Version in عربي (Arabic)

Every year, millions of people leave their countries of birth in search of better opportunities abroad. Often, these migrants are among the most talented workers in their home countries. At first glance, this is a loss for the home countries, which invested considerable time and money in educating and developing these people, only to watch them leave. But look again.

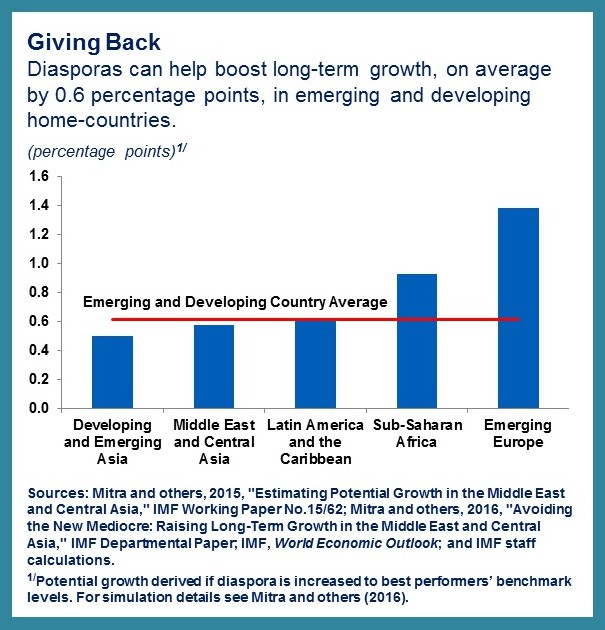

With the right policies, home countries can make use of their diaspora communities—which include emigrants and their descendants—to support the economy. In a recent study, my colleagues and I find that diasporas can help raise long-term economic growth, on average, by 0.6 percentage points in emerging and developing home countries (see chart).

How diaspora communities boost home-country growth

Diaspora communities can make a unique contribution to the development of their home countries—especially toward building physical capital and productivity, and ultimately helping to boost job creation, living standards, and higher growth.

How do they do this? First, they send money home in the form of remittances. Migrants from emerging and developing countries sent home $430 billion last year—three times more money than their home countries receive in financial assistance from other countries or international financial institutions and a substantial portion of their GDP. For example, as a percent of GDP, remittances represent 37 percent in Tajikistan, 30 percent in Nepal, around 25 percent in Tonga, Liberia, and Haiti, and 16 percent in Lebanon. These figures could be even higher if the high cost of sending remittances—ranging from 5 percent of the amount being sent in South Asia to 12 percent in Sub-Saharan Africa—were lowered.

When these remittances are spent on goods and services, they immediately support economic activity. When these remittances are used to invest, they can boost the home-country’s capital. For example, relatives back home may use this money to fund their own businesses—or they may save it, increasing the funds banks have to lend to businesses. Diasporas also invest directly in business opportunities and government bonds in their home countries. In addition to supporting investment in capital, diasporas also support productivity by funding education, training, and healthcare.

Second, by virtue of their education and training, diaspora networks convey knowledge and expertise—raising productivity through a variety of channels. By contributing to the design of educational curriculum and training, diasporas can raise the quality of education in their home countries. They can also directly provide rigorous professional development and leadership training programs. Combining their skills, contacts, and know-how with their insights into global opportunities and local customs, diasporas help home-country businesses overcome hurdles, raise efficiency, and expand into new markets. In the same vein, they can also be powerful advisors to governments in helping to improve the quality of public institutions and advocates to foreign businesses looking to expand. For example, Indian-born executives in U.S.-based technology companies played a critical role in giving their companies the confidence to outsource work to India.

Catalyzing diasporas

Ultimately, the intensity of diaspora involvement in their home country depends on a multitude of factors. Many of those are out of policymakers’ realm of influence, such as culture, a sense of identity, prevalence of extended families, and security conditions. However, there is also plenty governments can do.

A multi-pronged strategy can help governments get the most out of their large and successful diaspora communities, including:

- Developing networks are essential for deepening communication and building partnerships of diasporas with professional communities at home and across the diasporas themselves. Governments can support these networks in two key ways. As a first step, they can reach out to highly educated and motivated parts of their diasporas to encourage participation in the network. Governments can also provide forums for information sharing, ranging from simple websites to large-scale conferences. Globalscot, a diaspora network created and managed by the Scottish government, is just one example. Making use of various platforms, they have elevated the quantity and quality of global knowledge circulation in Scotland.

- Encouraging investment by relaxing legal barriers and capital flow restrictions faced by diasporas when investing in home-country property and business opportunities. Governments can also appeal to the patriotism of their diasporas by encouraging them to support public investment by marketing bonds catered to their interests. Infrastructure bonds sold by Israel are an example. More broadly, improvements to the business environment, governance, the quality of institutions, and reducing perceptions of corruption would facilitate investment from not only diaspora networks, but also from other entities abroad as well.

- Reducing remittance costs and improving access to wider financial services for migrants and remittance recipients would raise regular remittance flows. This can be achieved by enhancing the integrity of money transfer systems, improving the infrastructure for domestic and cross-border payments, removing legal barriers to the development of sound remittance markets, and fostering market competition. Recently, Indonesia, Liberia, Nicaragua, and Samoa implemented policy reforms, technical improvements, and regulatory changes aimed at enhancing the remittance market for consumers.

- A strong communications strategy on the benefits of diaspora networks is helpful in mobilizing support from elites in home countries. This is important because elites, who may view diasporas as competition, often have a strong influence on home-country institutions that partner with diasporas.