is not because of too much globalization, but rather too little. And the biggest threat to continuing to raise living standards throughout the world is not that globalization will succeed but that it will fail. It is the people of developing economies who have the greatest need for globalization, as it provides them with the opportunities that come with being part of the world economy.

These opportunities are not without risks—such as those arising from volatile capital movements. The International Monetary Fund works to help economies manage or reduce these risks, through economic analysis and policy advice and through technical assistance in areas such as macroeconomic policy, financial sector sustainability, and the exchange-rate system.

The risks are not a reason to reverse direction, but for all concerned—in developing and advanced countries, among both investors and recipients—to embrace policy changes to build strong economies and a stronger world financial system that will produce more rapid growth and ensure that poverty is reduced.

The following is a brief overview to help guide anyone interested in gaining a better understanding of the many issues associated with globalization.

What is Globalization?

Economic "globalization" is a historical process, the result of human innovation and technological progress. It refers to the increasing integration of economies around the world, particularly through the movement of goods, services, and capital across borders. The term sometimes also refers to the movement of people (labor) and knowledge (technology) across international borders. There are also broader cultural, political, and environmental dimensions of globalization.

The term "globalization" began to be used more commonly in the 1980s, reflecting technological advances that made it easier and quicker to complete international transactions—both trade and financial flows. It refers to an extension beyond national borders of the same market forces that have operated for centuries at all levels of human economic activity—village markets, urban industries, or financial centers.

There are countless indicators that illustrate how goods, capital, and people, have become more globalized.

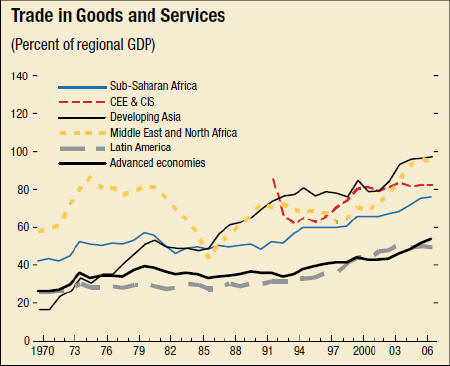

- The value of trade (goods and services) as a percentage of world GDP increased from 42.1 percent in 1980 to 62.1 percent in 2007.

- Foreign direct investment increased from 6.5 percent of world GDP in 1980 to 31.8 percent in 2006.

- The stock of international claims (primarily bank loans), as a percentage of world GDP, increased from roughly 10 percent in 1980 to 48 percent in 2006.1

- The number of minutes spent on cross-border telephone calls, on a per-capita basis, increased from 7.3 in 1991 to 28.8 in 2006.2

- The number of foreign workers has increased from 78 million people (2.4 percent of the world population) in 1965 to 191 million people (3.0 percent of the world population) in 2005.

The growth in global markets has helped to promote efficiency through competition and the division of labor—the specialization that allows people and economies to focus on what they do best. Global markets also offer greater opportunity for people to tap into more diversified and larger markets around the world. It means that they can have access to more capital, technology, cheaper imports, and larger export markets. But markets do not necessarily ensure that the benefits of increased efficiency are shared by all. Countries must be prepared to embrace the policies needed, and, in the case of the poorest countries, may need the support of the international community as they do so.

The broad reach of globalization easily extends to daily choices of personal, economic, and political life. For example, greater access to modern technologies, in the world of health care, could make the difference between life and death. In the world of communications, it would facilitate commerce and education, and allow access to independent media. Globalization can also create a framework for cooperation among nations on a range of non-economic issues that have cross-border implications, such as immigration, the environment, and legal issues. At the same time, the influx of foreign goods, services, and capital into a country can create incentives and demands for strengthening the education system, as a country's citizens recognize the competitive challenge before them.

