Versions in عربي (Arabic), Français (French), Русский (Russian), and Español (Spanish)

The outlook for further interest-rate increases by the US Federal Reserve revives interest in a compelling question: In an increasingly integrated global financial system, how much control do countries outside of the US retain over their economic policies?

For policymakers around the world, the question is more than academic. Their concern:

Global events have such a large impact on financial markets that there’s little scope left to pursue their own objectives, such as full employment or low inflation.

Unwelcome development

Here’s a simple example of why that’s the case. A decision by the Fed to raise interest rates increases yields on US assets, attracting capital from other countries. As a result, interest rates in those countries may go up, making it harder for consumers and companies to obtain the credit they need to buy more goods or invest in new machinery. That could be an unwelcome development in a country that is trying to keep borrowing costs low to combat unemployment, for example, or sustain economic growth.

To find out how much freedom central banks still have to pursue their own policy objectives, the latest IMF Global Financial Stability Report develops indexes that measure changes in financial conditions in a broad array of advanced and developing economies. Financial conditions refer to how easy or difficult it is to borrow money, and they can be influenced by bond prices and exchange rates. A measure of those conditions is a useful tool for assessing the likely impact of policy decisions.

Financial shocks

Our indexes show that global events account for between 20 percent and 40 percent of local conditions across countries, leaving policymakers considerable scope for action. And even as financial markets have become more integrated, the degree of control countries exert over domestic conditions has only diminished mildly over the past two decades. Still, the rapid speed and the strength by which external financial shocks tend to affect local markets often makes it difficult for policymakers to react in a timely and effective manner.

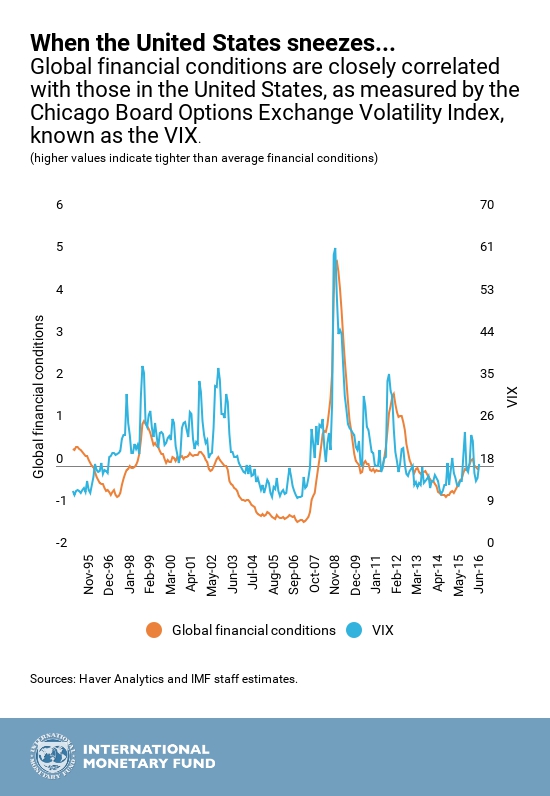

Global conditions appear to be strongly driven by the United States, in part because the dollar is the predominant currency in international transactions. We found that the global financial conditions index correlates strongly with those in the United States and with the Chicago Board Options Exchange Volatility Index, or VIX, a gauge of perceived risk in US equities.

Emerging markets, which are more sensitive to global conditions than advanced economies, should take steps to bolster their resilience to global shocks. They should deepen domestic financial markets and develop a local investor base, making their markets less susceptible to fluctuations in flows of money across borders.

Such steps are particularly important now, when financial conditions are tightening in response to the Fed’s rate hike.

The IMF will release more analysis from the Global Financial Stability Report on April 19.