When the G20 finance ministers and central bank governors meet in Gandhinagar next week, the world will be looking for joint action to address rising economic fragmentation, slowing growth, and high inflation. Agile multilateral support is vital to tackle common challenges posed by debt vulnerabilities, climate change, and limited concessional financing—especially for countries hit by shocks not of their making.

Outlook: resilience amid challenges

In April, the IMF projected global growth at 2.8 percent in 2023, down from 3.4 percent in 2022. The bulk of it–over 70 percent–is expected to come from the Asia-Pacific region.

Yet, recent high frequency indicators paint a mixed picture: weakness in manufacturing contrasts with resilience in services across the G20 countries and strong labor markets in advanced economies. At the same time, financial fragilities uncovered by tight monetary policy require careful management—particularly as restoring price stability remains a priority.

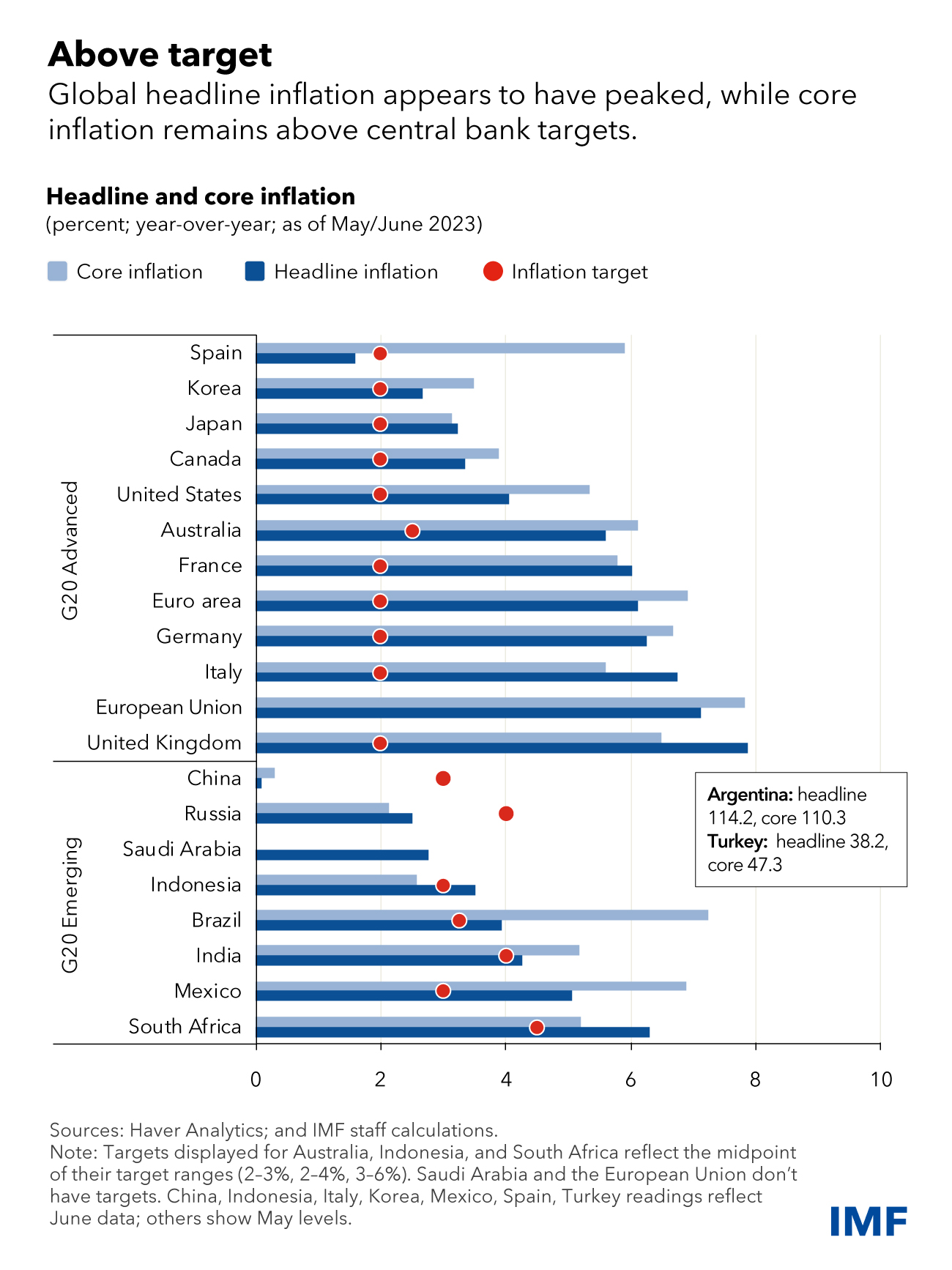

Global headline inflation seems to have peaked, and core inflation has eased somewhat, particularly in India. But in most G20 countries—especially advanced economies—inflation remains well above central banks’ targets.