Perhaps more importantly, globalization implies that information and knowledge get dispersed and shared. Innovators—be they in business or government—can draw on ideas that have been successfully implemented in one jurisdiction and tailor them to suit their own jurisdiction. Just as important, they can avoid the ideas that have a clear track record of failure. Joseph Stiglitz, a Nobel laureate and frequent critic of globalization, has nonetheless observed that globalization "has reduced the sense of isolation felt in much of the developing world and has given many people in the developing world access to knowledge well beyond the reach of even the wealthiest in any country a century ago."3

International Trade

A core element of globalization is the expansion of world trade through the elimination or reduction of trade barriers, such as import tariffs. Greater imports offer consumers a wider variety of goods at lower prices, while providing strong incentives for domestic industries to remain competitive. Exports, often a source of economic growth for developing nations, stimulate job creation as industries sell beyond their borders. More generally, trade enhances national competitiveness by driving workers to focus on those vocations where they, and their country, have a competitive advantage. Trade promotes economic resilience and flexibility, as higher imports help to offset adverse domestic supply shocks. Greater openness can also stimulate foreign investment, which would be a source of employment for the local workforce and could bring along new technologies—thus promoting higher productivity.

Restricting international trade—that is, engaging in protectionism—generates adverse consequences for a country that undertakes such a policy. For example, tariffs raise the prices of imported goods, harming consumers, many of which may be poor. Protectionism also tends to reward concentrated, well-organized and politically-connected groups, at the expense of those whose interests may be more diffuse (such as consumers). It also reduces the variety of goods available and generates inefficiency by reducing competition and encouraging resources to flow into protected sectors.

Developing countries can benefit from an expansion in international trade. Ernesto Zedillo, the former president of Mexico, has observed that, "In every case where a poor nation has significantly overcome its poverty, this has been achieved while engaging in production for export markets and opening itself to the influx of foreign goods, investment, and technology."4 And the trend is clear. In the late 1980s, many developing countries began to dismantle their barriers to international trade, as a result of poor economic performance under protectionist polices and various economic crises. In the 1990s, many former Eastern bloc countries integrated into the global trading system and developing Asia—one of the most closed regions to trade in 1980—progressively dismantled barriers to trade. Overall, while the average tariff rate applied by developing countries is higher than that applied by advanced countries, it has declined significantly over the last several decades.

The implications of globalized financial markets

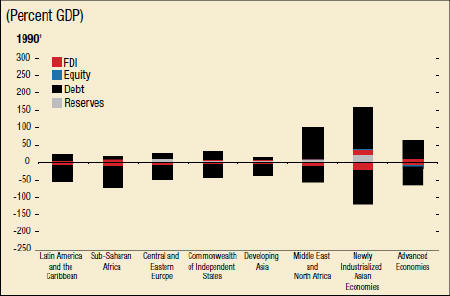

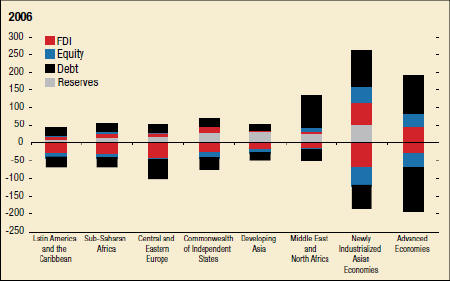

The world's financial markets have experienced a dramatic increase in globalization in recent years. Global capital flows fluctuated between 2 and 6 percent of world GDP during the period 1980-95, but since then they have risen to 14.8 percent of GDP, and in 2006 they totaled $7.2 trillion, more than tripling since 1995. The most rapid increase has been experienced by advanced economies, but emerging markets and developing countries have also become more financially integrated. As countries have strengthened their capital markets they have attracted more investment capital, which can enable a broader entrepreneurial class to develop, facilitate a more efficient allocation of capital, encourage international risk sharing, and foster economic growth.

Cross-Border Assets and Liabilities (Percent GDP)

1Data series bein in 1995 for central and eastern Europe and the Commonweatlth of Independent States.

