July 2019 was the hottest month ever recorded on earth, with countries across the world experiencing record-breaking temperatures. A prolonged drought is affecting millions of people in East Africa, and in August 2019 Greenland lost 12.5 billion tons of ice in one day.

A review of the literature by IMF staff aims to spur discussion of what policies to mitigate climate change could or should include. The review suggests that, while fiscal tools are first in line, they need to be complemented by financial policy tools such as financial regulation, financial governance, and policies to enhance financial infrastructure and markets, and by monetary policy.

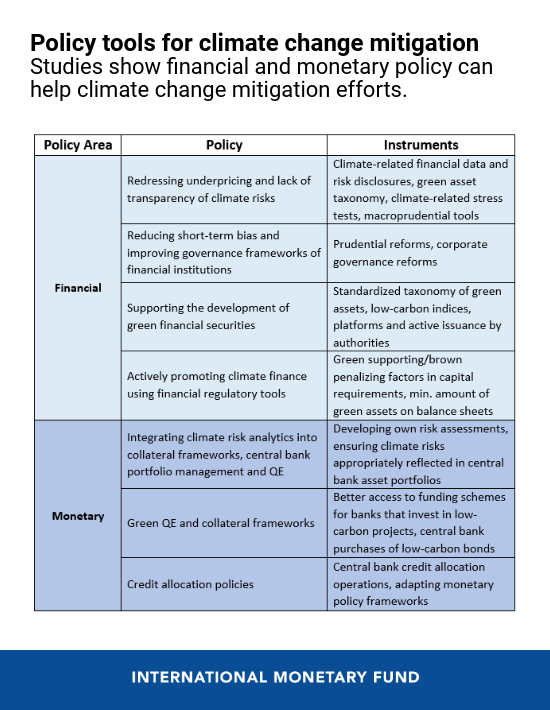

Financial and monetary policy tools can complement fiscal policies and help with mitigation efforts.

The stakes are high. There is a broad scientific consensus that achieving sufficient mitigation requires an unprecedented transition to a low-carbon economy. Limiting global warming to well below 2 degrees Celsius requires reductions of 45 percent in CO2 emissions by 2030, and reaching net zero by 2050. Despite the 2015 Paris Agreement, greenhouse gas emissions are high and rising, fossil fuels continue to dominate the global energy mix, and the price of carbon remains defiantly low, reinforcing the need for complementary policies.

The case for policy action beyond carbon pricing

Our review of academic and policy studies suggests that, currently, there are insufficient incentives to encourage investment in green private productive capacity, infrastructure, and R&D. At the same time, investments continue to pour into carbon-intensive activities. These undesirable economic outcomes prevent the needed decarbonization of the global economy. Decarbonization requires a transformation in the underlying structure of financial assets—a transformation that, studies suggest, is hindered by several deficiencies in the way markets function.

First, financial risks may not reflect climate risks or the long-term benefits of mitigation, given many investors’ shorter-term perspectives. Moreover, financial risks are often assessed in ways that do not capture climate risks, which are complex, opaque, and have no historical precedents.

Second, there is a wide gap between the private profitability and the social value of low-carbon investments. High uncertainty around their ability to reduce emissions, as well as the future value of avoided emissions, makes low-carbon investments unattractive to investors, at least in the short run.

Third, corporate governance that favors short-term financial performance may amplify financial “short-termism,” while constraints in capital markets can lead to credit rationing for low-carbon projects.

The above review of previous literature suggests that, because they directly influence the behavior of financial institutions and the financial system, financial and monetary policies can play a key role in addressing these issues.

Possible policy tools suggested by studies

The table below summarizes financial and monetary policy options for climate change mitigation, based on the above review of previous studies.

Policies that have been proposed in the literature can be divided into two categories: climate risk-focused and climate finance-promoting.

Climate risk-focused tools aim to correct the lack of accounting for climate risks for individual financial institutions and support mitigation by changing the demand for green and carbon-intensive investments, as well as their relative prices.

On the monetary policy side, examples include developing central banks’ own climate risk assessments, and ensuring that climate risks are appropriately reflected in central banks’ collateral frameworks and asset portfolios. On the financial policy side, tools include reserve, liquidity and capital requirements, loan-to-value ratios, caps on credit growth, climate-related stress tests, disclosure requirements and financial data dissemination to enhance climate risk assessments, corporate governance reforms, and better categorization of green assets by developing a standardized taxonomy.

Climate finance-promoting policies seek to account for externalities and co-benefits of mitigation at the level of society—that is, to account for how economic activity harms the environment but could instead, in addition to mitigating climate change, generate social value through, for example, reduced air pollution or more rapid technological progress. These policies could help shift relative prices and increase investments. However, the fact that they add new goals to existing policies makes them more controversial.

Monetary instruments to promote climate finance include better access to central bank funding schemes for banks that invest in low-carbon projects, central bank purchases of low-carbon bonds issued by development banks, credit allocation operations, and adapting monetary policy frameworks.

Financial policy instruments to actively promote climate finance revolve around “green supporting” and “brown penalizing” factors in banks’ capital requirements, and international requirements of a minimum amount of green assets on banks’ balance sheets.

What’s the bottom line?

More work is needed. The literature remains limited on the desirable package of measures to address climate mitigation. Nonetheless, financial and monetary policy tools can complement fiscal policies and help with mitigation efforts. All hands are needed on deck, for, as Mark Carney of the Bank of England has warned, “the task is large, the window of opportunity is short, and the stakes are existential.”