(Versions in 中文, Português, Русский, and Español)

Emerging markets have had a great run. The fifteen largest emerging market economies grew by 48% from 2009 to 2014, a period when the Group of Twenty economies collectively expanded by 6%.

How did emerging markets sustain this growth? In part, they drew upon bank lending to drive corporate credit expansion, strong earnings, and low defaults. This credit boom, combined with falling commodity prices and foreign currency borrowing, now leaves emerging market firms vulnerable and financial sectors under stress, as we discuss in the latest Global Financial Stability Report.

Credit booms and credit gaps often foreshadow severe bad debt cycles

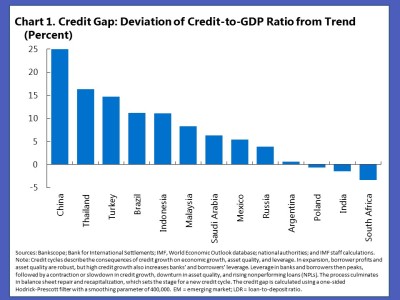

Credit booms can feed the buildup of risks to the financial system—excess investment leading to surplus production capacity, deteriorating cash flow for corporates, rising default risk, and ultimately bank capital losses. The credit gap, a measure of a country's increase in borrowing (credit to GDP ratio) relative to its historical average, highlights vulnerable countries.

By the end of 2014, China, Thailand, Turkey, Brazil, and Indonesia all had credit gaps above 10%, a level often considered the benchmark for risky credit booms (Chart 1). China’s 25% credit gap places the country in the 5% highest credit gaps across emerging markets since the 1970s. This is consistent with other signs of strain: the growth of opaque ‘shadow credit’ markets, and Chinese policymakers’ desire to limit financial market developments (for example, corporate defaults or volatility in equity and currency markets) that could trigger spillovers across the credit system.

However, credit gaps do not capture all problems. Russia, Argentina and India currently have low credit gaps. Other factors also can cause stress for the financial system. The interaction of excessive credit growth with a broad range of other factors renders current conditions across emerging market economies particularly worrisome. Recent depreciation of corporates’ home currencies against the dollar and falling commodity prices are increasing stress on weaker borrowers, and increased borrowing rates could exacerbate the situation. Our latest Global Financial Stability Report focuses on these risks.

Emerging market banks have not increased buffers ahead of the bad debt cycle

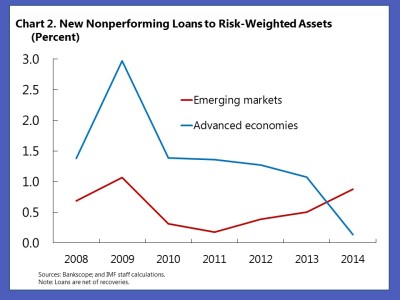

Consistent with the beginning of the end of the credit boom, emerging market banks are starting to see new non-performing loans at a faster rate, which is now above developed economy levels for the first time since the financial crisis (Chart 2).

At first blush, emerging market banks appear to have adequate capital and other buffers against financial losses. Their aggregate Tier 1 capital ratio is about 11%, well above the regulatory minimum, and has actually risen slightly since 2009. At the same time, regulatory standards and market expectations have raised the bar considerably over that period. Advanced economy banks, despite much lower stated profitability than their emerging market peers, have collectively engineered a nearly 4 percentage points increase in Tier 1 capital adequacy ratios.

More broadly, the end of a credit boom is normally when banks have built-up their capital buffers through years of high earnings. But, rather than conserving capital to buffer the inevitable turn of the credit cycle, emerging market banks channeled essentially all the earnings into underwriting further growth. As the boom cycle approaches its end, the need to build reserves against rising credit losses will strain future earnings and the ability of banks to maintain credit growth. Emerging market economies now face the risk of rising credit costs, slowing bank earnings, decelerating credit growth, and weak economic performance. These potential weaknesses have serious economic implications for emerging markets and, given their size, for the global economy.

These issues call for a mix of micro- and macroprudential policies

The policy responses are both straightforward and difficult. At this late stage in the credit cycle, recent market turbulence is a warning to policymakers of the need to prevent further deterioration in financial sector conditions. In many countries, the risks of continued rapid credit growth increasingly outweigh its economic benefits. This underscores the need to deploy available micro- and macroprudential tools designed to keep individual institutions and the financial system as a whole safe, to discourage the further accumulation of excess borrowing and foreign indebtedness.

Effective microprudential policies might include higher risk weights (capital requirements) or perhaps caps on the most problematic exposures, which might include property developers, commodity producers and companies with large foreign currency borrowings. Many countries should make stronger corporate insolvency regimes a priority.

Corporate debt in emerging markets makes them vulnerable particularly if interest rates rise. In the current environment, regulators should pay special attention to the vulnerabilities created by borrowing from overseas and in foreign currencies. At the microprudential level, regulators need to monitor banks’ and borrowers’ foreign currency exposures, including derivatives positions, and introduce and strengthen stress tests related to foreign currency risks.

At the macroprudential level, maintaining sovereign investment grade-status is crucial. Accelerating measures to foster money market and corporate bond issuance may also improve corporates’ access to funding pools that reduce dependence on capital-constrained banks and potentially flighty offshore creditors.