A view of Guatemala City, Guatemala at dusk. More social and infrastructure spending in the country can help spur inclusive growth (photo: iStock/Opla)

Guatemala: More Investment and Social Spending Needed

June 8, 2018

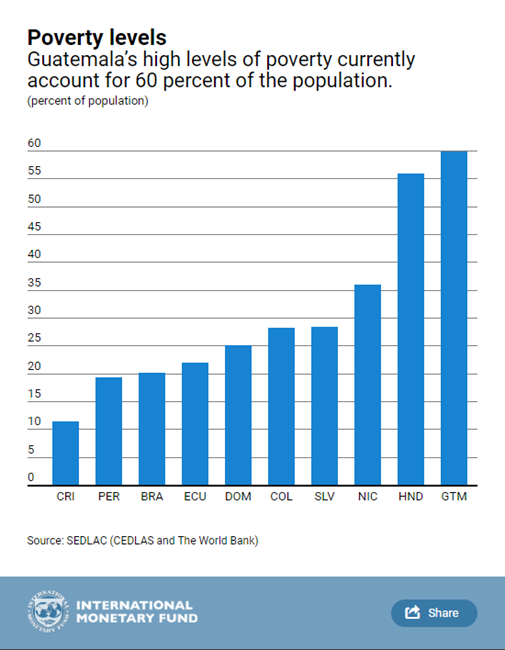

Economic growth for Guatemala, Central America’s largest economy, is expected to rise to 3.2 percent this year, said the IMF in its annual health check of the economy. But incomes have not risen enough over the last decade to substantially reduce high levels of poverty—currently at about 60 percent of the population.

Related Links

IMF Country Focus sat down with Esther Pérez Ruiz, IMF mission chief for Guatemala, to discuss the report’s overall findings, as well as key recommendations that can help the country lift growth prospects and living standards for its 17 million citizens.

The IMF just completed its annual assessment of Guatemala's economy. How is the economy doing?

Before I answer your question, let me express my profound condolences for the recent tragedy that has hit Guatemala, caused by the Fuego volcanic eruption.

Sound monetary and fiscal policy, plus a stable macroeconomic environment, have made the economy remarkably resilient to volatile politics over the last couple of years, including the political upheaval that shook the country in mid-2017.

At the same time, the economy has been losing steam since 2016, as a result of weakening confidence in the business sector, constrained government spending, and court-mandated suspensions of mining activities. Strong remittances, however, have helped sustain private consumption. Going forward, growth is expected to rise to 3.2 percent this year on better U.S. growth, supportive monetary conditions, and some recovery in budgetary spending from decade-low levels.

Fast Facts: Guatemala

- Population (2018 est.): 17 million

- Currency: Quetzal

- Life Expectancy (2016): 72 years

- Adult literacy rate (2017 est.): 79%

- Real GDP Growth (2015): 2.8%

- GDP per capita (2016): $4,155

What are some of the key priorities that can help support growth for Guatemala?

Over the near term, policies should be geared at supporting domestic demand in the country, including by passing a supplementary budget with a focus on capital spending.

Policymakers will also need to continue to improve the execution of government spending on social

protection and infrastructure. This includes developing the preventive capacities and concurrent auditing of the General Comptroller to speed up execution without diluting the focus on governance. Clarifying the application of administrative versus criminal procedures in procurement and enhancing coordination by the Vice Ministry of Transparency will also help improve the efficacy of government procurement.

Improving the ease of doing business in the country can also stimulate economic activity. For example, the government is introducing online systems for business tax reporting and registration, and a system of arbitration to resolve business disputes (rather than having to pursue a civil claim in the courts). Adopting the pending Competition Law and clarifying the framework for investment in extractive industries are important to spur domestic investment and to attract foreign investors.

