Serbia: 2015–18 Stand-By Arrangement

May 2019

When the three-year precautionary Stand-By Arrangement was approved in 2015, Serbia’s economy faced large fiscal imbalances and protracted structural challenges. Concerns arose from (1) declining revenues, despite tax rate hikes; (2) rising mandatory spending, especially public wage and pension bills; (3) expanding state aid to ailing state-owned enterprises, usually in the form of direct subsidies and guarantees for borrowing; and (4) the cost of resolving ailing public banks.

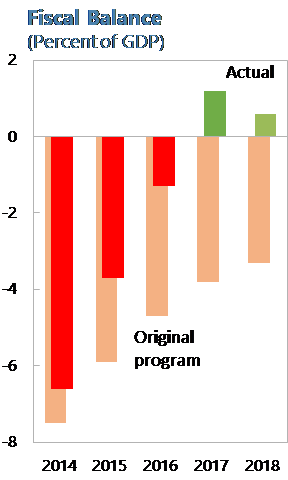

The program envisaged sizable fiscal consolidation. Consolidation plans of more than 4½ percent of GDP focused on durable expenditure measures (curbing mandatory spending and reducing state transfers to state-owned enterprises), since tax rates had been raised during the two years before the program. Efforts to improve tax collection efficiency and broadening the tax base—while taking a cautious approach to the assumed fiscal gains in the macroeconomic framework—were also envisaged. Prior to arrangement approval, the authorities had initiated reforms of state-owned enterprises, which fed into the program.

Over time, the fiscal adjustment mix shifted, and outturns exceeded planned amounts. At the outset, a 7 percent of GDP adjustment in primary current spending was envisaged, while revenues were to decline by more than 2 percent of GDP. Over time, the composition was adjusted, with both revenues and primary current spending contributing equally to a fiscal adjustment of 6 percent of GDP. This was facilitated by positive growth surprises—partly on the back of strengthened confidence and financial sector intermediation—which supported revenue overperformance. Value-added tax, corporate income tax, and excise taxes played an increasingly important role. Current expenditures (particularly wage and pension expenses and state transfers) were contained, and capital spending was broadly protected relative to programmed projections. However, capacity constraints prevented the full execution of additional public investment enabled by revenue overperformance.

Program conditionality focused on limiting fiscal risks and strengthening institutions to support the envisaged fiscal consolidation while enhancing financial stability. A ceiling was included to constrain current primary expenditure. In addition, the program aimed to strengthen the public wage system, reduce budget subsidies and state guarantees, improve public financial management and tax administration, strengthen bank resolution frameworks, and reduce nonperforming loans.

With expenditure on social programs roughly comparable with that of peers, the program supported improvements in the existing social safety net. While there was no explicit conditionality related to social protection, the program supported amendments to the Law on Social Protection with the aim of improving the effectiveness and targeting of cash welfare allowances. In light of concerns regarding the social impact of reforms—in particular related to electricity tariff increases—the program pointed to the World Bank’s assistance in lessening such impact by improving the efficiency of social spending and safety nets.

The program was successfully completed. Serbia succeeded in addressing macroeconomic imbalances and restoring confidence and growth. Fiscal sustainability was restored, and the external position was realigned with fundamentals. Success factors included conservative initial growth forecasts and—supported by strong ownership—the flexible implementation of durable fiscal adjustment, which largely protected capital spending. At the same time, progress in implementing structural and institutional reforms was mixed, and the Stand-By Arrangement was succeeded by a program under the Policy Coordination Instrument to support the remaining structural reform agenda.