Yet there is an energetic debate underway, among leading academics and policy experts, on the precise impact of financial globalization. Some see it as a catalyst for economic growth and stability. Others see it as injecting dangerous—and often costly—volatility into the economies of growing middle-income countries.

A recent paper by the IMF's Research Department takes stock of what is known about the effects of financial globalization.5 The analysis of the past 30 years of data reveals two main lessons for countries to consider.

First, the findings support the view that countries must carefully weigh the risks and benefits of unfettered capital flows. The evidence points to largely unambiguous gains from financial integration for advanced economies. In emerging and developing countries, certain factors are likely to influence the effect of financial globalization on economic volatility and growth: countries with well-developed financial sectors, strong institutions, sounds macroeconomic policies, and substantial trade openness are more likely to gain from financial liberalization and less likely to risk increased macroeconomic volatility and to experience financial crises. For example, well-developed financial markets help moderate boom-bust cycles that can be triggered by surges and sudden stops in international capital flows, while strong domestic institutions and sound macroeconomic policies help attract "good" capital, such as portfolio equity flows and FDI.

The second lesson to be drawn from the study is that there are also costs associated with being overly cautious about opening to capital flows. These costs include lower international trade, higher investment costs for firms, poorer economic incentives, and additional administrative/monitoring costs. Opening up to foreign investment may encourage changes in the domestic economy that eliminate these distortions and help foster growth.

Looking forward, the main policy lesson that can be drawn from these results is that capital account liberalization should be pursued as part of a broader reform package encompassing a country's macroeconomic policy framework, domestic financial system, and prudential regulation. Moreover, long-term, non-debt-creating flows, such as FDI, should be liberalized before short-term, debt-creating inflows. Countries should still weigh the possible risks involved in opening up to capital flows against the efficiency costs associated with controls, but under certain conditions (such as good institutions, sound domestic and foreign policies, and developed financial markets) the benefits from financial globalization are likely to outweigh the risks.

Globalization, income inequality, and poverty

As some countries have embraced globalization, and experienced significant income increases, other countries that have rejected globalization, or embraced it only tepidly, have fallen behind. A similar phenomenon is at work within countries—some people have, inevitably, been bigger beneficiaries of globalization than others.

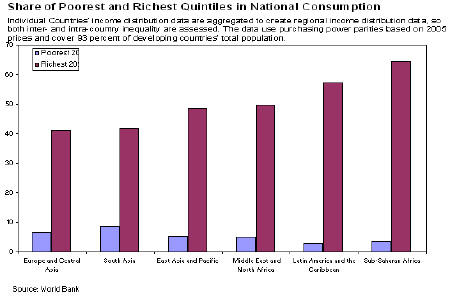

Over the past two decades, income inequality has risen in most regions and countries. At the same time, per capita incomes have risen across virtually all regions for even the poorest segments of population, indicating that the poor are better off in an absolute sense during this phase of globalization, although incomes for the relatively well off have increased at a faster pace. Consumption data from groups of developing countries reveal the striking inequality that exists between the richest and the poorest in populations across different regions.

As discussed in the October 2007 issue of the World Economic Outlook, one must keep in mind that there are many sources of inequality. Contrary to popular belief, increased trade globalization is associated with a decline in inequality. The spread of technological advances and increased financial globalization—and foreign direct investment in particular—have instead contributed more to the recent rise in inequality by raising the demand for skilled labor and increasing the returns to skills in both developed and developing countries. Hence, while everyone benefits, those with skills benefit more.

It is important to ensure that the gains from globalization are more broadly shared across the population. To this effect, reforms to strengthen education and training would help ensure that workers have the appropriate skills for the evolving global economy. Policies that broaden the access of finance to the poor would also help, as would further trade liberalization that boosts agricultural exports from developing countries. Additional programs may include providing adequate income support to cushion, but not obstruct, the process of change, and also making health care less dependent on continued employment and increasing the portability of pension benefits in some countries.

