September 18, 2018

[caption id="attachment_24507" align="alignnone" width="1024"] A customer pays at a supermarket using her smartphone in Bangkok, Thailand: urban and rural areas in the region widely use mobile payment platforms to access financial services (photo: Li Mangmang Xinhua News Agency/Newscom)[/caption]

A customer pays at a supermarket using her smartphone in Bangkok, Thailand: urban and rural areas in the region widely use mobile payment platforms to access financial services (photo: Li Mangmang Xinhua News Agency/Newscom)[/caption]

In Asia, the world’s fastest-growing region, expanding access to financial services for more people will mean higher growth, as well as lower poverty and inequality.

How? When people and companies can open checking accounts or establish lines of credit, they are better able to borrow and manage their savings and spending, all of which greases the wheels of the economy.

Our latest research shows how Asia can benefit from giving more people more access to financial services.

Mind the gap

The good news is that more people in Asia are using financial services than ever before, through ATMs and the popularity of mobile banking. Despite this progress, wide disparities in access to, and usage of, financial services—known as financial inclusion—in countries still exist.

For example, the gaps in Asia between rich and poor, rural and urban populations, and men and women are some of the highest in the world. In India, only about 52 percent of male adults from the poorest income group have a bank account, compared to 80 percent from the highest income group.

Income is not the only factor contributing to the gap between what are often referred to as “the banked” and “the unbanked”. The vast diversity of the region means that factors such as geography, financial sector structure, and policies are also important.

More access to financial services can help poor people climb out of poverty.

Implementing policies that promote widespread access to financial services, including by using fintech to spread the benefits more broadly and effectively, can help close these gaps in Asia.

Benefits of widespread financial access

Our research finds that greater access to financial services can bring substantial economic gains.

More access to financial services can help poor people climb out of poverty by making it possible for them to obtain credit and insurance to run a business, invest in education or health, manage risk, and weather financial shocks—all of which can generate income and improve the quality of their lives. This is vital for lower-income countries like Myanmar and Nepal, where less than 40 percent of households have a bank account.

Furthermore, we found that if all Asian countries with poor access to financial goods and services improved to the level of Thailand—an emerging market economy in Asia at the frontier of financial inclusion—poverty in the region could fall by about 4 percent or around 20 million people.

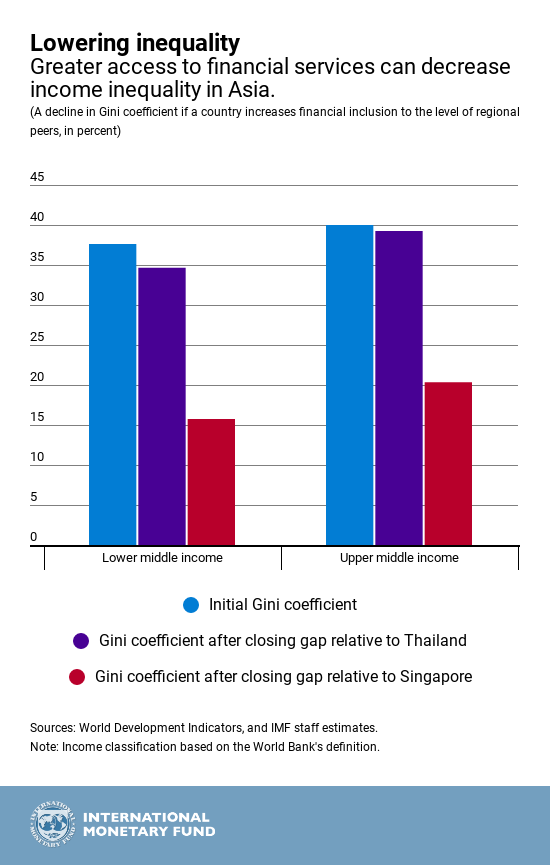

Our research further shows that expanding access to financial services, especially to poor households, can increase their economic opportunities and improve their livelihoods leading to a decline in the overall level of income inequality within a country.

