Fortune, wrote Machiavelli five hundred years ago in The Prince, is like a violent river. She “shows her power where virtue has not been put in order to resist her and therefore turns her impetus where she knows that dams and dikes have not been made to contain her.” Managing the ebb and flow of government’s fiscal fortunes poses similar challenges today. We need a risk-based approach to fiscal policymaking that applies a systematic analysis of potential sources of fiscal vulnerabilities. This method would help countries detect potential problems early, and would allow for institutional changes to build resilience.

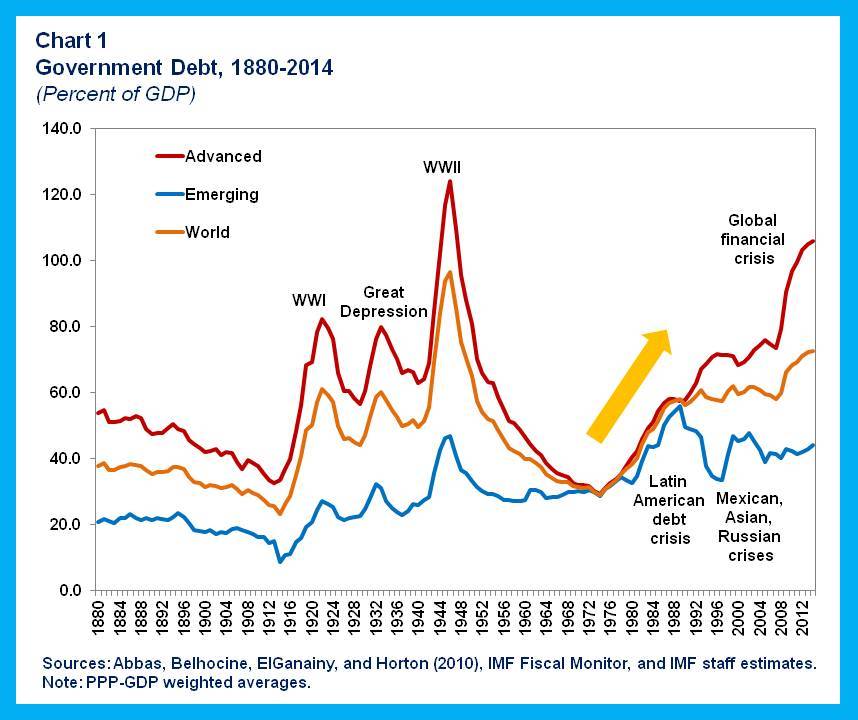

Before the 1970s, sharp public debt increases were associated with the World Wars and Depression (Figure 1). But in the 1970s, the pattern changed and public debt began a steadily rising trend. In the 1990s debt to GDP leveled off as advanced and emerging market economies strengthened policies and growth was strong. But the global financial crisis restored the earlier upward trend. Meanwhile, liabilities generally not reflected in debt figures—such as public pension and health costs—have continued to accumulate.

Not only is government debt at unprecedented levels in peacetime, but government debt only gives a partial view of public finances. In isolation it can be misleading. Today, risks to public finances are significant. As will be described in the Fiscal Monitor, due out on April 15, clear and present risks arise from low growth and low inflation in the euro area and Japan. Developing economies face pressures coming from adverse changes in exchange rates and financing conditions. More recently, sharply lower oil prices and persistently low commodity prices are hurting commodity exporters.

Contingent liabilities to struggling banks and troubled public enterprises pose additional sources of risk, oftentimes materializing when macro fundamentals are weak. Moreover, when an adequate institutional setup is lacking, these contingent liabilities can be difficult to limit ex-ante because the state typically serves as the insurer of last resort whenever something goes wrong in the economy. Once realized, these risks can quickly spillover into regional and even global crises.

In this context of high debt and latent risks, several key policy questions come to the fore. How can public finances be made safe in a world full of risks? How can these risks be usefully estimated and analyzed? How can fiscal policy contribute to mitigating those risks and promoting more sustainable and inclusive growth?

