In Latin America and the Caribbean, high prices for commodities—like coffee and copper—were once a key driver of growth, helping countries to raise incomes and lower poverty. But stable and moderate levels of commodity prices mean that in the future countries will need to rely on alternative sources of inclusive growth.

Commodity dependence

Latin America and the Caribbean region is rich in fertile lands, mineral ores, and oil, natural gas and coal deposits. Its economies are leaders in the export of coffee (Brazil, Colombia, Central America), copper (Chile, Peru), iron ore (Brazil), oil and gas (Bolivia, Colombia, Ecuador, Mexico, Trinidad and Tobago, Venezuela), and soybeans (Argentina, Brazil, Uruguay).

Because the region’s economies rely heavily on exporting commodities—economic activity, government revenue, and current account balances are susceptible to commodity price shocks.

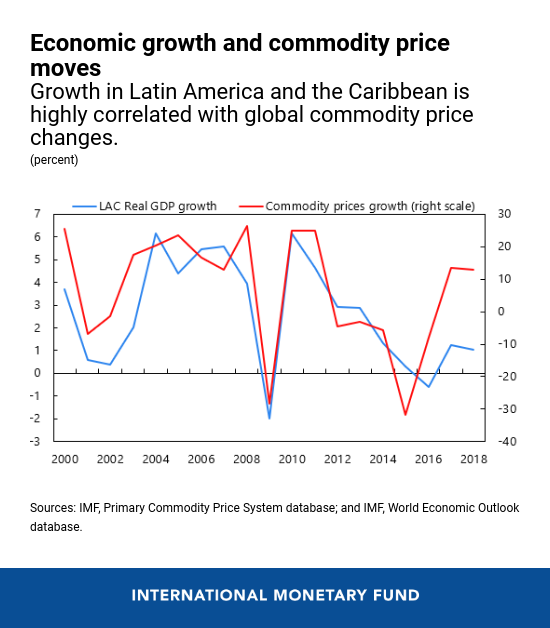

More notably, previous IMF research has found that growth in Latin America is highly correlated with commodity price changes. Therefore, the outlook for commodity prices is key in forecasting the region’s economic prospects.

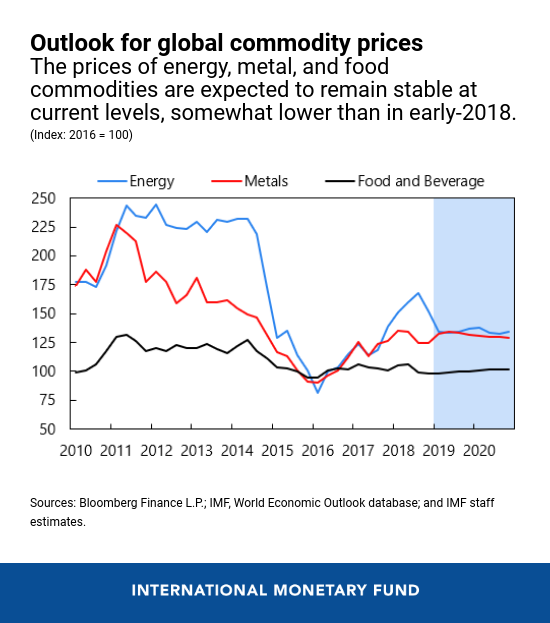

Given China’s large weight in commodity markets, a US-China trade deal could lead to a rebound in commodity prices.

The rebound would benefit Latin America and the Caribbean’s energy and metal exporters, but not necessarily the region’s agricultural exporters, which have benefitted from recent trade tensions through a premium on the price of their soybeans. The ongoing El Niño phenomenon—the climate pattern of ocean water warming—could hurt agricultural exporters, but higher food prices could partly offset this effect.

