Emerging market economies have enjoyed good growth in recent decades but are still far from closing gaps in living standards with advanced economies. Emerging markets also need growth to be shared by everyone, particularly by providing their growing populations with good jobs and social protection.

In a new IMF staff paper, we look at how the design of labor markets—institutions and policies—could foster inclusive growth in these countries.

Different designs

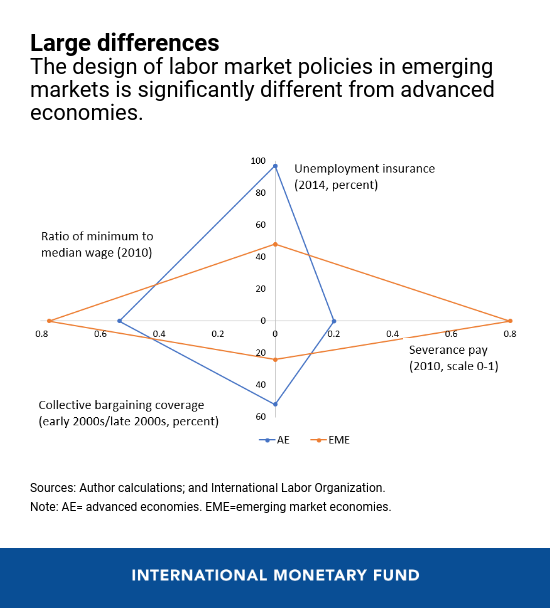

The design of labor market policies in emerging markets differs significantly from that in advanced economies, as shown in this simple summary figure.

- Only half of emerging markets have unemployment insurance systems in place, while they exist in nearly all advanced economies. This means that workers in emerging markets have less to fall back on in the event that they lose their jobs.

- In contrast, employment protection legislation is just as prevalent in emerging markets as in advanced economies. In fact, emerging markets out-rank advanced economies—at least in law—on one important component of such legislation, severance pay (what companies must pay workers if they dismiss them).

- Collective bargaining agreements cover only about 20 percent of workers in emerging markets and about half of workers in advanced economies.

- The ratio of the minimum wage to the median wage is higher in emerging markets than in advanced economies. This means that in emerging markets, the minimum wage is closer to the median wage, which partly reflects low median wages.

Does the design of labor markets in advanced economies offer some guidance for emerging markets?

Protecting workers

Creating high-paying jobs requires that jobs rendered unproductive are replaced by more productive ones. But workers need some basic protections in the face of these job reallocations. This can be done partly through an unemployment insurance system, which gives workers who lose their jobs some income support while they search for new jobs. By contrast, employment protection legislation—rules such as valid grounds for eliminating jobs and provision of severance pay—protect jobs by keeping companies from excessive firing or reallocation of workers.

Though the context in emerging countries is different, the experience of advanced economies suggests it may be better to protect workers more through unemployment insurance than through very stringent employment protection legislation. The model in Nordic countries like Denmark—moderate and predictable employment protection combined with high unemployment benefits but with active policies to get the unemployed back into jobs—is a prominent example.

Does the design of labor markets in advanced economies offer some guidance for emerging markets?

In emerging markets, the need to provide workers some insurance against the risk of income loss is greater than in advanced economies. However, the risk that policies fail is also greater owing to widespread labor market informality and limited administrative capacity. This may help explain why emerging markets rely more on employment protection legislation, which, however, protects only a fraction of workers—risking a dual labor market of protected formal sector workers and a large unprotected informal sector—and can be one of the obstacles to creating jobs in the formal sector.

Hence, as informality is reduced and administrative capacity improves, there is a case for emerging markets to gradually expand unemployment insurance and move toward less stringent and more predictable employment protection legislation.

This has been the direction advocated by the IMF over the past decade, based on our survey of advice to 30 emerging and frontier market economies. For example, Chile, Malaysia, and Turkey were advised to introduce or expand unemployment insurance systems while lowering severance payments. Several others, such as Morocco and Indonesia, were advised to lower very high legal severance payments, which can channel work to the informal sector and foster segmentation of labor markets.

Appropriate wage levels

When it comes to minimum wages, the approach, level, and design that work well will vary by country. Minimum wages serve an important distributional purpose in emerging markets by providing a basic standard of living for workers. They are helpful to alleviate the poverty of those whose jobs may not as yet pay enough to make ends meet. They can also reduce the risk that employers will underpay workers. If set too high compared with median wages, however, minimum wages can also dissuade companies from hiring low-skilled workers in the first place, keeping them from accumulating the skills that would move them later in their career into higher-paying jobs.

The setting of the minimum wage thus has to balance essential distributional needs against possible adverse impacts on job creation. One route is to set minimum wages to a reasonable level (relative to the median wage in the country) and to complement them with programs such as cash transfer programs or—where administrative capacity allows—in-work tax credits. For instance, Dibao in China and Bolsa Familia in Brazil have successfully provided income support targeted to the poor. Another route may be to have lower minimum wages for certain groups of workers or in certain regions where they are particularly high relative to the local median wage.

The IMF’s advice to the Philippines and South Africa over the past few years illustrates the former route. In the case of South Africa, while advocating that the national minimum wage be set so as to not hurt job creation, the IMF has also recognized the government’s goals of reducing inequality and providing minimum household income needs, and has advocated that social transfers and progressive taxation be used to meet these goals. The latter route was advocated in Malaysia, where the advice was to lower minimum wages in some regions.

Collective bargaining: trust matters

Along with legally required minimum wages, collective bargaining between workers and their employers can play a useful complementary role in setting decent wage and working conditions. But making bargaining work on a sector-wide basis is more difficult, although advanced countries like Germany or the Netherlands have succeeded. A lot depends on specific details of the bargaining arrangements, including whether the interests of all individual companies are well represented at the bargaining table, worker representatives coordinate among themselves, and the sector-level agreement provides some minimum flexibility to accommodate the different needs of individual firms.

The IMF’s labor market advice has evolved over time, as it increasingly emphasizes the need for social protection and more inclusive growth. While the IMF continues to assess how labor market institutions can be designed in a way that supports economic efficiency, it is also paying more attention to reducing inequality.

Overall, IMF advice has been broadly consistent with lessons from the academic literature on how to foster flexibility while strengthening safety nets. Getting labor market policy right in emerging markets will require important next steps, such as better integrating efficiency and equity considerations, providing more specific advice in each area, and accounting for how different policy areas interact.