Most frameworks used to analyze fiscal risks rely–explicitly or implicitly–on a number of unexamined assumptions concerning the behavior and relevance of those risks. Specifically, they assume that fiscal risks are independent (the realization of one risk does not make the realization of any other risk more or less likely), symmetric (positive and negative shocks to the public finances are equally likely and equally beneficial/costly), and linear (the costs/benefits increase proportionally with the size of the underlying disturbance).

The global crisis provided a costly lesson in the limitations of such assumptions. It reminded us that, in fact:

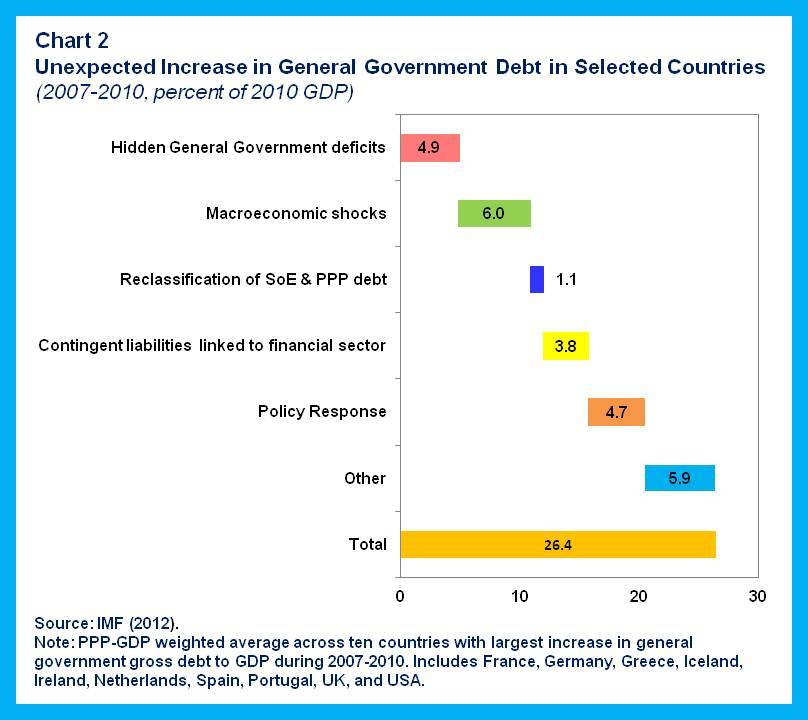

- Fiscal risks are highly correlated: When it comes to public finances, bad news really does “come in threes.” Figure 2 illustrates the perfect storm of fiscal shocks for the 10 countries hardest hit by the crisis. Not only were there multiple sources of increases in debt, but these were also systematically linked: undisclosed general government deficits (such as skeletons in subnational government accounts); adverse macroeconomic developments; contingent liabilities to the financial sector, state-owned enterprises (SOEs) and private-public partnerships (PPPs); and the government’s own discretionary policy response to the crisis.

