(Versions in Español)

In housing crises, high mortgage debt can feed a vicious circle of falling housing prices and economic slowdown. As a result, more households default on their mortgages and the crisis deepens. A new IMF Working Paper studies the differences in the housing crises and policy responses in Iceland, Ireland, Spain, and the United States, and argues that crisis policies geared to provide temporary debt service relief for struggling households, followed by durable loan modifications, can help break this vicious circle.

Why policymakers worry about mortgage distress

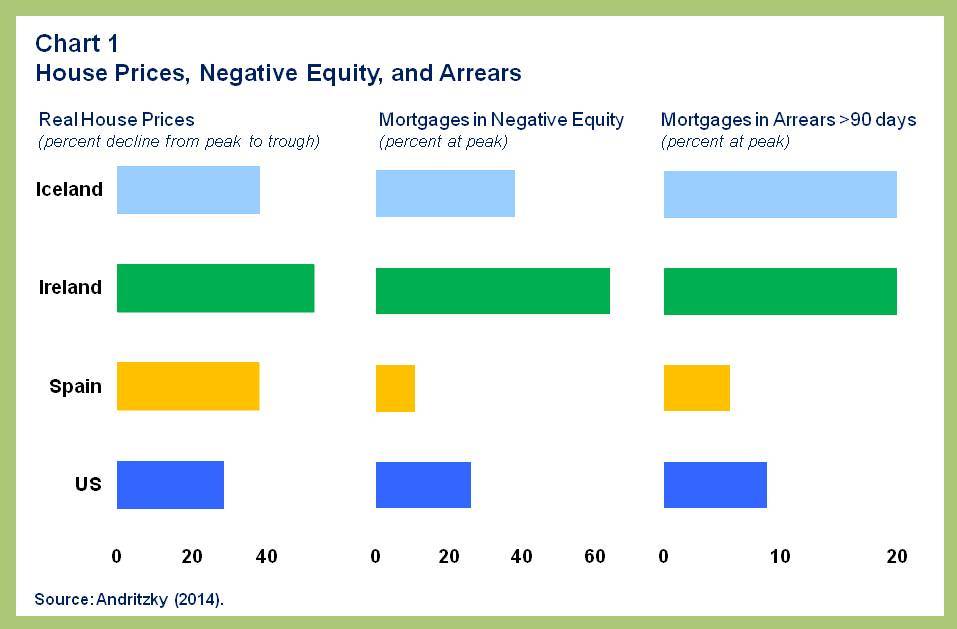

The recent global financial crisis affected many countries, but those with previous housing booms and high mortgage debt typically suffered deeper and longer recessions. One reason is that housing busts and high debt can amplify the initial shock. For instance, property markets may get flooded from forced home sales by overindebted households. The resulting fall in house prices then further reduces the wealth of all homeowners and induces them to cut consumption, which slows the economy even more. We saw this cycle play out in the recent housing crises in Iceland, Ireland, Spain, and the United States, although with different intensity (Chart 1).

For sure, it is best to avoid housing-related boom-bust cycles, as emphasized in previous work on housing recoveries. However, once mortgage default becomes widespread, a crisis resolution strategy is needed. While the experience shows that there is no “one-size-fits-all” solution, there are a few policies that could help to curtail the downward spiral resulting from severe housing busts.

Providing breathing space with temporary forbearance

In all four countries, lenders offered debt service relief through temporary forbearance in one form or another, for instance by reducing mortgage payments to interest only for a limited time. While forbearance can help households to adjust their consumption more smoothly, it also invites free riding by some borrowers not under severe financial distress. Lenders should therefore consider temporary forbearance only for borrowers who are currently under proven financial strain but have sufficiently strong prospects to recover their debt service capacity. In any case, lenders must closely monitor forborne loans.

Foreclosure will have to play a role

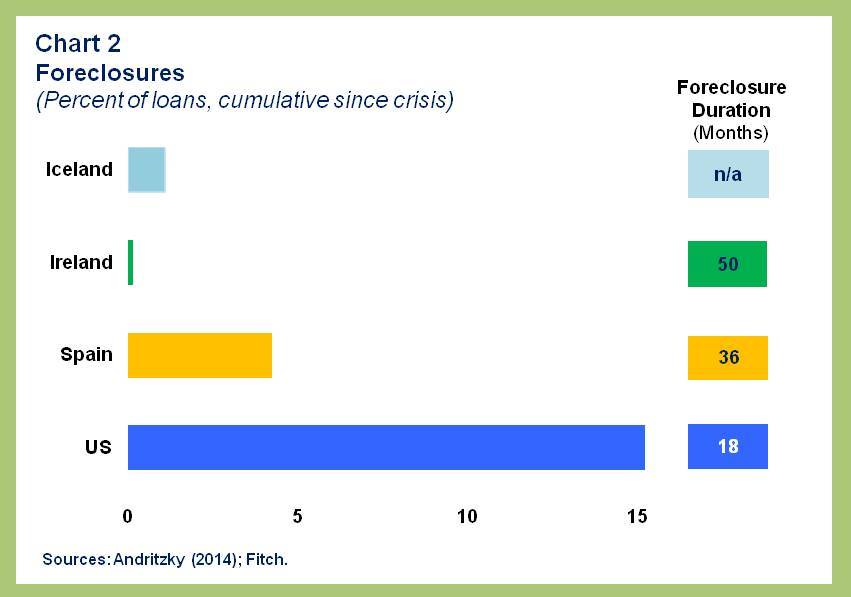

Foreclosure has been widespread in some countries, particularly in the US, while largely absent in others, such as Ireland (Chart 2).

