(Versions in Español and Português)

Latin America is heading for tougher times. Regional growth is expected to dip below 1 percent in 2015, partly as a result of the drop in global commodity prices. How well placed is the region for the coming lean times?

Countries face this slowdown from much weaker fiscal positions than when the global financial crisis hit. Then, Latin America responded strongly with expansionary fiscal policies, including explicit fiscal stimulus programs in many countries. But, as growth has recovered, this increase in spending has proved difficult to reverse.

Our new study looks at six large emerging countries of Latin America—Brazil, Chile, Colombia, Mexico, Peru, and Uruguay—how they reacted to the global financial crisis, the longer-term consequences of their policy choices, and the main lessons for policymakers.

The golden decade

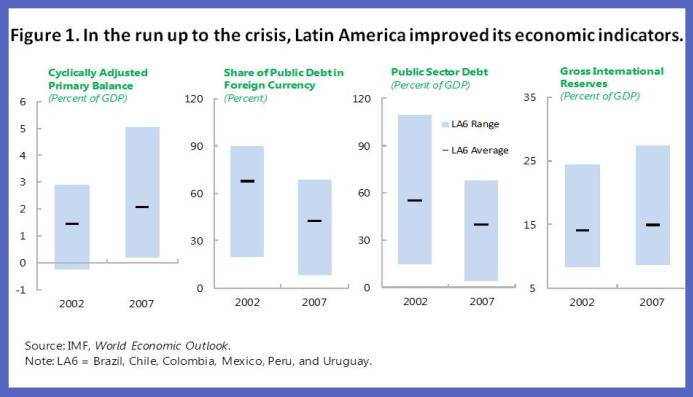

In the decade before the crisis, Latin America experienced a renaissance—strong growth, high commodity prices, buoyant investor optimism, and better policy frameworks. Public debt went down, there was less reliance on dollar-denominated borrowing, and foreign exchange reserves were built up.

Most countries avoided the temptation of going on an excessive spending spree during these boom years, despite pressing social and public infrastructure needs. However, countries could have done more to pay down debts and prepare for the rainy days to come. Nevertheless, at the start of the crisis, their fiscal positions were in good shape.

The storm

While the global financial crisis originated outside the region, it initially hit Latin America hard through the drop in commodity prices and global trade. The discipline maintained in the past decade paid off though. Instead of tightening fiscal policy and adding to recessionary forces, as Latin America had often been forced to do in the past, countries were able to implement a more expansionary policy stance, with explicit fiscal stimulus programs in five out of the six countries. These programs helped to reduce output losses by about 0.75 to 2 percent of GDP.

The aftermath

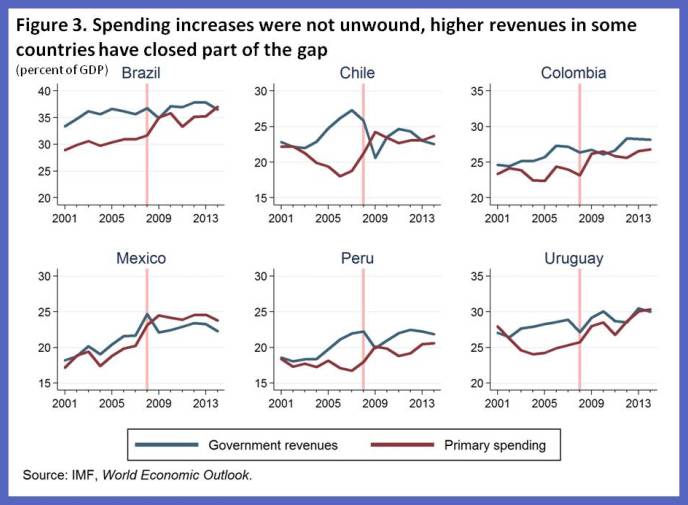

After the crisis, Latin America bounced back strongly, helped by the quick recovery of commodity prices and wide availability of global financing. However, as it recovered, countries could not resist the temptation to go back to their old, procyclical ways. With the exception of Chile, countries in the region insufficiently tightened fiscal policy as they found it difficult to cut spending back to pre-crisis levels, even as they headed quickly back to full employment.

Crisis legacies

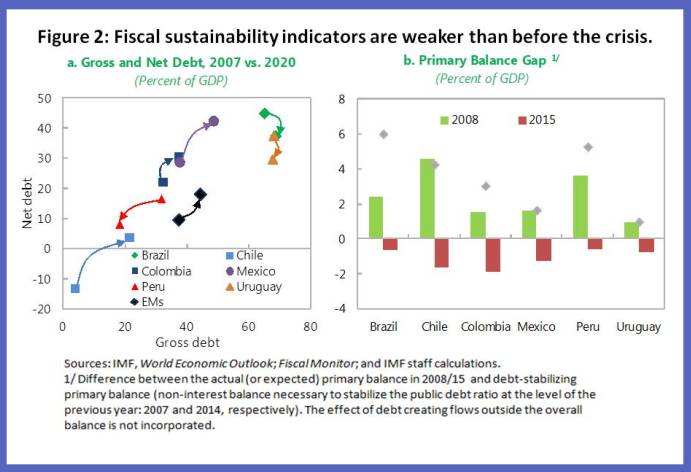

Today, many countries in Latin America are in a weaker fiscal position. In fact, their fiscal accounts are weaker now than on the eve of the crisis. While fiscal deficits and debt levels are not alarming, fiscal vulnerabilities have increased, eroding the room for maneuver. If another crisis were to hit tomorrow, most of Latin America would find it difficult to respond with the same vigorous fiscal support as they did in 2009.

The structure of public finances has also changed. Spending on wages and social benefits has been ratcheted up and will be politically difficult to reverse. Revenue increases are helping to close the gaps but there is perhaps a need to reconsider the desired size of government and how much taxation the population can tolerate to fund those public services.

A more pervasive and less evident legacy has been the weakening of the region’s fiscal institutions. While some rule bending may have been understandable given the extraordinary global events of 2008–09, there was little effort to re-anchor fiscal objectives and return to prudent and transparent frameworks during the boom years. For many, the weakening of fiscal institutions and controls has become a permanent feature—with changes to the targets and coverage of the fiscal rules and some off-budget operations.

Main takeaways

A few key lessons emerge from Latin America’s experiences over the past decade:

- Countercyclical fiscal policy—if it is applied at all—should be used symmetrically. A major fiscal stimulus during a crisis needs to be offset with fiscal conservatism as times get better.

- Fiscal institutions need to be strengthened. They should be designed to support a prudent buildup of buffers during good times while providing flexibility to react as headwinds build. Countries should set their goals in terms of structural balance targets that adjust for the cycle and movements in commodity prices. Alternatively, expenditure rules could be used as a technically easier option. There should be well-defined escape clauses for those unexpected catastrophes like we saw following the failure of Lehman Brothers. There should also be safeguards put in place to ensure that fiscal authorities work to make up for lost ground, once the dark clouds of crisis dissipate.

- The region has ample scope to improve the efficiency of its public spending. This would help to cope with increasing demands for public services while containing spending pressures. Smarter adjustments may take more time to identify and implement, but will help build social support for addressing the imbalances that have accrued post-crisis.