Since mid-2014, diversity and divergence—applying to countries’ economic situations, policies and performance—have dominated global economic discussions. Differing economic performance in major advanced countries has led to divergent monetary policies.

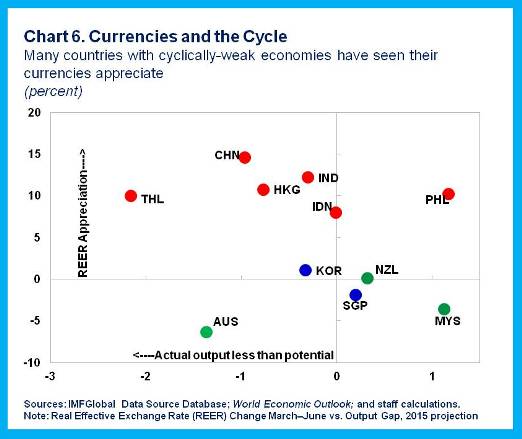

Both the Bank of Japan and the European Central Bank have started significant expansions of their balance sheets, while the U.S. Federal Reserve has ended its bond-buying program and is expected to start raising rates. This has had many effects, in particular, contributing to a sharp depreciation of the Yen and the Euro against the U.S. dollar (see chart 1).

The policy actions by the major advanced economies, among other factors, have also had diverse effects within Asia (excluding Japan).

In this chart-based blog, we consider three key issues: the impact on the region of monetary policy divergence among major advanced economies, potential tensions this may pose, and possible policy responses.

Impact on the region

Recent actions by the Bank of Japan and European Central Bank would tend to create capital inflows into Asia (excluding Japan) and appreciation pressure, but prospective action by the Fed would tend to create the opposite.

- Most countries in the region have experienced capital outflows rather than inflows in recent months. The main exception is India, which has received substantial inflows.

- Most currencies in the region have appreciated in real effective exchange rate (REER) terms (i.e., against a weighted average of their trade partners’ currencies after adjusting for inflation), but depreciated against the U.S. dollar.

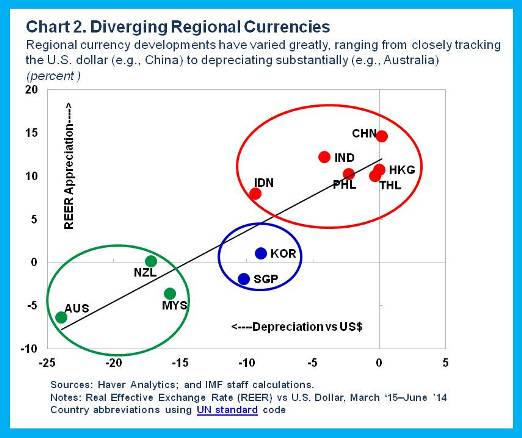

Chart 2 shows three groups:

- China/Hong Kong SAR/India/Indonesia/Philippines/Thailand―large REER appreciation and little depreciation versus the U.S. dollar. The increase for China (15%) has been particularly sharp, reflecting its link to the U.S. dollar, and follows on from a trend 5% annual appreciation for the last 10 years. (Indonesia’s REER appreciation is inflated by the recent reduction in fuel subsidies).

- Korea/Singapore―little REER change and some depreciation versus the U.S. dollar.

- Australia/New Zealand/Malaysia―large depreciation versus the U.S. dollar and, for Australia and Malaysia, significant REER depreciation.

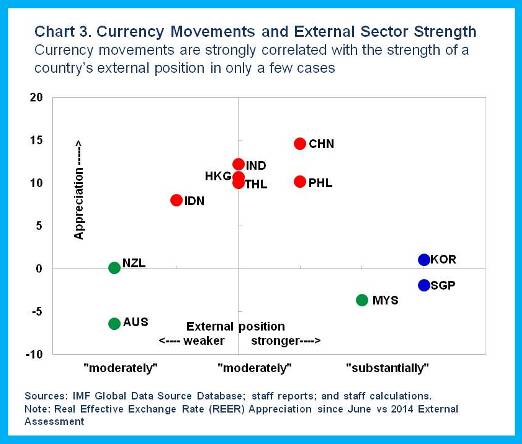

Countries with external positions stronger than implied by fundamentals have, as one would expect, tended to see their REERs appreciate (e.g., China), and vice versa (e.g., Australia). However, Group 2 countries (Korea, Singapore) and Malaysia have seen little or no REER appreciation despite strong external positions and some Group 1 countries (Indonesia, India, Hong Kong SAR, Thailand) have seen significant REER appreciation despite having balanced, or indeed, weaker, external positions.

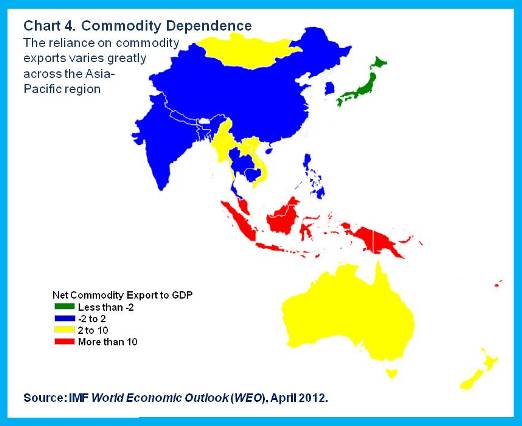

However, these REER movements should be seen in the context of other global developments since June (see charts 3 and 4). In particular, as a result of the sharp fall in the price of oil and most other commodities, many countries’ trade balances have risen. But others, especially Malaysia and Indonesia, but also Australia and New Zealand, have lost significant export revenue from lower commodity prices (helping explain why, for example, Malaysia’s currency has depreciated).

