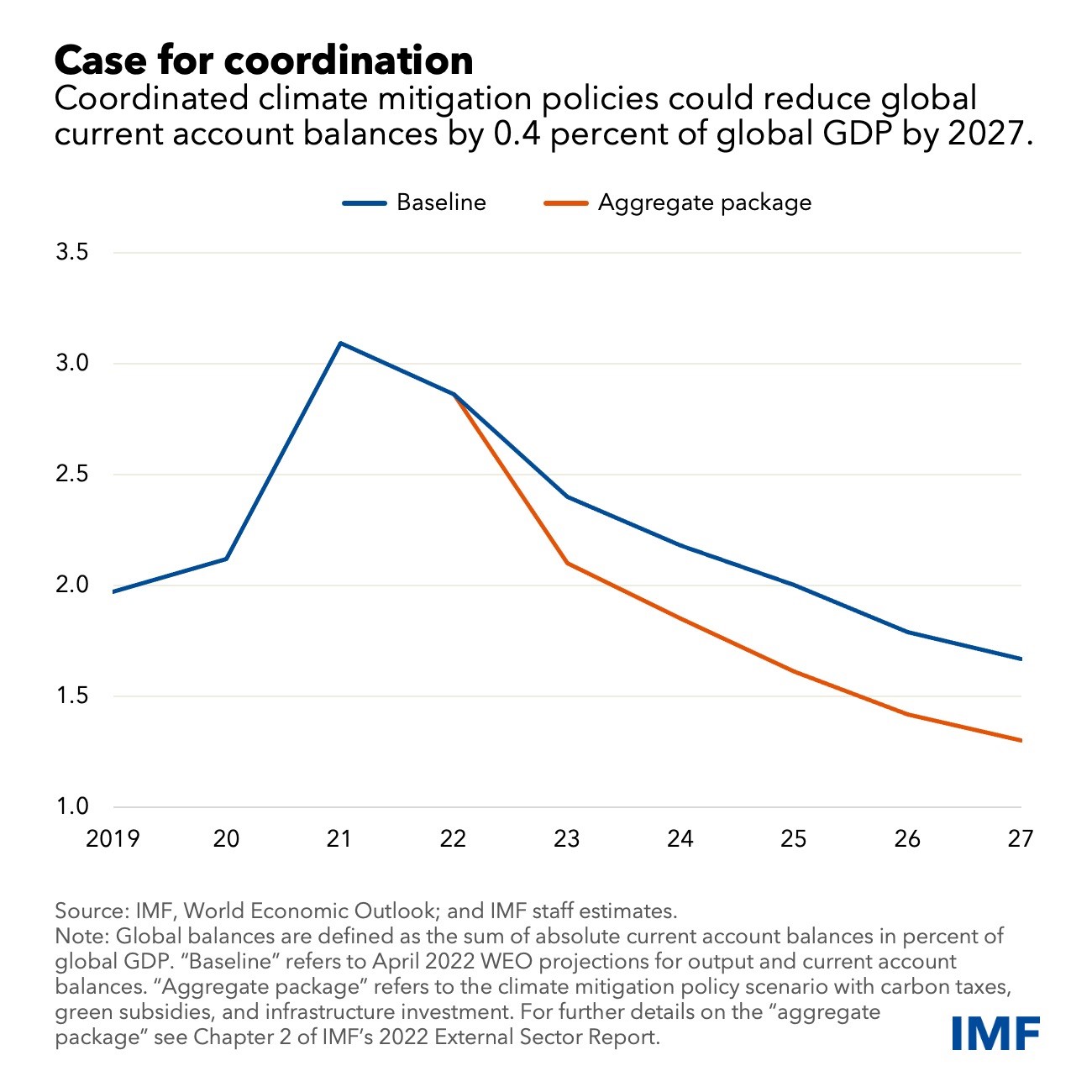

Our latest Chart of the Week, drawn from the IMF’s External Sector Report, shows the impact a globally coordinated mitigation policy package could have on current account balances. According to our model-based scenario analysis, the carbon tax has the biggest effect. By discouraging energy usage, economic activity will likely shift toward more labor-intensive, low-carbon sectors as a result.

Global interest rates are also likely to fall in the longer term because of the decline in investment in fossil fuels, following an initial infrastructure investment-induced rise.

The precise effects will be different for every country, however. Unlike greener economies, current account balances in more fossil-fuel-dependent economies may increase because of the sharp fall in investment in carbon-intensive sectors. This would likely cause global capital flows to shift toward greener advanced economies, putting a disproportionate burden of economic adjustment on lower-income fossil-fuel-exporting developing countries, which historically have contributed little to carbon emissions.

Increased burden sharing in climate change mitigation efforts could help limit the shift in capital flows. This would mean higher carbon taxes and emission cuts for advanced economies. Accelerating investment in green energy and renewables in developing countries could also contribute, including through increased financing and technology transfers from advanced countries.

Clearly, both advanced and developing countries will need to play their part in reducing emissions. To succeed, policy coordination and burden-sharing arrangements will be key.