(Version in Türk)

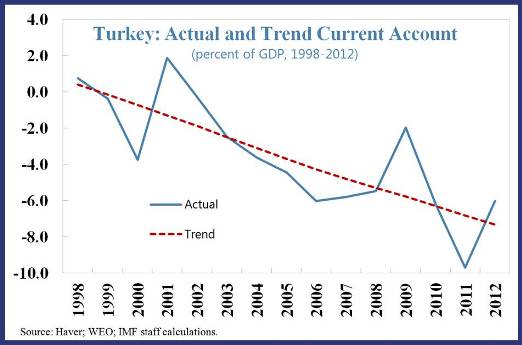

Turkey has received well-deserved praise for its growth performance over the last decade. Yet along with this success story has come a steady widening of the current account deficit, projected to come out at 7.4 percent of GDP in 2013. The counterpart of this deficit is a reliance on external financing, much of which is of a short-term nature, highlighting the Turkish economy’s main problem at the moment.

Turkey has received well-deserved praise for its growth performance over the last decade. Yet along with this success story has come a steady widening of the current account deficit, projected to come out at 7.4 percent of GDP in 2013. The counterpart of this deficit is a reliance on external financing, much of which is of a short-term nature, highlighting the Turkish economy’s main problem at the moment.

The external deficit presents a speed limit to economic growth

In our recent annual review of Turkey’s economy, regression analysis suggests that, barring a significant change in policies or the economic environment, the level of growth consistent with a stable current account is in the 2¾ - 3½ percent range. In other words, growth above this speed limit would lead to a wider current account deficit. This is why we argue that policies should aim at reducing the external deficit, as otherwise growth of 4 to 5 percent per year is unlikely to be sustainable.

This speed limit can change

Raising domestic savings – both public and private – would lower Turkey’s dependence on external financing and hence its current account deficit. Policies should aim to improve competitiveness further through structural change. At the same time, monetary policy should tackle persistently above-target inflation that chips away at Turkey’s competitiveness through real exchange rate appreciation.

These are reforms that will take considerable time to bear fruit. Meanwhile, it will be important for the government to maintain flexibility in the budget. This will help cushion the volatile economy by enabling officials to adjust spending and taxation to the economic cycle.

Policy recommendations to enable faster growth

- Domestic savings: Recent reforms of the private pension system have increased participation and pension savings. They are a good step, on which officials could follow-up by providing more incentives for pension savings. More ambitious public savings targets in the over the next few years, akin to achievements before the global financial crisis, could also contribute.

- Competitiveness: Turkey’s structural policies should aim to improve the competitiveness of domestic goods relative to imports and move exports up the value chain. The strong growth in Turkey’s export volume over the past decade has not made up for its high import needs. Moreover, growth in export value has started to lag behind the growth in export volume. The government should therefore focus policies on encouraging investments in higher-value-added export sectors, such as chemicals, pharmaceuticals, machinery, and equipment. Such a move towards higher-technology activities will help maintain competitiveness, even as wage levels in Turkey continue to rise. Thus far, bottlenecks in the development of skills and education of the workforce and in innovation and research and development have acted as impediments to moving down this road.

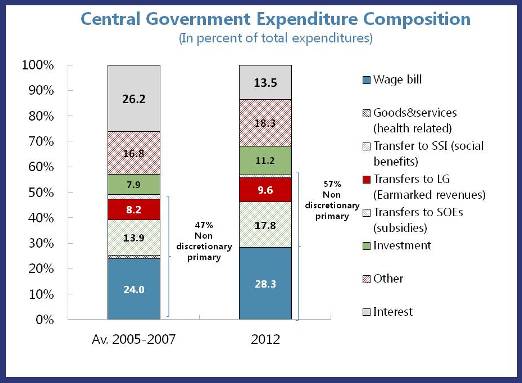

- Flexible Budget: The government should keep the budget flexible. This will lock in past fiscal gains by creating room for the government to adapt spending and taxation as economic circumstances change, and secure a higher and more stable public contribution to national savings. Turkey’s fiscal effort in the last ten years has brought about an impressive reduction in debt and interest costs. The fiscal space created has allowed the government to boost social spending, leading to a strong improvement in social indicators. Yet, in recent years the share of non-discretionary primary spending—such as compensation to employees and transfers to social security—has grown rapidly. With revenues strongly dependent on output growth, the loss of flexibility in primary expenditure has become a source of concern. It reduces the capacity of fiscal policy to react nimbly to economic shocks and ultimately to achieve a higher level of public savings.

Likewise, growing primary expenditure rigidities could undermine hard-won fiscal discipline. In fact, while Turkey has over-performed in terms of overall fiscal targets in the past, officials have systematically exceeded spending ceilings set in the medium-term fiscal plan, exposing weaknesses in public financial management practices.

Policies for a flexible budget

To preserve a flexible budget, Turkey should restrain spending growth and improve existing budgetary procedures. To do so, there are five main policy options the Turkish authorities have at their disposal: contain the public employment growth rate; introduce more flexible public wage indexation mechanisms; renew efforts to reform the pension system; save over-performance in revenues; and undertake a gradual move to a more binding spending ceiling framework, including a mechanism to adjust for past deviations.

A combination of these policies would help the government maintain budget flexibility and hence preserve the fiscal gains achieved over the past decade.