Does the European Union need closer fiscal integration, and in particular a stronger fiscal center, to become more resilient to economic shocks? A new IMF book, Designing a European Fiscal Union: Lessons from the Experience of Fiscal Federations, published by Routledge, examines the experience of 13 federal states to help inform the debate on this issue. It analyzes in detail their practices in devolving responsibilities from the subnational to the central level, compares them to those of the European Union, and draws lessons for a possible future fiscal union in Europe.

The book sets out to answer three sets of questions: (1) What is the role of centralized fiscal policies in federations, and hence the size, features, and functions of the central budget? (2) What institutional arrangements are used to coordinate fiscal policy between the federal and subnational levels? (3) What are the links between federal and subnational debt, and how have subnational financing crises been handled, when they occurred?

Federations have addressed these issues in many different ways, but four features stand out when comparing their practices to those of the European Union.

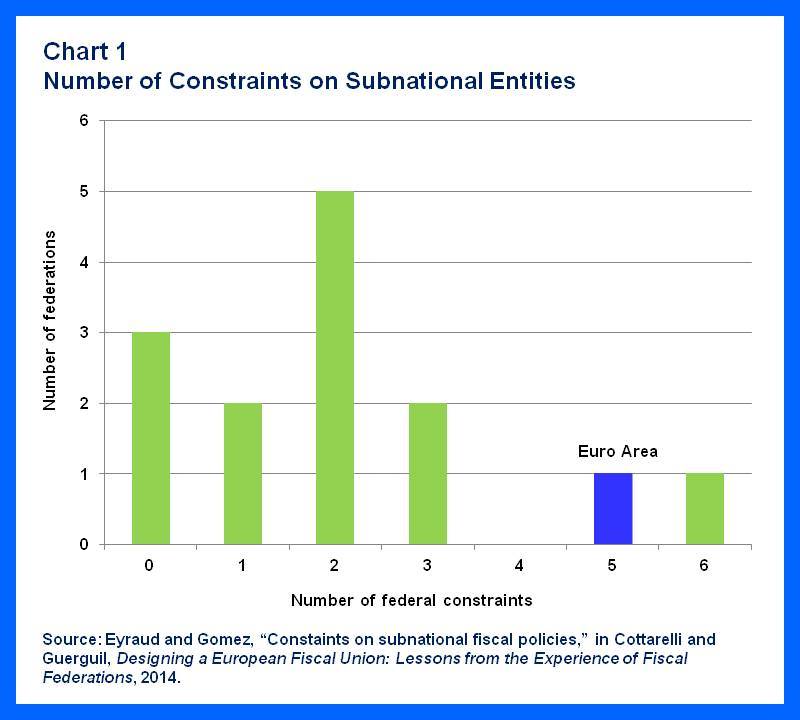

- Unlike federations, the EU’s budget is extremely small and nearly entirely dependent on transfers from its members. Even in highly decentralized federations, the large size of the central budget, with its own taxing capacity, allows it to play an important stabilizing role (see Chart 1). In contrast, the European Union has no economically-meaningful center and fiscal risk-sharing is nearly non existent. It remains to be seen whether this arrangement can survive as a permanent EU feature or whether a stronger form of fiscal centralization will be required.

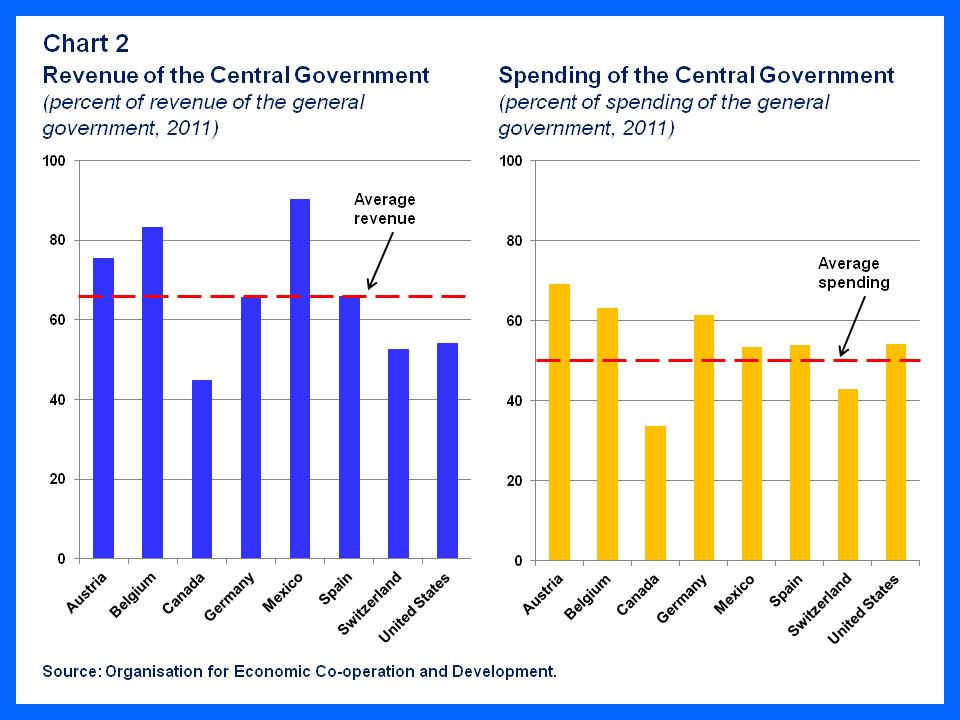

- Fiscal discipline in the European Union is long on institutions but short on shared policy instruments. Partly because it opted for a small central budget, the European Union relies much more than existing federations on an extensive set of institutional arrangements to ensure fiscal discipline (see Chart 2). But this raises significant enforcement, and thus credibility, challenges that will also have to be addressed.

- Shared debt is rarely seen in federations. Some of the proposals recently put forward in the euro area, such as common debt issuance and self-standing lending facilities for crisis support, are not a permanent feature of federations, although they have played a role in the early life of federations.

- Subnational financial crises have often, but not always, shaped fiscal responsibility sharing arrangements in federations. The role and size of the central government in federations reflects a combination of historical circumstances and social and political preferences. For example, the most decentralized federations are often those where states were independent entities before the establishment of the federation--cases that may be more relevant for the European Union. On the other hand, a succession of severe and protracted sub-national financial crises led to the introduction of substantial constraints on local budgets in a previously relatively decentralized federation like Brazil. The current crisis in the euro area may thus influence the future shape of the union beyond the resolution of the financing crisis itself.

Given the challenging economic and political circumstances in Europe, it may well be impractical to expect a prompt, well-articulated response to these questions. But the concrete experiences of federations do shed light on the decisions and trade-offs that the European Union will likely have to face in a not so distant future.