For an economist interested in examining the evolution of monetary and exchange rate regimes, Central, Eastern and Southeastern Europe (CESEE) provides a habitat of unparalleled diversity. Almost every type of regime can be found in the region: from floating and inflation targeting over various pegs to the unilateral use of the euro and full euro area membership.

Why do CESEE’s monetary regimes differ so much from one another, and how have they performed? Looking forward, how can they help countries address the economic challenges they are likely to face? If a country’s current regime seems suboptimal, could it switch to a more suitable one, and if so, how?

A new paper by the IMF’s European Department tackles these questions. This is a good time to take stock: in the past 15 years or so, CESEE went through a large boom-bust-recovery cycle, with a capital-flow-fueled boom in the early and mid-2000s, a sharp recession after the 2008 global financial crisis, and finally a gradual recovery. This allows analyzing monetary regimes’ performance in a variety of challenging circumstances.

What do we find?

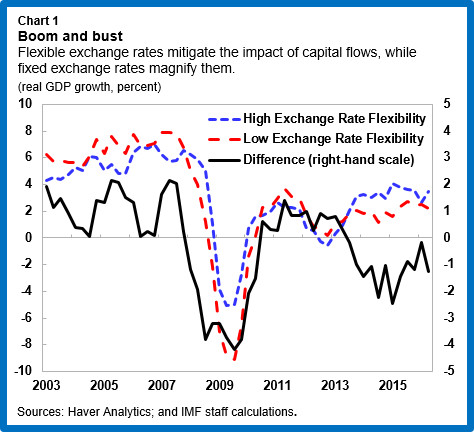

First, the boom and bust were, in general, less pronounced in economies with flexible exchange rates, with a more muted pre-2008 boom, followed by a shorter and shallower recession, and a more robust recovery. We spell out the full mechanism underlying these developments in the paper. But in short, flexible exchange rates tended to mitigate the impact of capital in- and outflows, while fixed exchange rates magnified them (see Chart 1). That fixed exchange rates can amplify capital flows through pro-cyclical credit booms is well documented for emerging economies, and it clearly shows up in CESEE.

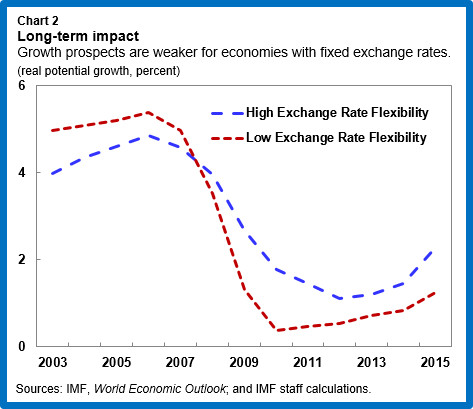

Second, excessive boom and bust continues to affect economies long after these episodes have ended. As a result, potential growth in economies with fixed exchange rates is now, on average, almost a percentage point below that of economies with flexible exchange rates, as high private sector debt accumulated during the boom weighs on investment (see Chart 2).

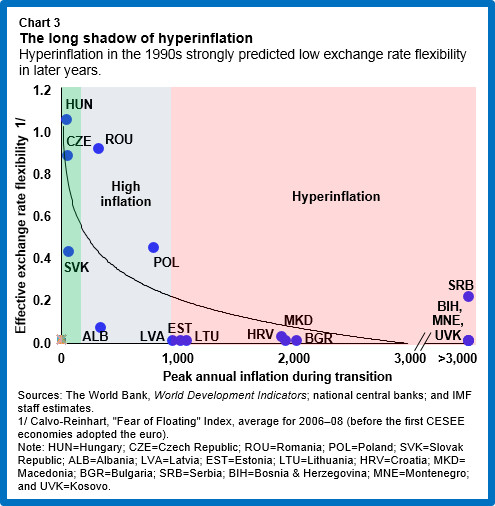

But third, and importantly, this does not mean that countries with fixed exchange rates simply chose the wrong regime. Fixed exchange rates are there for a reason. For CESEE, we can trace their existence back to experiences with hyperinflation during the 1990s (see Chart 3). Wherever populations suffered hyperinflation, they continue to distrust local currencies to this day. Among other things, they are much more likely to hold bank deposits in euros. In such an environment, tying the currency to a strong anchor like the euro provides stability and can instill confidence—and this can be more important than better managing credit cycles.

What does this suggest for exchange rate policy going forward? For countries with flexible exchange rates, we see little need for reorientation—their regimes have generally served them well (while, of course, good economic management across the full range of policy tools—monetary, fiscal and structural policies—will remain critical to good economic performance). But what can countries with fixed exchange rate regimes do to achieve more balanced growth without ceding stability? We sketch two strategies:

• The first is to gradually increase exchange rate flexibility. But this is not an easy option, given especially the hyperinflation legacy. International experience suggests that a switch requires strong macroeconomic policies, regulatory measures that encourage the use of the domestic currency, and an extended period of low inflation, solid growth and exchange rate appreciation that solidifies confidence in the domestic currency. How feasible this strategy is depends on country circumstances. Some CESEE countries may have sufficiently strong institutions by now to transition—but others will likely need the fixed exchange rate as stability anchor for some time. Further, for countries that expect to adopt the euro soon, the upfront costs of transitioning to more flexibility may not be worthwhile.

European institutions could help, through greater acceptance of prudential measures that promote the use of local currencies—instead of interpreting these as quasi-capital controls inconsistent with the European treaties. And a financial safety net during the transition to flexibility—for example in the form of unsecured European Central Bank swap lines—could help overcome the populations’ entrenched distrust in floating currencies.

• A second option is to make existing fixed exchange rate regimes work better. This requires high wage flexibility and a much stronger use of countercyclical fiscal and macro-prudential policies. But this is not easy to realize either. Running a countercyclical fiscal policy is challenging for emerging economies, reflecting low fiscal multipliers, financing constraints, and political economy pressures. And macro-prudential policies that put restrictions on bank lending suffer from evasion, with banks circumventing regulations in one country by providing loans cross-border from another. Thus, effective macro-prudential measures require a coordinated European anti-evasion effort.

To summarize, the diversity of exchange rate regimes in CESEE reflects in large measure different habitats. One type of exchange rate regime is not inherently better than another—suitability depends on local conditions. But as in the natural world, regimes need to evolve as conditions change, otherwise their economies risk falling behind.