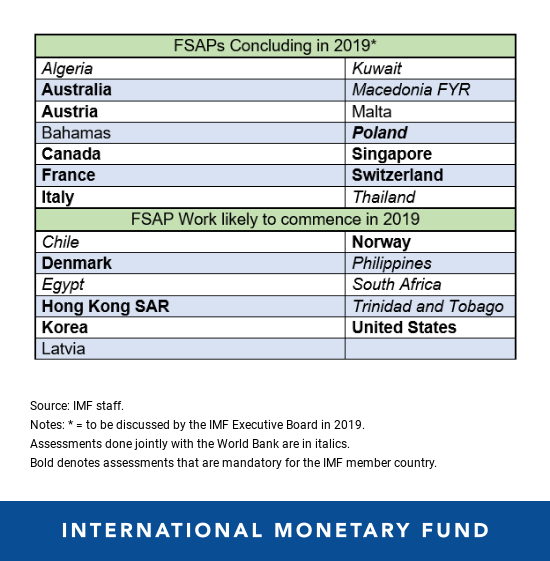

In 2019, the IMF will complete 14 assessments under the Financial Sector Assessment Program (FSAP). Eight of this year’s assessments are mandatory: Australia, Austria, Canada, France, Italy, Poland, Singapore, and Switzerland. The other six are voluntary: Algeria, Bahamas, Kuwait, FYR Macedonia, Malta, and Thailand.

The FSAP is an in-depth analysis of a country’s financial sector. It serves as the principal tool for assessing countries’ financial stability. The IMF conducts about 12 to 14 assessments each year. Since 2010, the world’s top financial sectors undergo a mandatory financial check-up every five years. In developing economies and emerging markets, the IMF conducts the assessments jointly with the World Bank, with the IMF focusing on financial stability and the World Bank focusing on financial development issues.

In 2019, the IMF will complete 14 assessments under the Financial Sector Assessment Program, the principal tool for assessing countries’ financial stability.

Some highlights for countries under review in 2019 include:

Australia: Australia experienced 27 years of uninterrupted economic growth, but now also sees a rise in household debt and a buildup of real estate exposure in a concentrated banking system. The assessment will examine the risks and vulnerabilities in the financial system, taking into account how regulators take measures to strengthen resilience and reduce risks. The assessment will also examine the effectiveness of banking, insurance, and financial market supervision; crisis management arrangements, as well as review the macroprudential policy framework, which includes the policies intended to minimize systemic financial risk.

Canada: Canada hosts a large and sophisticated financial system, which experienced strong growth amid limited losses from the 2015–16 oil price shock, outperforming international peers. The assessment will analyze the resiliency of banks and mortgage insurers against the backdrop of highly indebted households, rapidly rising house prices, and housing demand outstripping supply; emerging risks from nonbank and market activities such as insurance and securitization; potential systemic liquidity issues; and financial stability implications of interconnectedness within both the domestic financial system and cross-border. Furthermore, the assessment will emphasize the need to enhance systemic risk oversight and coordination among key regulatory agencies.

France: France’s large and sophisticated financial system is positioned to play a meaningful role in the wider European system, given the recent moves toward the euro area banking union and the capital markets union. The assessment will focus on stress testing, as well as contagion risks across borders and across various sectors of the financial system, such as banking and insurance. The assessment will also evaluate the adequacy of oversight across banking, insurance, and investment fund sectors; the macroprudential policy framework given risks from corporate leverage and cross-border activities; and the implementation of the new insurance supervision and resolution frameworks.

Italy: In recent years, the level of capital held by banks in Italy increased, and at the same time, their quality of assets improved. However, vulnerabilities re-emerged with the recent rise in government bond yields and a slowing economy. The assessment will examine banks’ risks and vulnerabilities, including those stemming from corporate sector loans and exposure to government bonds. The assessment will also evaluate financial oversight for banks, securities markets, and insurance companies; the macroprudential framework; and the effectiveness of the crisis-management and corporate insolvency frameworks.

Singapore: The financial system in Singapore is highly integrated into international financial markets and is a critical financial hub in the region. Singapore recently experienced rapid economic growth, underpinned by openness, prudent and forward-looking policies, and strong institutions. Going forward, the country aims to transform its economy and become a global technological innovation hub, including for fintech. The assessment will examine the stability aspects of the financial sector’s extensive cross-border linkages and the challenges posed by current and prospective financial innovation.

Switzerland: In the years since its 2014 assessment, Switzerland’s economy rebounded, and the country made considerable progress to strengthen bank resilience. Switzerland established itself as a fintech hub, which requires developing novel regulations and supervisory monitoring to effectively support policy development. The assessment will focus on the too-big-too-fail banking regime, the effectiveness of banking resolution, the macroprudential framework, and fintech developments. The assessment will also review the supervisory effectiveness—including its intrusiveness into banks’ risk management and internal controls.

Thailand: In Thailand, banks account for a sizable share of the financial sector and appear sound. Financial vulnerabilities arise from high household debt and investment weaknesses among small- and medium enterprises. The assessment will analyze the resilience of deposit-taking institutions to adverse macrofinancial shocks; evaluate the strength of the oversight of banks, insurance companies, and specialized financial institutions, such as state-owned large deposit-taking institutions; and undertake an assessment of the macroprudential and the crisis-management frameworks.

In addition to the 14 assessments to be completed in 2019, 11–13 new assessments are planned to begin this year. They will cover five jurisdictions with mandatory assessments (Denmark, Hong Kong SAR, Korea, Norway, and the United States) and at least six with voluntary assessments (Chile, Egypt, Latvia, Philippines, South Africa, and Trinidad and Tobago).