Money

Matters: An IMF Exhibit -- The Importance of Global Cooperation

|

Destruction

and Reconstruction (1945-1958)

|

Part

1 of 6

|

|

|

|

| |

The

Post War World

|

| Conflict

and Cooperation |

Next--> |

| |

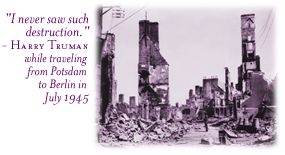

The

Most Destructive War in History

|

By

the end of World War II, much of Europe and Asia, and parts of Africa,

lay in ruins. Combat and bombing had flattened cities and towns, destroyed

bridges and railroads, and scorched the countryside. The war had also

taken a staggering toll in both military and civilian lives.

Shortages of food, fuel, and all kinds of consumer products persisted

and in many cases worsened after peace was declared. War-ravaged Europe

and Japan could not produce enough goods for their own people, much

less for export.

What was needed to pull Europe and Asia back into the international

economy? The answer was money - but what kind? The currencies

of war-torn countries? Gold? Dollars?

|

credits |

The

Most Expensive War in History

|

In

addition to the toll in human lives and suffering, countries spent

more money on World War II than in all previous wars put together.

By 1945, exhausted countries faced severe economic problems that frustrated

reconstruction efforts:

- Inflation

- Debt

(mostly owed to the United States)

- Trade

deficits

- Balance

of payments deficits

- Depleted

gold and dollar supplies

|

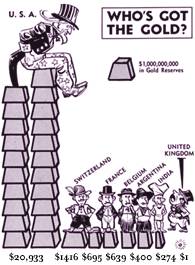

The

Dollar Gap

|

The

devastated countries needed gold or U.S. dollars (the only currency

considered to be "as good as gold") to pay for imports

and make debt payments. However, both dollars and gold were

alarmingly scarce in the war-scarred countries.

Many countries retreated from the market. Communist Eastern

Europe abandoned it altogether. The world’s multilateral

financial and trading system faced a serious threat. Only the

United States had emerged from the war with the strength and

resources to help. But would it step forward?

|

credits |

Worldwide

Gold Shortage

|

|

By

1947, the United States had accumulated 70% of the world’s

gold reserves. The United Kingdom had gone from being the

world’s greatest creditor to the world’s greatest

debtor. Countries had sold off most of their gold and dollar

reserves, as well as their foreign

investments, to pay for the war. What few reserves remained

were now quickly running out. Trade

deficits meant there was little hope of replenishing them.

|

Five

cigarettes for an egg?

A carton of cigarettes for a piano?

|

|

|

Severe

inflation plagued the

weakened economies. By 1948, wholesale prices were 200% higher

in Austria, 1,820% higher in France, and a massive 10,100%

higher in Japan than they had been before the war. In 1948,

the French government devalued the franc by 80%, making a

5,000 franc note practically worthless. In some countries

like Germany, the monetary system collapsed. People resorted

to barter, often using cigarettes as money.

|

|

| |

|

| Conflict

and Cooperation |

Next--> |

|