Listen to the brightest minds in the field of economics and development discuss their latest research and deconstruct global economic trends. IMF Podcasts are free to use for broadcasters, educators and institutions.

March 28, 2024

Women In Economics / Natural resources

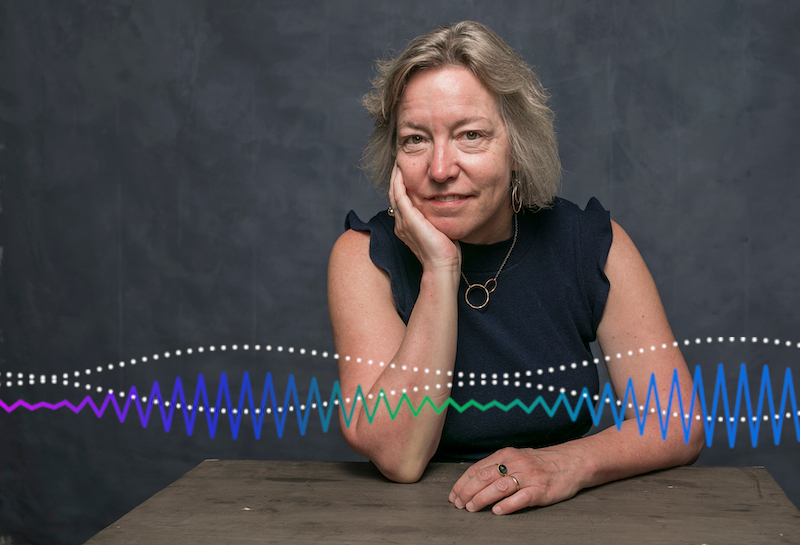

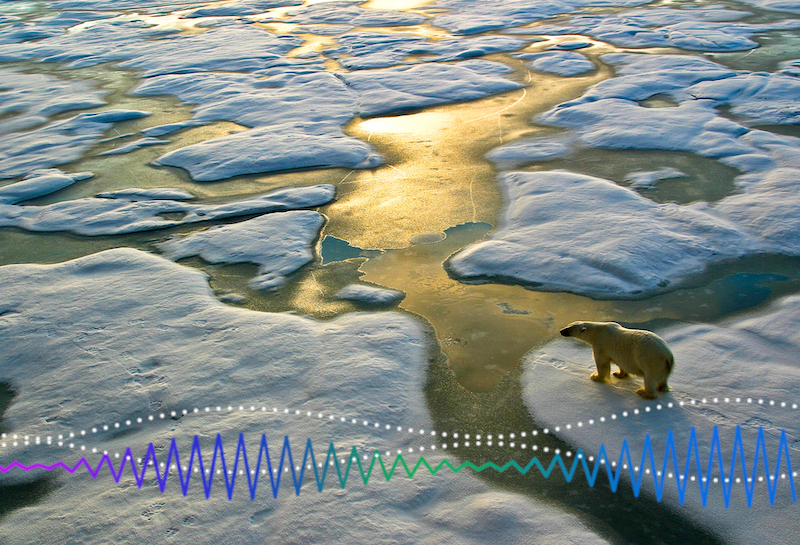

Catherine Kling November 16, 2023

Having access to nature can improve lives. But nature is a resource that is undervalued in our economies, and all too often left off the balance sheet. Catherine Kling is an environmental economist at Cornell University in the Dyson School of Applied Economics and Management and has focused much of her career on creating the kind of data that encourages governments to include the value of nature in their economic decision-making. In this special episode of our Women in Economics series, Kling and Journalist Rhoda Metcalfe discuss why putting a price tag on nature will help save it.

Jim Tebrake January 23, 2024

Jookyung Ree July 20, 2023

Christine Richmond, Raphael Lam November 28, 2023

SURESH NAIDU April 5, 2024

Stephanie Bell January 4, 2024

November 2, 2023

International Monetary Fund

Bruce Edwards produces the IMF podcast program. He's an award-winning audio producer and journalist who's covered armed conflicts, social unrest, and natural disasters from all corners of the world. He believes economists have an important role in solving the world's problems and aspires to showcase their research in every IMF podcast.

Sign up for our weekly podcast newsletter by entering your email address below:

IMF Podcasts are the views of the International Monetary Fund (IMF) staff and external officials on pressing economic and policy issues of the day. The IMF, based in Washington D.C., is an organization of 190 countries, working to foster global monetary cooperation and financial stability around the world. The views expressed are those of the author(s) and do not necessarily represent the views of the IMF and its Executive Board.

@ COPYRIGHT INTERNATIONAL MONETARY FUND