In the months and years following previous pandemics, the countries most affected saw a rise in social unrest. Based on this historical trend, the COVID-19 pandemic could pose a threat to the social fabric in many countries, but these trends do not pre-determine an outcome.

Pandemics can set off a vicious cycle of economic despair, inequality, and social unrest.

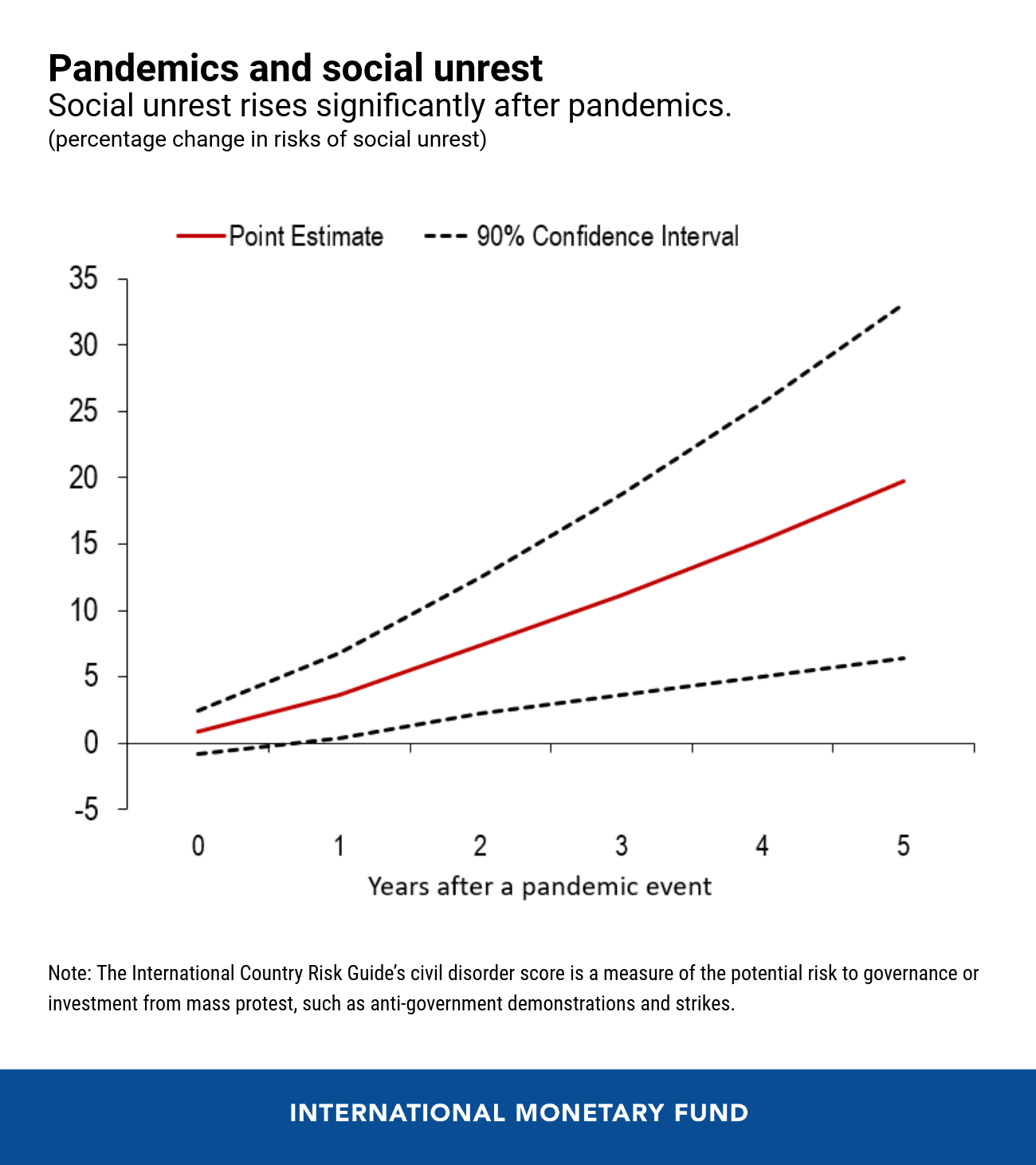

We take a closer look into this issue in a new IMF staff working paper by analyzing the effect of past major pandemics in 133 countries over 2001–18: SARS in 2003, H1N1 in 2009, MERS in 2012, Ebola in 2014, and Zika in 2016. As shown in our chart of the week, social unrest increased consistently following each of these outbreaks. The International Country Risk Guide’s civil disorder score, which is a high frequency and cross-country measure of social unrest, increased significantly, on average, one year after the pandemic.

In terms of methodology, we apply two complementary econometric approaches. First, we use monthly data to estimate how the level of social unrest responds to pandemics. We use social unrest and pandemic data at a monthly frequency and establish a direct link between exogenous pandemic events—that is, those stemming from external factors—and civil disorder (which is expressed as a score). Second, using annual data we explore the channels through which past major pandemics lead to social unrest in the medium term. In particular, we focus on inequality and economic growth as the two key channels.

Indeed, pandemics can set off a vicious cycle of economic despair, inequality, and social unrest. Using econometric analysis, we show that past major pandemics led to a significant increase in social unrest in the medium term, by reducing growth and increasing inequality. Higher social unrest, in turn, is associated with lower growth, which worsens inequality, forming a vicious cycle.

Which countries are more vulnerable? Additional analysis in the Regional Economic Outlook for Asia-Pacific suggests that the effect is stronger when income inequality is already high to begin with. An increase in the net (post-tax and transfer) Gini coefficient—a commonly-used measure of inequality—is associated with more social unrest when the initial level of the net Gini is above 0.4. More than 45 percent of countries in the world, and about one-third of Asian economies, have a net Gini coefficient higher than this threshold.

We also find that the impact of inequality on social unrest depends on the extent of redistributive transfers. An increase in inequality is associated with more unrest when redistributive transfers are low, suggesting that social safety measures help reducing social tensions.

Policymakers need to pay special attention to preventing scarring effects on the livelihoods of the most vulnerable in their societies. These are historical trends, not the destiny of countries.