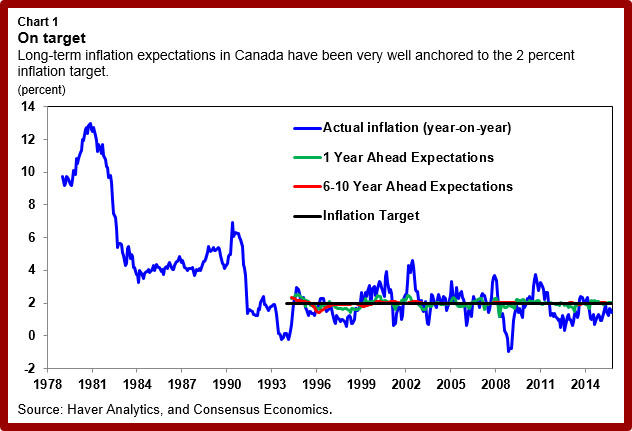

For the past 25 years, Canada’s monetary policy framework has been working well. Headline inflation averaged 1.9 percent, 1994–2015, and long-term inflation expectations have been very well anchored to the 2 percent target (Chart 1).

The current economic environment, however, poses unusual challenges to monetary policy in many countries: low and sub-zero interest rates; significant economic slack; and the risk that inflation might get stuck below target. In the event of further headwinds, the Bank of Canada has indicated that it might use unconventional tools, such as ad hoc forward guidance on the policy interest rate, quantitative easing, funding for credit, and negative interest rates. But using such tools are not without disadvantages.

In our recent paper, we consider instead modifications to the existing framework that would increase the effectiveness of monetary policy. In particular, we make a case for the Bank of Canada to use conventional forward guidance before employing unconventional tools to achieve its policy goals.

Conventional forward guidance

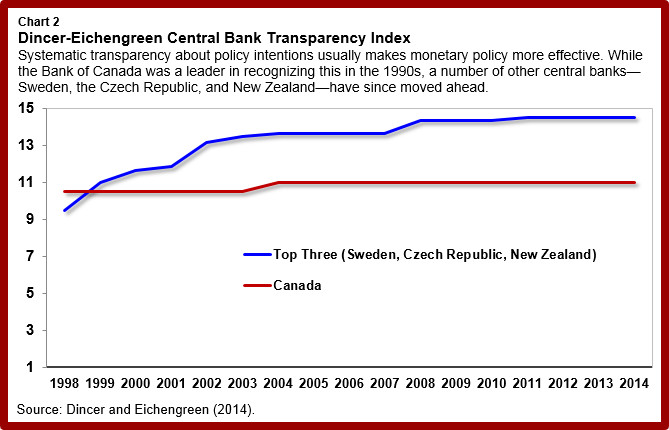

Systematic transparency about policy intentions makes monetary policy more effective.

We recommend that the Bank of Canada—like most central banks that rank above it on the Dincer-Eichengreen transparency index (Chart 2)—publish the path of the short-term interest rate from the forecast used at its policy meetings (of which there are 8 per year). That is, the Bank should, as a matter of routine, provide conventional forward guidance as to the future path of the rate, with the usual caveats, of course, including that such guidance is not a commitment and is conditional on the Bank’s latest forecast. It is important to emphasize that conditions change in ways that forecasts do not foresee, and policymakers must therefore adjust the future interest rate path so as to guide inflation back to the target within a reasonable time horizon. Publication of a confidence band for the interest rate path, and alternative scenarios to the baseline forecast, help to clarify the conditionality.

Conventional forward guidance, however, should not be confused with ad hoc forward guidance, an unconventional tool that has been used to stimulate the economy and spur a robust recovery. Such guidance was practiced by the Bank of Canada in 2009, and more extensively by the U.S. Federal Reserve and the Bank of England. The conditional commitment to a very low rate had some success in reducing longer-term interest rates, but it has also created communications problems especially with respect to the duration of the commitment and to what would happen next (see, for example, in the United States).

Conventional forward guidance would help strengthen the inflation-targeting framework.

Two points to stress here.

First, the current setting of the money market overnight interest rate—the Bank’s main policy instrument—in and of itself has a negligible direct effect on the macro economy. The effectiveness of any policy rate actions depends on their influence over expected future short-term rates, and hence on the medium- and longer-term interest rates at which households and firms invest and borrow. Policymakers must therefore have a view on the whole medium-term path of the policy rate when making decisions.

Second, even given all the objective factors forecasters consider important, the future policy rate path that will return inflation to the target is not unique. The one chosen for the forecast reflects policymakers’ preferences about the short-run output and inflation trade-off. Only the central bank can know which path it has in mind in managing this trade-off. In the absence of direct guidance, markets have to guess at their intentions.

Through its impact on expectations, conventional forward guidance would help to make the monetary policy instrument more effective. By publishing the forecast interest rate path, the central bank reveals how it plans to navigate the short-run trade-off between output and inflation. If the path is considered credible to market participants, the term structure of interest rates and the exchange rate will move in support of the objectives of policy.

More than just an academic debate

Some might see this issue as merely an academic debate but it has real consequences. It can strengthen the policymakers’ toolkit to address Canada’s current economic challenges.

Under conventional forward guidance, an aggressive strategy to deal with the current slack and improve the economy’s resilience would be made possible. For example, further negative shocks when the policy interest rate is near zero could push the economy closer towards a low inflation trap, from which escape can be very difficult.

In this context, a strategy where there is an explicit forecast for the policy rate to stay low for longer, and inflation temporarily overshoots the target, would help to raise inflation expectations, lower real interest rates, depreciate the exchange rate, and stimulate the economy, as laid out in our paper. As economic growth improves, the desired interest rate would increase and the economy can safely exit from ultra-low interest rates. Conventional forward guidance allows the central bank to give a credible public account of the strategy to achieve its objectives and reinforce confidence in the 2 percent inflation target.

In light of Canada’s economic challenges, its current policy for fiscal stimulus is fully justified, especially in view of the low government debt-to-GDP ratio and the exceptionally low cost of long-term government borrowing. Making monetary policy instruments more effective would compliment these fiscal efforts to boost growth, strengthening Canada’s resilience and ability to handle unexpected shocks.