May 7, 2018

[caption id="attachment_23478" align="alignnone" width="1024"] Marsaxlokk Harbor, Malta. Not only tourist paradise: the country’s economy makes profits on the betting and gambling industry (photo: iStockPhoto/Andrey Danilovich). [/caption]

Marsaxlokk Harbor, Malta. Not only tourist paradise: the country’s economy makes profits on the betting and gambling industry (photo: iStockPhoto/Andrey Danilovich). [/caption]

Known mostly for its azure seas and spectacular old towns, Malta has also become a hub for gambling and betting companies: nowhere else in the European Union does this sector account for such a large part of the economy as on the island south of Sicily in the Mediterranean Sea. While the gambling and betting boom contributes to the country’s trade balance and job creation, it also draws attention to a skills shortage and infrastructure gaps the sector is grappling with, a recent IMF paper shows.

Malta has been going through an economic boom in recent years: at nearly 6.5 percent of average GDP growth between 2013 and 2016, its economy has grown significantly faster than the euro area, and is today one of the fastest growing countries in the entire EU.

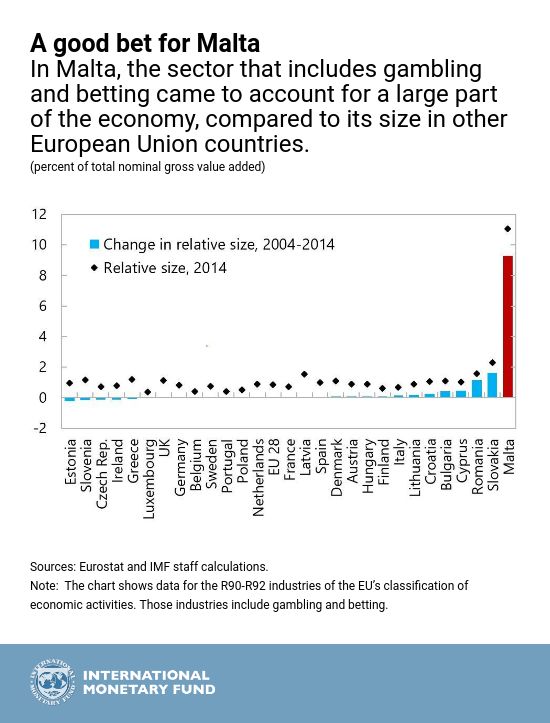

Together with the expansion, the economy reoriented toward the services sector. That sector includes gaming firms: providers of gambling and betting services, done the traditional way at lottery counters and casinos, but more importantly online or on mobile devices. In this sector, Malta’s advantage over the rest of the EU is staggering both in the relative size of the gaming industry (almost 12 percent of Malta’s total gross value added in 2016) and its recent expansion (the share in Malta’s gross value added grew by 9 percentage points between 2004 and 2014).

By 2016, gaming firms and other closely related businesses provided around 4.4 percent of Malta’s full-time equivalent jobs, with healthy increases in wages. The services trade surplus surged to 30 percent of GDP from about 12 percent of GDP in 2004, largely owing to strong gaming exports.

What explains Malta’s exceptional performance in this field? Partly, by being the first: the island was the pioneer among member states to regulate the online gaming industry in 2004, attracting firms from places such as Sweden and Austria to open shop. Then, unlike other countries with often state-owned gaming monopolies, Malta assigned licenses to multiple private enterprises. It also helped that the country is English speaking, and offers business-friendly tax regimes and political stability.

Malta keeps refining its gaming regulations, and to tackle money laundering risks, it has recently adopted new rules in this area that make online gambling and betting firms fully subject to EU anti-money laundering requirements. These include, among others, transparency in the ownership of companies, and cooperation among national financial intelligence units.

Yet, the boom brought to the surface several issues that need fixing. Due to a digital skills shortage, about 67 percent of employees in online gambling and betting firms are foreigners. Newly arrived software developers, specialized lawyers, and senior managers face rising housing rents. Companies have trouble finding modern office space and transport congestion has worsened. To ensure that growth prospects for the gaming and other sectors remain favorable, Malta is addressing these challenges by improving education and training for its workforce, revamping infrastructure, and strengthening innovation on the island.