Supply chain disruptions have become a major challenge for the global economy since the start of the pandemic. Shutdowns of factories in China in early 2020, lockdowns in several countries across the world, labor shortages, robust demand for tradable goods, disruptions to logistics networks, and capacity constraints have resulted in big increases in freight costs and delivery times.

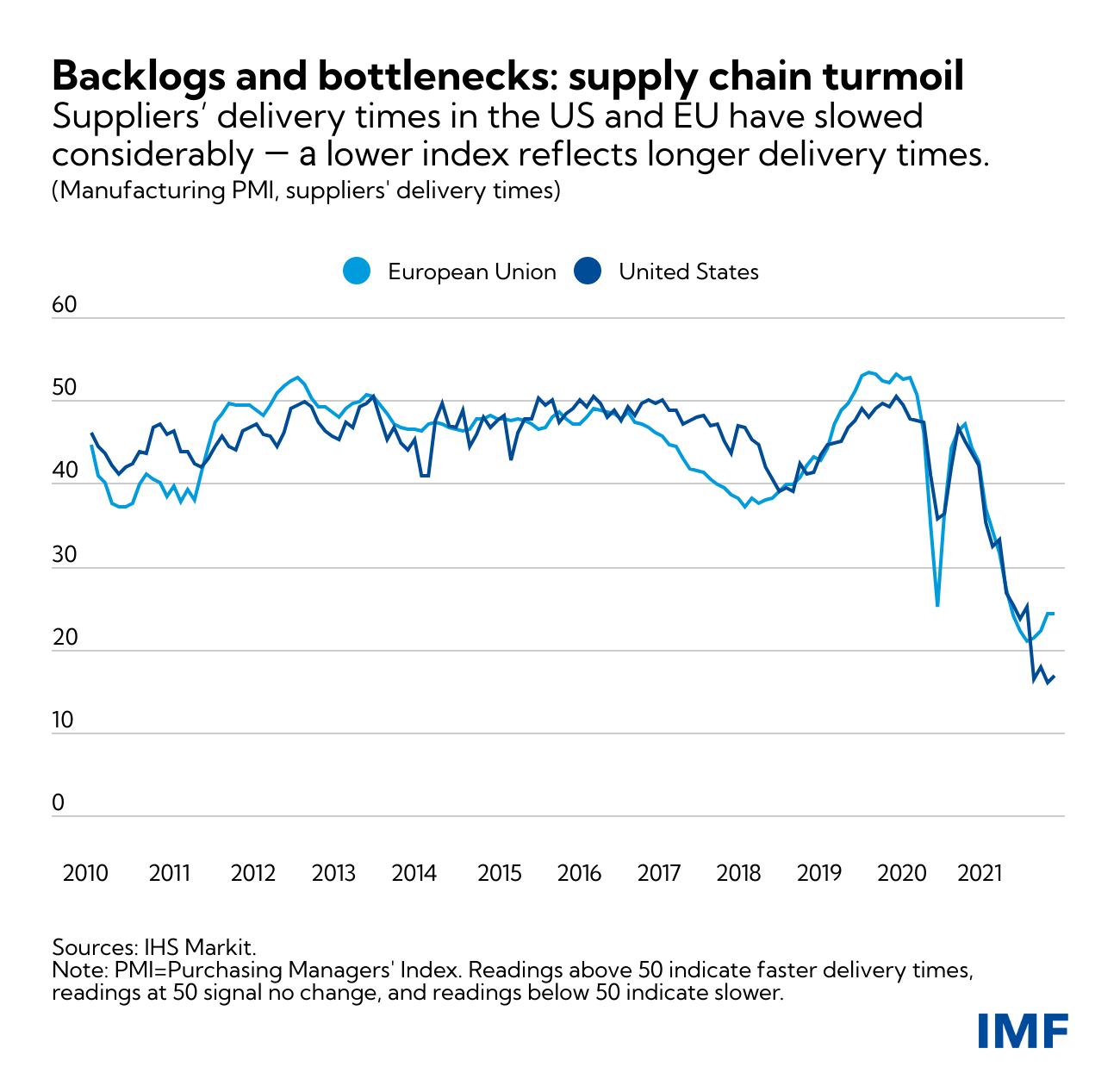

Our chart of the week shows suppliers’ delivery times in the United States and the European Union have hit record highs since late 2020 (the data goes back to 2007). IHS Markit’s suppliers’ delivery times index is constructed from Purchasing Managers Index business surveys and reflects the extent of supply chain delays.

To calculate the index, purchasing managers are asked if their suppliers' delivery times are, on average, slower, faster, or unchanged compared to the previous month. Readings above 50 indicate faster delivery times, readings at 50 signal no change, and readings below 50 indicate slower delivery times compared with those of the prior month.

The recent sharp drop in the delivery times index reflects surging demand, widespread supply constraints, or a combination of both. During such times, suppliers usually have greater pricing power, causing a rise in prices. Moreover, these supply chain delays can reduce the availability of intermediate goods which, combined with labor shortages, can slow down production and output growth.

Once the number of new COVID-19 cases starts to decline, capacity constraints and labor shortages should ease, taking some of the pressure off supply chains and delivery times. However, some experts believe that there’s unlikely to be swift relief from supply chain disruptions. Elevated demand during the holiday season in some of the world’s largest economies, another wave of new COVID-19 cases, and extreme weather events, if they materialize, could cause supply chain disruptions.