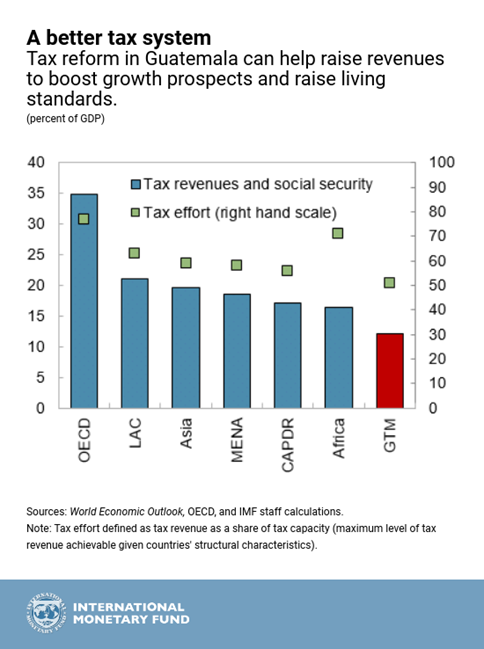

You mentioned the need for more social and infrastructure spending. How can the government raise revenues to support these efforts?

Higher social and infrastructure spending that raise government expenditure to at least 15 percent of GDP is key to lifting more Guatemalans out of poverty. For the government to raise enough revenues to support these efforts, policies should focus on:

-

Strengthening tax administration: Policymakers will need to focus on reinforcing value-added tax (VAT) controls. Strengthening large-taxpayer office management and enhancing the use of tax information and tax collection enforcement are also ways to improve tax compliance in the country.

-

Implementing tax reform: Increasing personal income tax (PIT) rates can raise revenues for social and infrastructure spending. Integrating corporate income tax, implementing higher indirect taxes and fewer exemptions will also help modernize Guatemala’s tax system and increase revenues.

-

Revenue mobilization should be supplemented with measures to raise spending efficiency. Better aligning pay with performance and reforming current regulations for Civil Service and Salaries in Public Administration will be important milestones, along with completing the public-sector personnel census.

With about 60 percent of the population living in poverty, what can be done to raise living standards?

Continued involvement in high-impact projects aimed at achieving the UN’s Sustainable Development Goals is critical to overcoming poverty in Guatemala. These programs support the country’s efforts to help the most vulnerable groups in society and include:

-

expanding preventive and primary health care;

-

increasing access to nutrition, water, and sanitation services;

-

broadening the coverage of the main social assistance program Mi Bono Seguro;

-

expanding pre-primary education programs; and

-

maintaining and expanding the roads network.

Currently in Guatemala, about 70 percent of total employment is outside the formal workforce. What can the government do to close that gap and create more formal jobs?

Tackling labor market informality can help promote a fairer tax and social protection system. Key actions that can help create more opportunities in the formal labor market include:

-

improving the productivity of informal workers through investments in education, rural roads, and irrigation;

-

fostering apprenticeship schemes, such as Mi Primer Empleo, and other vocational training programs;

-

setting the minimum wage and part-time work remuneration to achieve higher employment outcomes; and

-

extending health and pension systems to the self-employed.

Tackling corruption is critical for promoting economic growth with widespread benefits. What is Guatemala doing on this front and what more can be done ?

Guatemala’s efforts to tackle endemic corruption are evident. The General Prosecutor’s Office and the International Commission Against Impunity in Guatemala are making inroads into dismantling networks suspected of illegal activities in areas such as tax fraud, illicit campaign financing, irregular procurement practices, and influence peddling in the judiciary. Since 2014, the prosecutor’s office has dismantled 178 criminal organizations operating at the national level and confiscated assets worth more than $28.5 million.

Looking ahead, there is scope to scale up corruption convictions. Strengthening judicial effectiveness and reinforcing the asset disclosure regime for public officials can help tackle corruption. Furthermore, ensuring transparency with respect to beneficial ownership of corporate vehicles could help avoid conflicts of interest and tackle illicit monetary flows, and ultimately improve governance in the country.