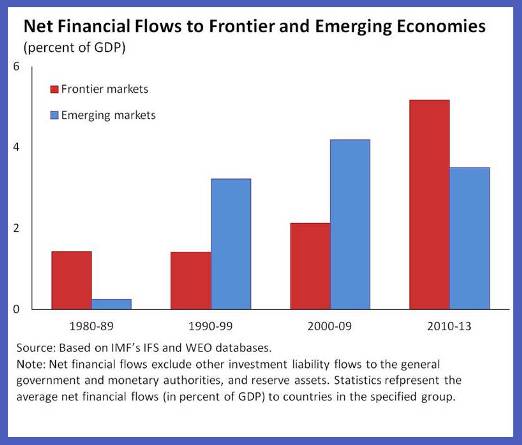

There has been a remarkable increase in financial flows to frontier economies from private sources which, in relation to their economic size, are now on par with those to emerging economies (see chart).

These large private flows can be volatile—responding strongly to changes in global conditions—as emerging economies’ experience has shown, and generate financial-stability and macroeconomic risks.

The anticipated rise in U.S. interest rates sometime this year is thus expected to create macroeconomic volatility for both emerging and frontier economies. How policymakers in frontier economies can navigate this uncharted territory of volatility and risks from capital flows, and what is the optimal pace and degree of financial liberalization that they should pursue to meet their developmental objectives are pressing policy questions confronting many of these countries.

To debate the issues and policies, and benefit from peer-to-peer learning, the IMF recently brought together experts from both emerging and frontier economies.

Here are some key insights that emerged from the discussions:

- No one-size-fits-all. Frontier economies have not taken a “one-size-fits-all” approach toward the pace and extent of capital account liberalization. Some countries, like Bangladesh, have adopted a more cautious stance. They allow flows into the tradable sector, regulate foreign investors’ access to the financial sector, and have so far refrained from issuing sovereign bonds in international markets. By contrast, other countries like Uganda and Zambia have largely open financial accounts, and increasingly face macroeconomic challenges—notably exchange rate overshooting—from volatile portfolio flows that appear to overwhelm their domestic financial markets. The pace of liberalization has slowed down in some countries like Ghana, after large capital inflows induced fiscal excesses and volatility in the exchange rate.

- “Pragmatic” approach to liberalization. The optimal degree of capital account liberalization for frontier economies—which are relatively less financially and institutionally developed—is open to question. Developing countries are said to benefit from liberalization as they are saving-constrained, and foreign saving helps them to finance worthy investments, which accelerates economic growth. Dani Rodrik, however, argued that in practice many frontier economies are more likely to be investment-constrained rather than saving-constrained. If liberalization encourages inflows that strengthen the currency, investments in crucial tradable-goods industries will suffer, thus undercutting the growth potential of liberalizing economies. This, in his view, calls for the adoption of structural capital controls, and a “pragmatic” approach to financial integration. More generally, Olivier Jeanne noted that there may be a tension between the level of the exchange rate desirable for economic growth and the one actually produced by financial markets when the economy opens to foreign flows. Countries such as China, which have recorded impressive growth performance, and graduated from the frontier to emerging economy status in the last twenty years, have done so without fully opening up their capital accounts.

- Institutional challenges to managing flows. Institutional weaknesses in some frontier economies complicate management of large capital inflows. These include a lack of central bank independence, public debt sustainability concerns (in some frontier economies, much of the flows represent foreign borrowing by governments), and weak financial supervision and regulation. This raises the question of whether frontier economies with largely or fully open capital accounts could potentially benefit from some rolling back of liberalization in the form of additional regulation of more fickle types of capital flows.

- Lessons from emerging economies. Learning from the experience of emerging economies, policymakers need to manage volatile capital flows by deploying a host of tools, including monetary policy geared to meeting the inflation target; foreign exchange intervention (in the face of currency appreciation pressures and to the extent that costs of sterilization are manageable and the credibility of monetary policy framework is not jeopardized); and prudential measures or capital controls, as appropriate. The IMF has recognized the role for capital controls to mitigate financial-stability risks. Views differed, however, on the right combination of these policy tools, with some such as José de Gregorio remaining skeptical of the use of capital controls and foreign exchange intervention, and arguing that the first line of defense for macroeconomic and financial stability is sound macroeconomic policies (inflation targeting; fiscal prudence; greater exchange rate flexibility), and prudential measures.

- Capital controls vs. macroprudential measures. While recent studies point to the effectiveness of capital controls and prudential measures in mitigating financial-stability risks, more research is warranted to evaluate their effectiveness in different contexts, such as in more versus less financially developed systems; for inflow versus outflow shocks; or for different types of capital flows—direct investment, portfolio equity, portfolio debt, or banking flows. As a practical matter, Dani Rodrik suggested that an inventory of capital controls and prudential measures should be created to fit different circumstances—the measures should be monitored, evaluated, and revised as needed.

So where do we go from here? The discussions at the conference highlighted that while progress has been made in recent years in thinking about the liberalization and management of capital flows, many questions remain subject to debate.

Is more liberalization always desirable, or might it frustrate other economic goals, including income convergence with high-income countries? Does full liberalization expose FMs to a greater risk of destabilizing shocks that are difficult to manage in practice, and outweigh the benefits of financial integration, or can such risks be offset by more vigorous deployment of different policy tools? What is the role, right combination, and possible effectiveness of the different policy tools—including foreign exchange intervention and capital controls—to manage capital flow volatility?

Clearly, we need more research and debate to explore these issues. The conference was a step in the right direction. We have much to gain from peer-to-peer discussions, and the exchange of information on policy options among policymakers, as well as from debating these issues more broadly with academics and financial sector experts.