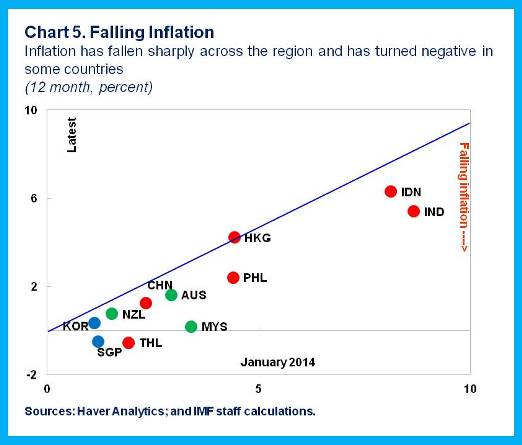

The fall in commodity prices together with REER appreciations across most economies, is also pushing down inflation (see chart 5). In many countries, inflation is now at very low levels (China, Korea, New Zealand), or even negative (Thailand, Singapore). Core inflation has tended to move less, but generally in the same direction.

The potential tensions

The main tensions that may emerge from policy actions by advanced economies, especially in some of the largest economies, relate to weakening exports and financial instability.

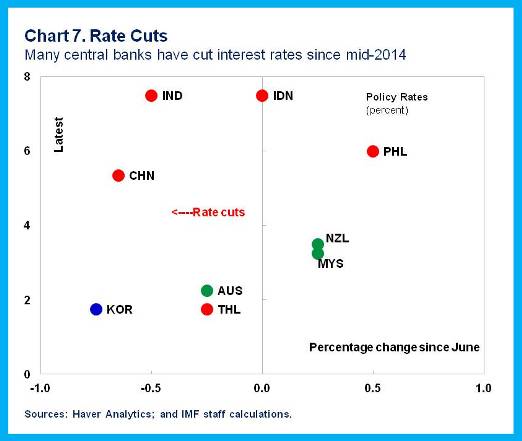

- Weakening exports. We expect export volume growth to hold up across the region overall. However, stronger currencies could weaken external demand, which in turn could lower overall economic growth and exacerbate internal imbalances. Indeed, only for Australia and the Philippines do the recent REER movements go in the direction of reducing internal imbalances (as measured by the output gap— the difference between what an economy is capable of producing without sparking inflation and what it is actually producing). In contrast, output in Thailand, China, and Hong Kong SAR is projected to remain well below potential, which the strong REER appreciation will tend to exacerbate (see chart 6).

- Financial instability. Risks vary greatly across the region. For example, many corporates have borrowed in U.S. dollars (e.g., Indonesia), and the stronger U.S. dollar will make debt service more costly. India’s large capital inflows could lead to significant financial volatility in the event they reverse (as during the 2013 “taper tantrum”). Looking forward, if countries were to significantly loosen monetary policy to offset the contractionary impact of stronger currencies, this could foster excessive credit growth.

Need for flexible monetary policy response

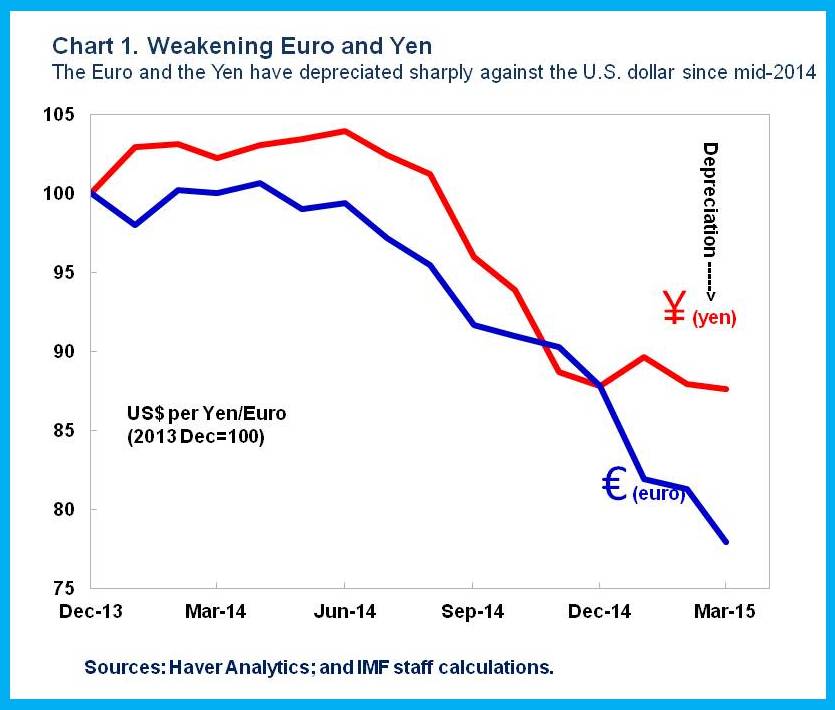

Many countries have responded to these developments above by cutting interest rates (see chart 7). Several countries have also taken other measures, for example, India accumulated international reserves to strengthen buffers ahead of potential increased global financial volatility.

Going forward, especially if exchange rate and capital flow pressures continue, monetary policy should generally continue to respond flexibly, with macro-prudential policy the first line of defense for addressing financial stability concerns. The specific response should of course depend on individual country circumstances.