News from Asia and the Pacific

IMF Tokyo Shares Analysis of Global, Regional Economic Prospects at its First Virtual Seminar

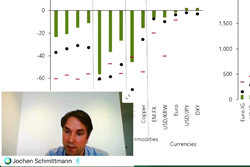

May 28, 2020, Tokyo, Japan – In an effort to reach out to its audience virtually in the midst of the COVID-19 pandemic and share the IMF’s economic surveillance findings and policy recommendations, the Fund’s Regional Office for Asia and the Pacific (OAP) today held its first webinar on global and regional economic prospects and financial market developments.

This first virtual IMF Economic Issues Seminar hosted by OAP—in which two speakers shared key takeaways from the April 2020 editions of the IMF’s World Economic Outlook (WEO) and Global Financial Stability Report (GFSR)—drew 53 people from public agencies, universities, the private sector and the media.

Sumi elaborated on recent global and regional economic developments and discussed alternative outlook scenarios and risks, before sharing the IMF’s broad policy advice for countries both during and beyond the crisis. “We need to be united against the COVID-19 pandemic,” he concluded, adding that the IMF is facilitating international cooperation to help its members cope with the extremely difficult challenges they currently face.

“However, it's important to keep in mind that there are still stresses in some markets and uncertainty and risks remain high,” he warned, adding that monetary and financial policies should continue to remain supportive to minimize permanent damage to the economy and enable a strong recovery.

Following the presentations, a number of viewers posed questions. Some raised concerns about potential increases in banks’ non-performing loans and the future of global value chains. Another asked whether the global expansionary policy stance could lead to inflationary pressure. There was also a voice asking how countries in the world could use the reset after the pandemic to catch up on their Sustainable Development Goals (SDGs), to which Sumi responded that a greener recovery is highly hoped for. Many viewers responded to the post-seminar survey and expressed their appreciation for the opportunity to learn about global and regional economic prospects and market developments during the COVID-19 crisis. Some requested additional virtual events to learn more about IMF emergency financing and its effectiveness during the COVID-19 pandemic and post-crisis fiscal sustainability in various countries.

Agenda |

|

|

2:00-2:30 pm |

Part 1 |

|

2:30–2:50 pm

|

Part 2

IMF Global Financial Stability Report |

|

2:50–3:15 pm |

Q & A |

Speakers’ bios

- Chikahisa Sumi is the Director of the IMF Regional Office for Asia and the Pacific. He has worked on Asia and the Pacific countries for eight years in the IMF, including leading missions to the Philippines, Singapore, New Zealand and Fiji. He also headed the Financial Sector Surveillance Group of the IMF Asia and Pacific Department (APD), and led the Future of Asia’s Finance project including the publication of “The Future of Asian Finance” book in 2015. Before returning to the IMF, Mr. Sumi held key positions in the Japanese Government, including Deputy Vice Minister of Finance for International Affairs and Deputy Commissioner of Financial Services Agency.

- Jochen M. Schmittmann is the IMF Resident Representative in Singapore, covering Singapore, Malaysia, and financial market developments across Asia. Prior to moving to Singapore, Jochen worked in the Asia and Pacific, Western Hemisphere, Finance, and Monetary and Capital Markets departments at the IMF. Jochen has published on a range of topics in finance and macroeconomics, including behavioral finance, currency hedging, and the economic impact of demographic change in Asia. He holds a Ph.D. in Financial Economics from Goethe University Frankfurt.