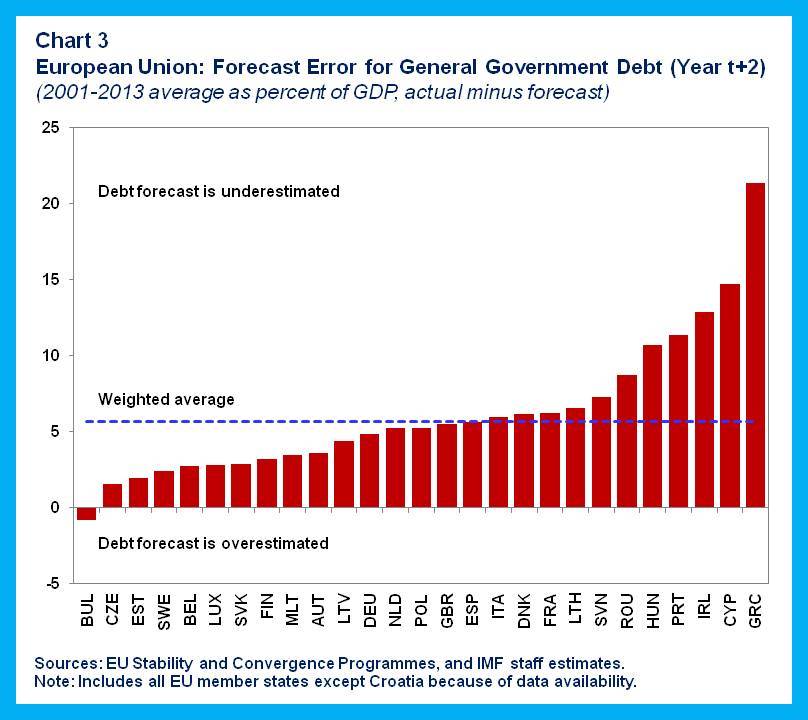

- Fiscal risks are asymmetric: Politicians are quick to “bank” upside risks to their fiscal forecasts; and are prone to downplay or overlook downside risks. Nowhere is this more evident than in the way countries treat contingent assets and liabilities. Government forecasts often include revenues from future asset sales to reduce borrowing requirements, even though the precise amount or timing of the sale is uncertain. By contrast, governments typically exclude contingent liabilities, like guarantees, because it is uncertain whether or when they will be called. The result is a forecast in which the balance of risks is skewed, with downside risks consistently understated. Figure 3 illustrates the optimistic bias by EU countries in forecasting government debt over the last 12 years.

- Fiscal risks are non-linear. For small disturbances it is reasonable to assume that costs increase proportionally to the size of the disturbance. However, in extreme events, the associated financial, economic, social and political consequences can be much greater. Once markets perceive government debt to be unsustainable, spiraling interest rates and depreciating exchange rates can ensue. In some cases, countries may suffer a “sudden stop,” simply cut-off from market access. This non-linear relationship between economic shocks and their consequences can give rise to what Olivier Blanchard calls “dark corners,” situations in which the economy can badly malfunction.

The combination of high debt levels with fiscal risks that are highly correlated, asymmetric, and non-linear demands a new approach to fiscal policymaking–one in which fiscal risk analysis actively informs the most important fiscal decisions.

Elements of this more risk-based approach to fiscal policymaking are already in place in a growing number of countries, Many countries produce not only point estimates of the path of government finances but also alternative macro-fiscal scenarios which present the fiscal implications of changes in key macroeconomic assumptions (for example those published by EU countries as part of their Stability Programs). Some countries now produce statements of fiscal risk identifying the sources, magnitude, and, in some cases, likelihood of discontinuous risk to public finances (an example is the comprehensive fiscal risk statement published by the Philippines). A few countries bring these two approaches together into stochastic projections of the key fiscal aggregates. The UK Office of Budget Responsibility presents its forecasts in the form of probabilistic “fan charts,” which highlight the degree of uncertainty around their central estimate for growth and government borrowing. These projections are then used to estimate the probability of the UK government meeting its stated medium-term fiscal objectives. In most cases, however, risk analysis is produced to satisfy a legal or multilateral requirement or relegated to an appendix of the national budget document.

The IMF has already taken some important steps to improve and inform fiscal risk analysis among its members. A number of tools are already in place, including the fan charts in the Fund’s debt sustainability analyses and work on future liabilities from age-related spending. We also provide heat maps in fiscal transparency evaluations, already published for Bolivia, Costa Rica, Ireland, Mozambique, Portugal, and Russia.

Going forward, we will consider how to better measure, prevent and minimize fiscal risks by taking into account their correlated, asymmetric and non-linear characteristics. We will also explore how to mainstream fiscal risk assessments into fiscal decision making. This analysis will be part of a comprehensive approach to fiscal policymaking that also provides guidance on: enhancing fiscal transparency, including adoption of international accounting standards; analyzing and forecasting public sector balance sheets; and setting appropriate medium-term fiscal objectives that balance inclusive growth, stability, and risk management. It will also take account of the role of targeted public investments, structural reforms, and improvements in fiscal institutions in building resilience, supporting growth, and generating greater “upside risk” for public finances.

Machiavelli long ago recognized that to tame violent rivers (and fortune), one could, “when times are quiet, provide for them with dikes and dams so that when they rise later, either they go in a canal or their impetus is neither so wanton nor so damaging.” As some measure of calm returns to the battered global economy, today’s challenge is to construct the framework of dikes and dams for public finances which will enable countries better to weather the next storm.