Digital trade, from software sales to streaming movies, plays a bigger role than ever in the global economy. Yet with many developing countries struggling to fully participate in digital trade, now is the time for policy reforms that promote inclusion, starting with retaining the current tariff-free environment.

Digital trade has several unique benefits beyond traditional gains from trade. Software trade helps to digitalize the economy, increasing efficiency and boosting productivity. Trade in digital media, such as subscriptions to foreign journals, promotes interconnectivity, communication, and the transmission of knowledge and innovation. Finally, digital marketplaces, such as app stores or freelance programming websites, foster inclusion by reducing trade barriers for small firms and women-led businesses.

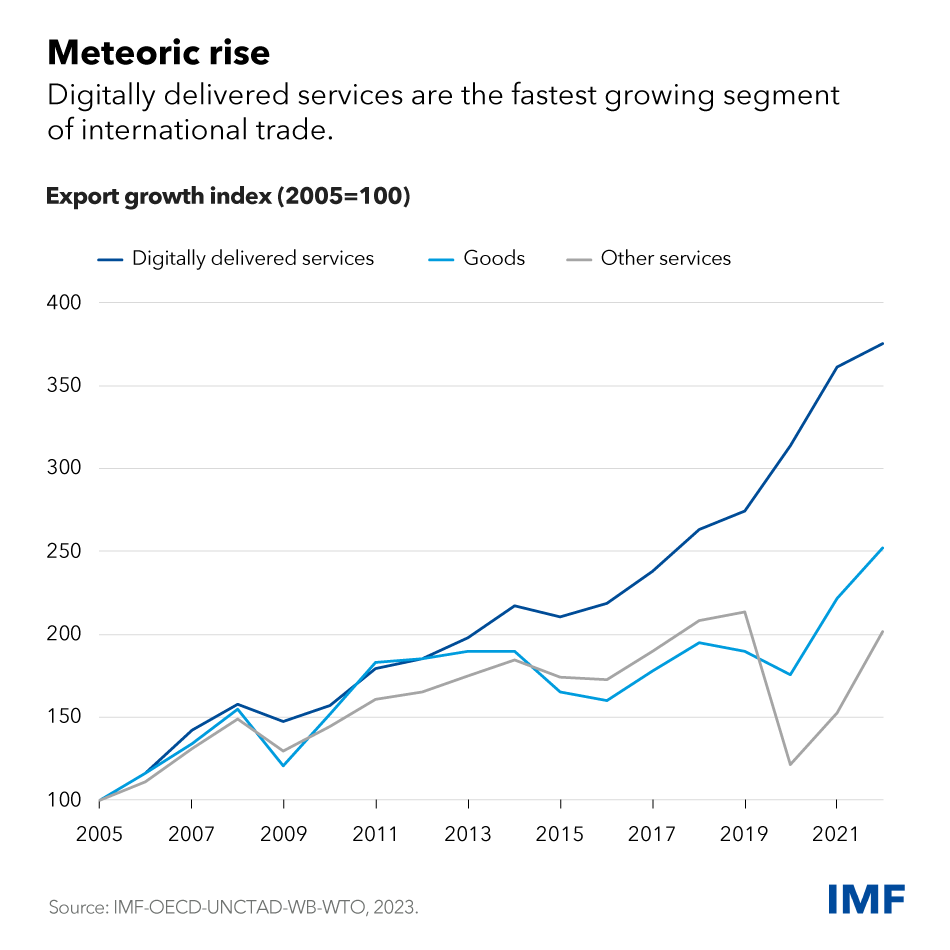

The value of global trade in digitally delivered products rose to $3.82 trillion last year, accounting for a record 54 percent share of services trade. With an 8.1 percent average annual growth rate for almost two decades, it has outpaced other categories like goods.

Digital trade in developing economies

Despite these opportunities, many developing economies, in particular low-income countries, risk falling behind. Reasons include gaps in connectivity, information and communication technology infrastructure and digital skills, as well as the lack of a predictable and transparent legal and regulatory environment. A new report by the IMF, the World Trade Organization and other international institutions on Digital Trade for Development sheds light on issues where global solutions can help make global digital trade more inclusive.

Domestic policies and regulations should enable remote transactions, enhance trust in digital markets, promote affordable access and support cross-border deliveries. Providing appropriate safeguards related to online transactions (such as data privacy, consumer protection and cybersecurity) is essential for the digital trade ecosystem to thrive.

And laws and regulations that ensure easy entry and exit of firms, strengthening enforcement against anti-competitive conduct and an open trade regime would promote healthy competition.

International cooperation on digital trade is also crucial to promote common “rules of the road”—a precondition for digital trade to continue to grow and deliver its benefits.

WTO moratorium

Although WTO agreements cover all types of trade, the only multilateral rule specific to digital trade is the moratorium on customs duties on electronic transmissions. The moratorium, which has been periodically extended since its introduction in 1998, prohibits tariffs on digital imports, thereby contributing to a stable and predictable policy environment for digital trade.

