Versions in عربي (Arabic), 中文 (Chinese), Français (French), Русский (Russian), and Español (Spanish)

Basic economic theory tells us that capital should flow from slow-growing rich countries to faster-growing poor ones in search of higher returns. A decade ago, our former Research Department colleagues Eswar Prasad, Raghuram Rajan, and Arvind Subramanian examined why the reverse had been true—capital generally flowed “uphill” from poorer to richer countries. Building on the seminal work of Robert Lucas, they argued that certain characteristics of poorer countries, such as weaker institutions and lower levels of education, may reduce the risk-adjusted returns to investing there.

In this blog, we revisit the uphill flow puzzle and discuss its policy implications. We show that uphill flows, after intensifying ahead of the global financial crisis, have recently reversed direction. These shifts reflect several factors, but the projected normalization of monetary policy in key advanced economies and increased policy uncertainties make a large and persistent reversal of uphill flows unlikely. Going forward, emerging and developing economies should continue to focus on polices that enhance the benefits of inflows, temper capital-flow volatility, and improve the resilience and depth of domestic financial markets.

Shifts in global capital allocation

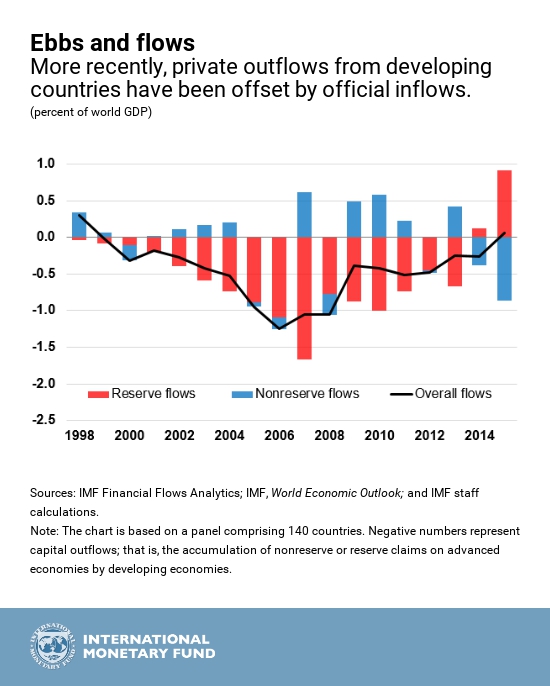

In the years preceding the crisis, advanced economies as a group received persistent and sizable net capital inflows. These inflows were mirrored by large and growing outflows from developing countries—and particularly China, the largest among them, which was integrating into the global economy—and exporters of raw materials, which benefited from the boom in commodity prices. Outflows from developing economies during this period were dominated by accumulation of official foreign exchange reserves.

Since the crisis, the paradox has unwound. Firms and households in advanced economies reduced their debts, resulting in less investment and lower net inflows of capital. These developments were matched by reduced outflows from developing economies as China started to rebalance its economy toward domestic consumption and the commodity income windfall for commodity exporters vanished. The slowdown and eventual reversal in uphill flows largely reflected movements in official foreign reserves, which started registering an overall decline a few years ago. In fact, since 2014 net private flows to developing countries turned negative, as documented by earlier IMF work, yet were offset by inflows as central banks unwound their foreign asset positions.

Role of saving and investment

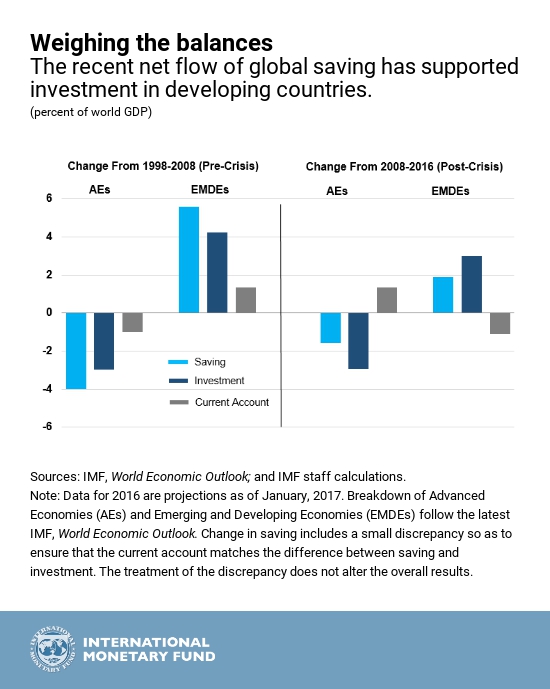

The pre-crisis uphill flows mostly reflected saving-related factors and did not prevent falling investment in advanced economies or rising investment in developing economies in relation to world gross domestic product. Investment-to-GDP ratios fell in advanced economies, with sharply lower saving nonetheless driving an increase in external deficits. In contrast, investment grew strongly in developing economies despite the intensification of capital outflows. That’s not surprising, given their generally lower stocks of capital. But that strength in investment was more than offset by a surge in saving. Intensive export orientation at the expense of consumption in China, and the resulting increase in commodity prices, were among the forces behind these patterns.

Following the crisis, investment and saving trends continued to diverge between rich and poor countries. In advanced economies, current account balances improved as investment fell. In developing nations, meanwhile, current account balances weakened, reflecting relatively faster investment growth, which, while slowing sharply from its pre-crisis rate, outpaced an increase in saving. Thus, the more recent net flow of global saving has been in the direction of supporting higher investment in developing countries.

Outlook and policies

A large downhill flow of capital seems unlikely to persist in the near term. For one thing, net private inflows to developing countries have turned negative recently. True, stronger growth and infrastructure needs in these economies, as well as structural changes like aging populations in richer ones, could push capital in the “right” direction. However, capital could again flow back to advanced economies as they tighten monetary policy, a prospect that began to appear more likely after the U.S. presidential election raised expectations for a more expansionary U.S. fiscal orientation. And big global uncertainties remain, not least because of the rising risk of protectionism, which could predominantly affect developing economies.

Reaping the benefits of capital inflows remains a central challenge for developing economies. In general, meeting it will require a further strengthening of policy frameworks to lower the risk of potential capital-flow reversals. While exchange-rate flexibility can help provide a buffer, additional tools may be needed at times to maintain orderly market conditions. Moreover, robust institutions and policy frameworks remain critical, as highlighted by earlier work, including well-functioning domestic and international financial markets to efficiently channel saving into investment.