Equally important, globalization should not be rejected because its impact has left some people unemployed. The dislocation may be a function of forces that have little to do with globalization and more to do with inevitable technological progress. And, the number of people who "lose" under globalization is likely to be outweighed by the number of people who "win."

Martin Wolf, the Financial Times columnist, highlights one of the fundamental contradictions inherent in those who bemoan inequality, pointing out that this charge amounts to arguing "that it would be better for everybody to be equally poor than for some to become significantly better off, even if, in the long run, this will almost certainly lead to advances for everybody."6

Indeed, globalization has helped to deliver extraordinary progress for people living in developing nations. One of the most authoritative studies of the subject has been carried out by World Bank economists David Dollar and Aart Kraay.7 They concluded that since 1980, globalization has contributed to a reduction in poverty as well as a reduction in global income inequality. They found that in "globalizing" countries in the developing world, income per person grew three-and-a-half times faster than in "non-globalizing" countries, during the 1990s. In general, they noted, "higher growth rates in globalizing developing countries have translated into higher incomes for the poor." Dollar and Kraay also found that in virtually all events in which a country experienced growth at a rate of two percent or more, the income of the poor rose.

Critics point to those parts of the world that have achieved few gains during this period and highlight it as a failure of globalization. But that is to misdiagnose the problem. While serving as Secretary-General of the United Nations, Kofi Annan pointed out that "the main losers in today's very unequal world are not those who are too much exposed to globalization. They are those who have been left out."8 A recent BBC World Service poll found that on average 64 percent of those polled—in 27 out of 34 countries—held the view that the benefits and burdens of "the economic developments of the last few years" have not been shared fairly. In developed countries, those who have this view of unfairness are more likely to say that globalization is growing too quickly. In contrast, in some developing countries, those who perceive such unfairness are more likely to say globalization is proceeding too slowly.

As individuals and institutions work to raise living standards throughout the world, it will be critically important to create a climate that enables these countries to realize maximum benefits from globalization. That means focusing on macroeconomic stability, transparency in government, a sound legal system, modern infrastructure, quality education, and a deregulated economy.

Myths about globalization

No discussion of globalization would be complete without dispelling some of the myths that have been built up around it.

Downward pressure on wages: Globalization is rarely the primary factor that fosters wage moderation in low-skilled work conducted in developed countries. As discussed in a recent issue of the World Economic Outlook, a more significant factor is technology. As more work can be mechanized, and as fewer people are needed to do a given job than in the past, the demand for that labor will fall, and as a result the prevailing wages for that labor will be affected as well.

The "race to the bottom": Globalization has not caused the world's multinational corporations to simply scour the globe in search of the lowest-paid laborers. There are numerous factors that enter into corporate decisions on where to source products, including the supply of skilled labor, economic and political stability, the local infrastructure, the quality of institutions, and the overall business climate. In an open global market, while jurisdictions do compete with each other to attract investment, this competition incorporates factors well beyond just the hourly wage rate. According to the UN Information Service, the developed world hosts two-thirds of the world's inward foreign direct investment. The 49 least developed countries—the poorest of the developing countries—account for around 2 per cent of the total inward FDI stock of developing countries.

Nor is it true that multinational corporations make a consistent practice of operating sweatshops in low-wage countries, with poor working conditions and substandard wages. While isolated examples of this can surely be uncovered, it is well established that multinationals, on average, pay higher wages than what is standard in developing nations, and offer higher labor standards.9

Globalization is irreversible: In the long run, globalization is likely to be an unrelenting phenomenon. But for significant periods of time, its momentum can be hindered by a variety of factors, ranging from political will to availability of infrastructure. Indeed, the world was thought to be on an irreversible path toward peace and prosperity early in the early 20th century, until the outbreak of Word War I. That war, coupled with the Great Depression, and then World War II, dramatically set back global economic integration. And in many ways, we are still trying to recover the momentum we lost over the past 90 years or so.