Tackling inflation and boosting growth

In the fight against inflation there are some early signs of monetary policy transmitting to activity, with bank lending standards tightening in the euro area and the United States. That said, policymakers should avoid “premature celebrations”: lessons from previous inflationary episodes show that easing policy too early can undo progress on inflation.

That’s why it is vital to stay the course on monetary policy until inflation is durably brought down to target, while closely monitoring financial sector risks. Here, clear central bank communication and financial sector oversight are needed to reduce the risk of disruptive shifts in financial conditions.

Fiscal policy must also play its part. Tightening the purse strings after a period of pandemic-related exceptional support can support disinflation, rebuild buffers, and enhance debt sustainability, while temporary and targeted measures may be needed to help vulnerable people cope with the immediate cost-of-living crisis.

At the same time, consolidation efforts should protect growth-enhancing investments where space allows. Why? Because while prospects are mixed in the near term, the medium-term outlook for the global economy remains bleak.

The IMF forecast for global growth over the medium-term is around 3 percent—well below the historical average of 3.8 percent during 2000-19. Moreover, economic fragmentation will both undermine growth and make it harder to tackle pressing global challenges, from rising sovereign debt crises to the existential threat of climate change.

The importance of joint action

The good news is that we have seen how the international community can deliver when differences are set aside.

In June, we saw the breakthrough on Zambia's debt restructuring. That was a significant milestone for the G20 Common Framework which was born out of efforts from the country authorities as well as both Paris Club members and other countries such as China, India, and Saudi Arabia. The agreement unlocks further financing as part of the $1.3 billion IMF arrangement agreed in August 2022.

In addition to progress on debt restructuring for Chad, this outcome also builds on trust and better understanding among creditors and debtors ushered in through the Global Sovereign Debt Roundtable.

But the work is not yet done. More effort is needed to accelerate the debt restructuring process through clear timelines, debt service suspension during negotiations, and improved creditor coordination on debt treatment for countries outside the Common Framework.

The G20 last month also announced the achievement of the $100 billion in pledges of special drawing rights (SDRs) to be channeled from richer to poorer countries. Set by the G20 in the wake of the IMF’s record $650 billion allocation of SDRs in 2021, meeting this target is a strong signal of broad international solidarity. We should also take inspiration from members who lifted the ambition of their pledges for SDR channeling: France and Japan to 40 percent of their allocations, and China to 34 percent.

Such exceptional generosity has allowed the IMF to do even more for our members. Around $29 billion in SDRs pledged to the Poverty Reduction and Growth Trust (PRGT) since 2020 is helping us deliver higher and larger financial support to low-income countries at zero interest.

Moreover, some $42 billion in SDRs have already been provided to the IMF’s Resilience and Sustainability Trust (RST) that was launched last year. Nine members have had their RST funding approved and dozens more have submitted requests.

Programs under the RST will support climate reforms, such as integrating climate considerations into fiscal planning in Costa Rica and strengthening climate-related risk management for financial institutions in Seychelles. And in Rwanda and Barbados, resources from the RST are complementing support from multilateral development banks which together are expected to catalyze additional financing from the private sector, including private investment in climate projects.

Supporting vulnerable countries

Important as these milestones are, however, they alone are not enough.

Many vulnerable emerging market and low-income economies are at the sharp end of multiple shocks and fundamental transitions.

Take climate change, where they have contributed very little to the problem, but are most vulnerable to the consequences. Or the cost-of-living crisis and high interest rates, which take a disproportionate toll, pushing more countries toward debt distress and threatening development prospects. Add to this increasing economic fragmentation that could deprive them from the benefits of an integrated global economy that delivered high growth and raised living standards for billions of people.

Taken together, these challenges mean countries will need more support in the months and years ahead—to ensure economic stability and get back on the path to income convergence with advanced economies. Strong multilateral institutions have a vital role to play in providing this support, especially IDA, the World Bank’s fund for low-income countries, and the IMF.

IMF reforms and resources

Many countries have navigated difficult transitions before, and at each turn the IMF has been part of the global response, adapting to help our members and their people confront new challenges. Now – faced by a fresh set of transitions – we will continue to adapt and respond with agility: through both timely policy changes and stronger resources.

The overriding priority is a prompt and successful completion of the 16th quota review: increasing the overall size of the IMF’s quota resources—which are critical for a robust global finance safety net— with mindfulness of how the global economy has evolved.

This must be complemented by decisions to replenish the Fund’s concessional resources for vulnerable countries: a fully funded PRGT and a replenished Catastrophe Containment and Relief Trust that provides debt service relief when countries are hit by large shocks.

Together, these steps will ensure the IMF remains an inclusive institution capable of serving the needs of its entire membership, especially vulnerable emerging and developing economies.

G20’s key role

In a more shock-prone world and at a time of fundamental transitions—from climate change and debt distress to trade tensions and economic fragmentation—the world has high expectations of international policymakers, and rightly so.

We must act now and act together to get all countries back on a sustainable path to growth and prosperity.

This calls for strong leadership from the G20 to ensure the international financial architecture is fit for purpose with a well-resourced and representative IMF at its center. The global response must be commensurate in size to the world’s challenges.