Using a statistical measure of income distribution, we found that when countries expanded access to financial services to the level of Singapore—where access to necessary and affordable financial services is widely available—inequality fell by as much as 10-20 percentage points from the current level of 30-43 percent.

Moreover, if Lao PDR reached Thailand’s level of financial inclusion, income inequality would drop by five percentage points—reaching a level not observed since 2002.

Financial inclusion also matters because it can improve the effectiveness of macroeconomic policies.

For instance, we found that it can improve the efficiency of public spending. When more households and businesses have access to financial services, governments can directly send transfers and payments to personal and business accounts. This helps to reduce waste in government spending, which could potentially free up resources that could be put toward promoting growth that benefits many, like social spending.

Fintech on the rise

Given how vital access to financial services is to economic growth and lowering income inequality, technological innovation in financial services—or what is commonly known as fintech—can be an important tool to expand financial services to some previously excluded groups, thanks to its cost savings and accessibility.

China, for example, is a global leader in mobile payments, with 61 percent of the population making digital payments in 2017 - accounting for 55 percent of total mobile payments in the region and exceeding the level of several high-income countries. Other emerging market economies and some low-income developing countries are using fintech, such as Bangladesh, Cambodia, Indonesia, and Malaysia.

The region has also emerged as a major center for mobile money service providers and users, second only to Sub-Saharan Africa.

Pacific Island countries, such as Fiji, Samoa, Solomon Islands, and Tonga, are increasingly using mobile technology to gain access to basic financial services. Mobile banking helps bypass the infrastructure deficiencies, and geography that make traditional banking, like going to a physical bank, rather difficult.

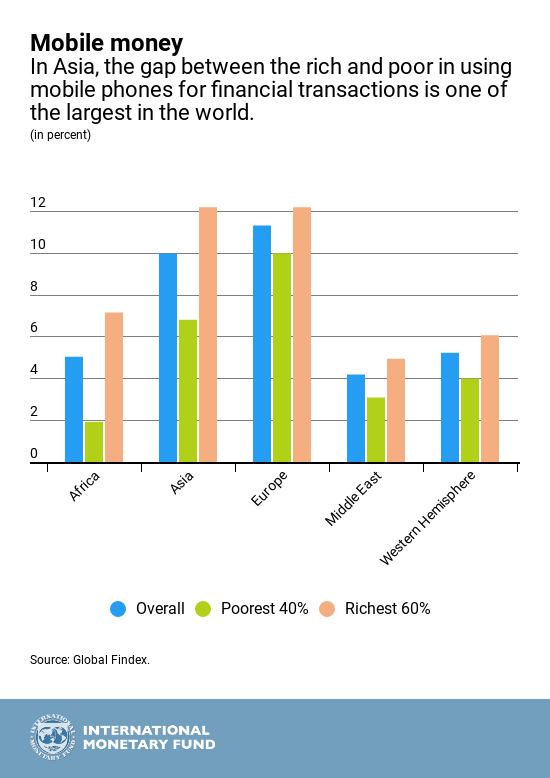

Despite these developments, the benefits of fintech in the region are unevenly spread, as the fintech gap in Asia between rural and urban areas is one of the world’s largest.

More financial access needed

There is no one-size-fits-all policy and Asia’s policymakers will need to strike the right balance between fostering innovation and maintaining financial stability in implementing a combination of wide-ranging policies.

For example, the emergence of microfinance in Bangladesh and the rise of mobile payments in Asia and many countries in Africa highlight that social experimentation and public-private partnerships can deepen and expand access to financial services, helping to spread its benefits more broadly.

At the same time, continuing to implement reforms that can reduce the cost of financial services, and encourage the unbanked to integrate into the financial sector will also help.

Samoa’s policymakers, for example, have made it a priority in the country’s National Financial Inclusion Strategy to appropriately design and price financial service products for widespread usage, especially by the low-income population.

Our research shows that both the largest and smallest countries offer lessons on how to improve financial inclusion in Asia. The key is to put in place the right set of policies for each country.