Regional impact

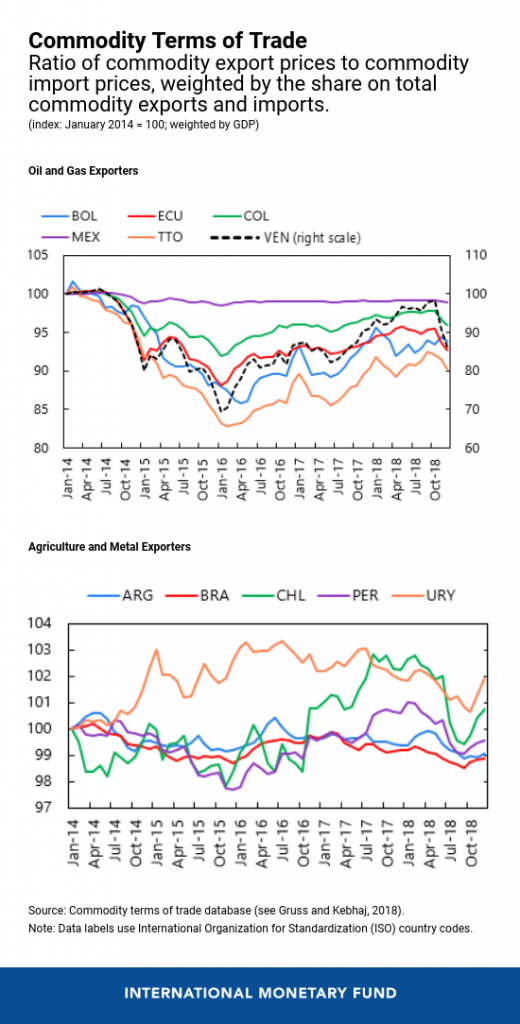

The impact of commodity price shocks differs across countries depending on the composition of their commodity exports and imports. A concise way to analyze this impact is by looking at the commodity terms-of-trade indices, which provide the ratio of average commodity export prices to average of commodity import prices.

This terms-of-trade index captures which countries would benefit and which would suffer from a specific change in commodity prices. For example, when oil prices fall as in late 2018, net oil importers such as Chile and Uruguay benefit, while net oil exporters such as Colombia and Venezuela suffer.

Given China’s large weight in commodity markets, a US-China trade deal could lead to a rebound in commodity prices.

The rebound would benefit Latin America and the Caribbean’s energy and metal exporters, but not necessarily the region’s agricultural exporters, which have benefitted from recent trade tensions through a premium on the price of their soybeans. The ongoing El Niño phenomenon—the climate pattern of ocean water warming—could hurt agricultural exporters, but higher food prices could partly offset this effect.

Regional impact

The impact of commodity price shocks differs across countries depending on the composition of their commodity exports and imports. A concise way to analyze this impact is by looking at the commodity terms-of-trade indices, which provide the ratio of average commodity export prices to average of commodity import prices.

This terms-of-trade index captures which countries would benefit and which would suffer from a specific change in commodity prices. For example, when oil prices fall as in late 2018, net oil importers such as Chile and Uruguay benefit, while net oil exporters such as Colombia and Venezuela suffer.

Previous studies have found that a rise in the commodity terms-of-trade boosts economic growth temporarily. Particularly, this occurred in economies with large commodity exports as a percentage of GDP, with growth returning to its pre-shock level once investment and consumption have adjusted to the higher terms-of-trade level.

The way forward

These results suggest that the short-lived rise in commodity prices from early-2016 to mid-2018 helped boost growth in Latin America and the Caribbean, particularly in the Andean countries. However, the outlook of stable prices indicates that commodity prices are unlikely to be a significant growth engine for the region in the coming years.

This outlook reinforces the need for the economies of Latin America and the Caribbean to accelerate the implementation of structural reforms to boost growth and improve social outcomes.

Key priorities include further opening to trade and foreign direct investment, streamlining regulations in the goods and labor markets, promoting competition, investing in infrastructure and education, and preserving or expanding well targeted social programs.