Whether to extend the moratorium will be a key issue at the WTO's 13th Ministerial Conference in February. A much-debated point in discussions ahead of the gathering in Abu Dhabi revolves around the fiscal implications of the moratorium, as some countries fear that the current rules could hurt their revenue potential and constrain their policy space. Recent research helps to inform this debate.

First, existing studies show that the moratorium has a relatively small impact on fiscal revenues—between 0.01 percent and 0.33 percent of overall government revenue on average. This is explained by low existing tariffs on digitizable products, particularly in advanced economies where digital trade has expanded the most.

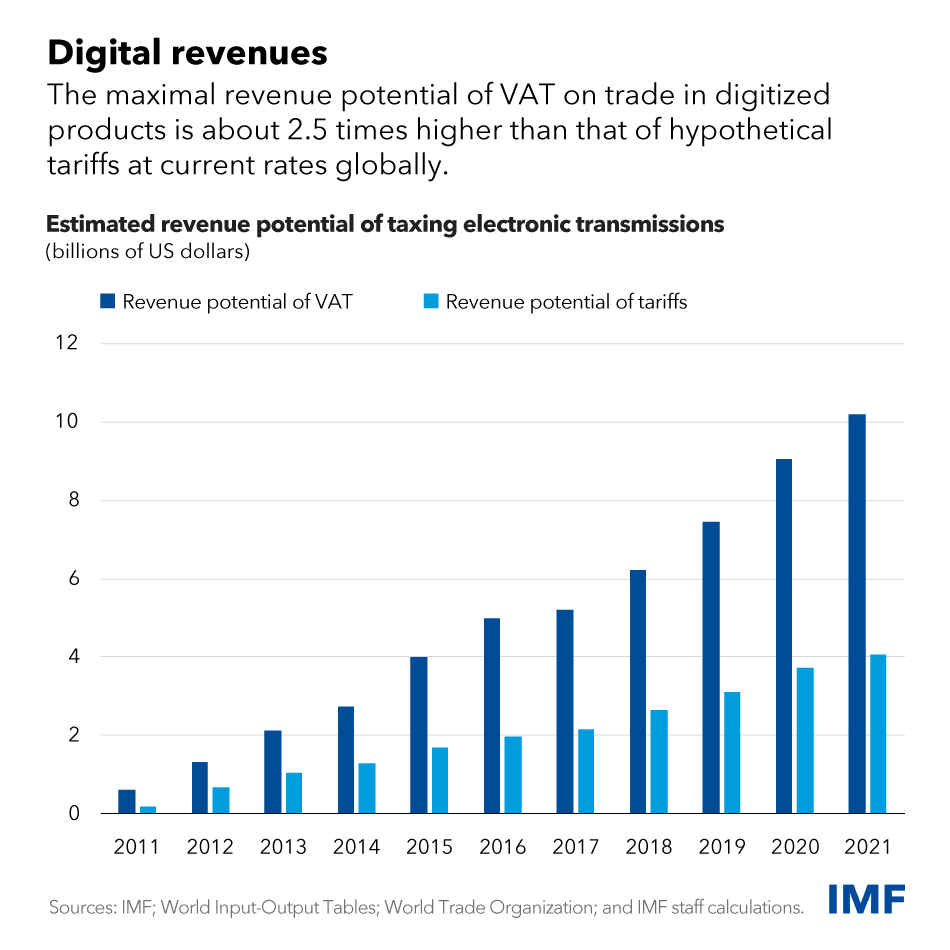

Second, domestic consumption taxes are more efficient instruments for taxing digital trade and can generate higher government revenues. Recent IMF staff analysis shows that imported digitized products within the scope of the moratorium are best taxed through existing domestic consumption taxes, such as value added tax (VAT), where collection methods can be adapted for digital transactions.

Globally, the revenue potential of VAT on trade in digitized products could be about 2.5 times higher than that of tariffs at current rates.

While this difference is mostly driven by advanced economies that have higher VAT than tariff rates, the revenue potential from VAT is either larger or roughly equivalent to that of tariffs for virtually all emerging market and developing economies. VATs are also more economically efficient because they are:

- broad-based and exclude intermediate inputs, thus creating less distortions per dollar raised

- easier to administer as they build on existing tax infrastructure; and

- easier to implement, with extensive experience across all income groups

This new staff research shows that, rather than compromising government revenues or constraining policy space, the WTO moratorium can help to effectively channel developing countries’ tax reform efforts in a more efficient direction. There is no tradeoff between open and inclusive digital trade. To the contrary: open trade supports developing countries’ inclusion in global digital markets.

—See the new report Digital Trade for Development, a joint publication by the International Monetary Fund, Organisation for Economic Co-operation and Development, United Nations Conference on Trade and Development, World Bank and World Trade Organization. For more information, see the IMF trade site.