Versions in عربي (Arabic), 中文 (Chinese), Français (French), and Español (Spanish)

Over the past three decades, income inequality has gone up in most advanced economies and in many developing ones as well. Why? Much of the research on inequality has focused on advances in technology and liberalization of trade as the main drivers. While technology and trade are global trends that are difficult to resist, IMF studies have shown that the design of government policies matters and can help limit increases in inequality.

Another important conclusion of IMF research: rising inequality poses risks to durable economic growth. This puts addressing inequality squarely within the IMF's mandate to help countries improve economic performance. So, the IMF is now building on years of research into inequality to offer its member countries policy solutions, particularly on equitable ways to tax and spend.

Understanding inequality

A good example is Bolivia, which had one of the highest levels of income inequality in Latin America at the turn of the century. When prices of its commodity exports boomed early in this century, the country saw a big reduction in inequality that put it in the middle of the regional pack. Eager to preserve those gains, the government wanted to understand the causes of the decline, and to develop policies that could keep inequality from creeping back up as a result of the recent drop in commodity prices.

Against this backdrop, inequality featured prominently in the IMF’s annual consultations with the government in 2015 and 2016, which drew on a detailed study using income data for Bolivian households. This deep dive showed that inequality had declined because the wealth from commodity exports had been shared with the rest of the economy through increased public investment, social transfers, and a higher minimum wage. Another study demonstrated the key role that expanding access to financial services could play in lowering inequality.

The IMF developed a model of the Bolivian economy to simulate how inequality was likely to evolve and to test which policies could help preserve the gains. Maintaining infrastructure investment and making it more efficient and better targeting cash transfers turned out to be the best policy levers.

Ethiopia offers another example of practical IMF advice. There, the IMF reviewed the evolution of inequality and measured the distributional impact of policies to enhance growth. Its recommendations included making income-tax thresholds more progressive, promoting financial instruments for rural savers, and revamping indirect subsidies to better serve low-income households.

Causes: budget deficits, labor markets

In studying the causes of inequality, IMF economists have focused on three policy areas: reducing budget deficits through tax increases or spending cuts, liberalizing labor markets, and removing barriers to the movement of capital across borders. While these policies can be beneficial, they can also sometimes have the side effect of raising inequality.

Inequality by country: IMF reports

Discussions of inequality have featured in country reports in all regions of the world and for advanced and developing economies.

- Africa: Ethiopia, Republic of Congo, Zambia

- Asia: Kyrgyz Republic, Myanmar, Singapore

- Europe: Denmark, Hungary, Lithuania

- Middle East: Israel, Saudi Arabia

- Latin America: Brazil, Guatemala, Honduras

Source: Selected IMF country reports for 2015–16.

Studies of specific countries corroborated those findings, which were based on a broad sample.

Research on Honduras, Guatemala, Republic of Congo, and Uganda confirmed that fiscal policies have a strong impact on inequality.

They also show that the size of the impact depends on how taxes are collected and revenue spent. The effects on inequality are larger when there is less recourse to direct income taxes and greater reliance on indirect taxes; on the other hand, spending on infrastructure reduces inequality.

Case studies of Ethiopia and Myanmar confirm that financial sector reforms can exacerbate inequality if access to financial services remains limited and labor mobility is constrained.

Consequences: inequality and growth

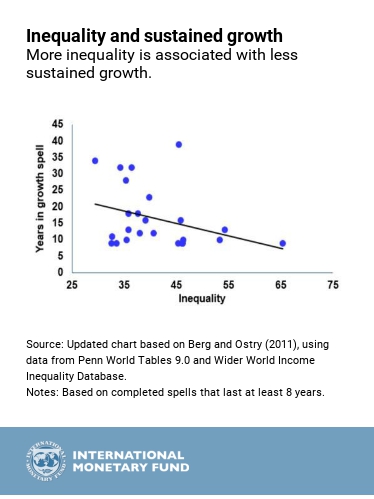

The importance that many governments are now giving to addressing inequality suggests that they feel that not doing so will have adverse socio-economic consequences. Their concerns have been bolstered by the finding of IMF research that inequality makes economic growth less durable.

This result has attracted considerable attention because it shows that high inequality imposes a direct economic cost, in addition to the costs highlighted by other (non-IMF) authors such as capture of the political process by elites, and a decline in social cohesion. The result also puts inequality within the remit of the IMF’s work: fostering sustained growth, a goal of IMF advice, requires some attention to inequality.

Why does greater inequality end up hampering durable growth? In developing economies, higher inequality has sometimes led to social or political crises, which in turn can derail growth.

In advanced economies, IMF work shows that greater inequality in incomes may lead to excessive borrowing by low- and middle-income households, which eventually triggers a crisis, a sequence of events that characterized the run-ups to both the Great Depression and the Great Recession.

The IMF’s latest review of the US economy showed that income polarization since 2000 has “had a negative impact on the economy, hampering the main engine of US growth: consumption.”

Cures for excessive inequality

Studies of the causes and consequences of excessive inequality naturally lead to discussions of possible remedies. For example, if fiscal policies contribute to inequality, the IMF’s advice on the design of these polices needs to account for that fact. This is both because the distributional consequences may be important in their own right to some governments, and because they can reduce the durability of growth.

The design of fiscal policy is critical for both redistribution and “predistribution”—improving equality of opportunity to prevent extreme inequality from arising in the first place. These policies include public spending on health and education, which can improve equality of opportunity for people from lower-income households.

In contrast, redistribution refers to actions taken after the fact so that disposable—or net—incomes are more equal than market incomes. Steps include progressive taxation, cash transfers to low-income families, and other welfare benefits. One important research finding, which has implications for the design of many policies, is that redistribution, unless extreme, does not have an adverse impact on growth.

Conclusion

To summarize, IMF work has made important contributions to the study of inequality.

- On causes, the finding that economic policies are an important determinant of inequality implies that governments can take steps to reduce inequality when it is deemed excessive;

- On consequences, inequality has been shown to have a direct economic cost in terms of reduced durability of growth—this puts it with in the remit of the IMF’s core work;

- On cures, the design of policies should take into account the distributional outcomes. This is increasingly being done in the advice that the IMF gives to it member countries.

Read also the recent IMF statement on operationalizing inequality.