It is important to remind that foreclosure has both benefits and costs. On one hand, strong foreclosure rights decrease lenders’ loan losses and contain opportunistic behavior by borrowers. On the other hand, large scale foreclosures can depress house prices and trigger more defaults. These negative effects become more significant in systemic housing crises.

In some countries, a foreclosure moratorium was introduced to delay or reduce foreclosure activity. However, the experience was mixed at best. Delays in the foreclosure process have been found to increase opportunistic defaults and overall workout costs. Instead, making foreclosure more costly through temporary fees or taxes could be more efficient in incentivizing lenders to consider foreclosure alternatives in a systemic crisis.

Time to modify

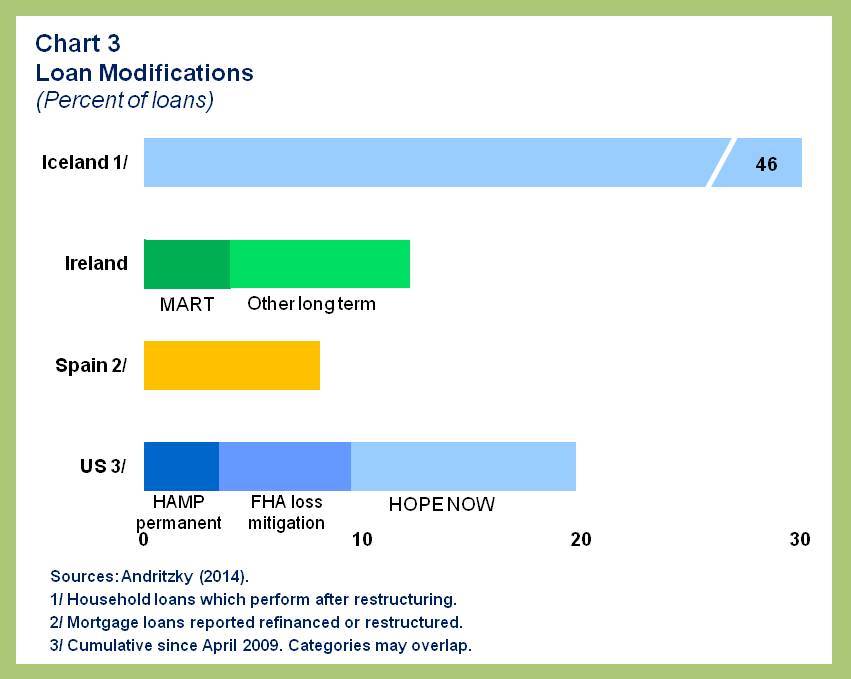

A loan modification is a one-time, permanent amendment to the terms of a loan which reduces the monthly debt service payments. The most common type of loan modification is a maturity extension which reduces the monthly amortization payments.

Loan modifications can help homeowners drowning in debt to overcome their debt servicing difficulties. The recovery from housing crises typically causes a rebound of incomes and house prices, helping many overindebted households to get back on their feet. While determining the right type of loan modification is difficult at the height of a crisis, the recovery phase will make it much easier to pin down suitable modification terms. Loan modifications during the recovery phase therefore dovetail well with temporary forbearance arrangements as crisis stopgap.

Available statistics suggest that more than 10 percent of mortgages underwent some type of modification or restructuring in each of the four countries (Chart 3). This outcome was often supported by dedicated policies, such as the Homeowner Affordable Modification Program (HAMP) in the US and supervisory workout targets in Ireland.

However, high renegotiation costs and other obstacles, such as prudential rules and taxes, have prevented a much higher extent of loan modification. It is therefore important to strengthen policies where needed to reduce barriers to modifications, while at the same time setting tight eligibility criteria to contain free riding. For instance, frameworks for orderly debt renegotiation, such as a code of conduct or a statutory insolvency framework, can help improve coordination between lenders and borrowers. Also, prudential or fiscal policies can set appropriate incentives to encourage loan modifications.

Reducing distress through across-the-board debt relief

Across-the-board debt relief provides immediate relief to many mortgagees. In Iceland, broad-based debt relief was in part facilitated by foreign bank creditors bearing the losses. However, in many circumstances, the economic benefit of broad-based debt relief is outweighed by its high upfront cost which would eventually need to be covered by taxpayers.

In conclusion, different country circumstances suggest that there cannot be a “one-size-fits-all” approach. Policy formulation must therefore take into account country specific factors as well as the stage of the recovery. In the direct aftermath of systemic housing crises, policies can facilitate temporary forbearance to provide breathing space to overindebted households, yet forbearance must remain selective and time-bound. In the subsequent recovery phase, policies should foster a durable resolution of distress, including by facilitating loan modification. It is important to bear in mind that foreclosure has negative side effects, particularly during systemic housing crises. However, foreclosure remains an efficient resolution tool in some cases and provides an important incentive for constructive borrower behavior.