That fragility of nearly a century ago still exists today—as we saw in the aftermath of September 11th, when U.S. air travel came to a halt, financial markets shut down, and the economy weakened. The current turmoil in financial markets also poses great difficulty for the stability and reliability of those markets, as well as for the global economy. Credit market strains have intensified and spread across asset classes and banks, precipitating a financial shock that many have characterized as the most serious since the 1930s. These episodes are reminders that a breakdown in globalization—meaning a slowdown in the global flows of goods, services, capital, and people—can have extremely adverse consequences.

Openness to globalization will, on its own, deliver economic growth: Integrating with the global economy is, as economists like to say, a necessary, but not sufficient, condition for economic growth. For globalization to be able to work, a country cannot be saddled with problems endemic to many developing countries, from a corrupt political class, to poor infrastructure, and macroeconomic instability.

The shrinking state: Technologies that facilitate communication and commerce have curbed the power of some despots throughout the world, but in a globalized world governments take on new importance in one critical respect, namely, setting, and enforcing, rules with respect to contracts and property rights. The potential of globalization can never be realized unless there are rules and regulations in place, and individuals to enforce them. This gives economic actors confidence to engage in business transactions.

Further undermining the idea of globalization shrinking states is that states are not, in fact, shrinking. Public expenditures are, on average, as high or higher today as they have been at any point in recent memory. And among OECD countries, government tax revenue as a percentage of GDP increased from 25.5 percent in 1965 to 36.6 percent in 2006.

The future of globalization

Like a snowball rolling down a steep mountain, globalization seems to be gathering more and more momentum. And the question frequently asked about globalization is not whether it will continue, but at what pace.

A disparate set of factors will dictate the future direction of globalization, but one important entity—sovereign governments—should not be overlooked. They still have the power to erect significant obstacles to globalization, ranging from tariffs to immigration restrictions to military hostilities. Nearly a century ago, the global economy operated in a very open environment, with goods, services, and people able to move across borders with little if any difficulty. That openness began to wither away with the onset of World War I in 1914, and recovering what was lost is a process that is still underway. Along the process, governments recognized the importance of international cooperation and coordination, which led to the emergence of numerous international organizations and financial institutions (among which the IMF and the World Bank, in 1944).

Indeed, the lessons included avoiding fragmentation and the breakdown of cooperation among nations. The world is still made up of nation states and a global marketplace. We need to get the right rules in place so the global system is more resilient, more beneficial, and more legitimate. International institutions have a difficult but indispensable role in helping to bring more of globalization's benefits to more people throughout the world. By helping to break down barriers—ranging from the regulatory to the cultural—more countries can be integrated into the global economy, and more people can seize more of the benefits of globalization.

1 BIS Quarterly Review, Bank for International Settlements (December 2006), p. 29.

2 IMF and International Telecommunications Union data.

3 Joseph Stiglitz (2003), Globalization and Its Discontents (New York: W.W. Norton & Company), p. 4.

4 Remarks by former President of Mexico Ernesto Zedillo at the plenary session of the World Economic Forum, Davos, Switzerland, January 28, 2000.

5 Reaping the Benefits of Financial Globalization, IMF Discussion Paper, (http://www.imf.org/external/np/res/docs/2007/0607.htm).

6 Martin Wolf (2005), Why Globalization Works (New Haven and London: Yale University Press), p. 157.

7 "Growth is Good for the Poor," Journal of Economic Growth (2002), and "Trade, Growth, and Poverty," The Economic Journal (2004).

8 From remarks at an UNCTAD conference in February 2000, in Johan Norberg (2003), In Defense of Global Capitalism (Washington: Cato Institute), p. 155.

9 Linda Lim (2001) The Globalization Debate: Issues and Challenges (Geneva: International Labor Organization).

| The IMF staff who contributed to this Issues Brief are Julian Di Giovanni, Glenn Gottselig, Florence Jaumotte, Luca Antonio Ricci, and Stephen Tokarick, with assistance from Mary Yang. Matt Rees served as a consultant on the project. |