عربي, 中文, Español, Français, 日本語, Português, Русский

There’s good news for people living in Las Vegas, Miami and Phoenix: the risk of a housing bust like the one they endured during the global financial crisis is fairly small. For folks in Toronto and Vancouver, however, the picture hasn’t improved since 2008, and the risk of a large decline in house prices remains elevated.

Those are among the insights generated by the IMF’s new tool for assessing the danger of a severe downturn in home prices. Homeowners, of course, are keenly interested in the value of what is probably their biggest asset. But there is also a strong link between home prices, the financial system, and the economy. The link is especially powerful when prices go down – as we explain in Chapter Two of the IMF’s twice-yearly Global Financial Stability Report.

Why do home prices matter for the broader economy? Housing construction and related spending on things like home improvements account for one-sixth of the US and euro-area economies, making them among the largest components of GDP. What’s more, mortgages and other housing-related lending are a big part of banks’ assets in many countries, so changes in house prices affect the health of the banking system.

Central banks in the United States, China, and Australia have expressed concern about large increases in home prices.

Boom-bust cycle

It’s no surprise, then, that more than two-thirds of financial crises in recent decades were preceded by a boom-bust cycle in home prices, and that central banks in the United States, China, Australia, and elsewhere have recently expressed concern about large increases in home prices.

Fortunately, the IMF’s new tool can help policy makers gauge the likelihood of a future housing downturn and take early steps to help limit the damage. The tool, dubbed House Prices at Risk, feeds into the Fund’s growth-at-risk model, which links financial conditions to the danger of an economic downturn (see the October 2017 GFSR .)

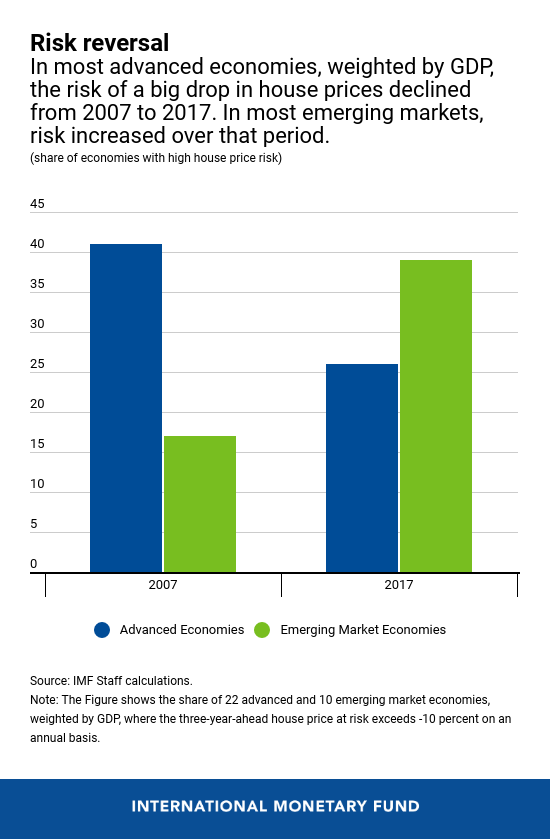

Our study encompasses data from 22 advanced economies, 10 emerging-market economies, and the major cities in those countries. We found that in most advanced economies in our sample, weighted by GDP, the odds of a big drop in inflation-adjusted house prices were lower at the end of 2017 than 10 years earlier but remained above the historical average. In emerging markets, by contrast, riskiness was higher in 2017 than on the eve of the global financial crisis. Nonetheless, downside risks to house prices remain elevated in more than 25 percent of these advanced economies and reached nearly 40 percent in emerging markets in our study. Among them, China stands out, especially its Eastern provinces.

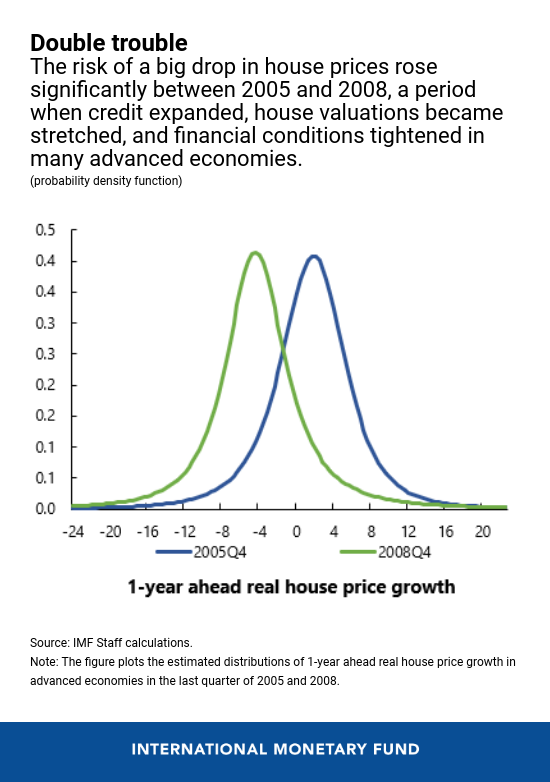

Readers may wonder how we came to these conclusions. First, we identified five conditions that affect home prices: past price growth, economic growth, credit booms, overvaluation, and financial conditions. Then we asked ourselves a question: if we look at large drops in home prices — those that occur roughly once every 20 years (that is, those that have a 5 percent probability) — can they be predicted by changes in those five conditions? What happens if, say, financial conditions tighten, households are loaded up on debt, and house prices are stretched? The answer: In this scenario, we can expect to see more instances of very large declines in home prices.

Synchronized swings

Interestingly, good news today may signal greater danger further down the road. In the short term, easy credit supports home prices. But longer term, easy credit could fuel overborrowing by homeowners, making a bust more likely. And, as described in the April 2018 GFSR , house prices in major cities around the world move in tandem, making it more likely that a shock in one country will affect housing markets elsewhere.

Significantly, we also found that large declines in home prices are associated with economic contractions and risks to financial stability. For example, our estimates show that a reading of minus 12 on our gauge – corresponding to a 5 percent probability of a 12 percent drop in prices – indicates a 31 percent probability of a financial crisis two years later in advanced economies and a 10 percent probability in emerging markets.

That makes our new model a useful predictive tool for policy makers seeking to keep their economies and financial systems on an even keel.

Policy choices

How should policy makers respond to heightened home-price riskiness? While they shouldn’t try to target prices, our results show that there are early steps they can take to improve the resilience of households, banks, and the economy. One is to tighten so-called macroprudential policies when the economy is strong and housing is booming. These policies include restricting the amount of a home loan as a proportion of the property’s value and limiting the size of monthly mortgage payments as a proportion of income.

Another option is cutting the central bank’s interest rate, although our results suggest that this may only help to mitigate near-term risks—up to a few quarters ahead—and only in advanced economies. Measures to manage capital flows might also help these countries when a surge in capital inflows increases downside risks to house prices. While our analysis focused on cyclical factors, other policy instruments may be considered as well, including longer-term structural policies—to increase the housing supply or impose zoning restrictions—or fiscal measures such as property taxes.

So, there are ways to mitigate the risks. With the help of our tool, policy makers can take the appropriate steps in a timely manner – and prevent a crisis like the one that shook the world in 2008.

Watch a conversation with the authors: