Latin America has enjoyed strong growth during the last decade, with annual growth averaging 4½ percent compared with 2¾ in the 1980s and 1990s. What is behind this remarkable economic performance and will this growth be sustainable in the years ahead?

Our recent study (see also our working paper) looks at the supply-side drivers of growth for a large group of Latin American countries, to identify what’s behind the recent strong output performance.

Supply side factors of growth

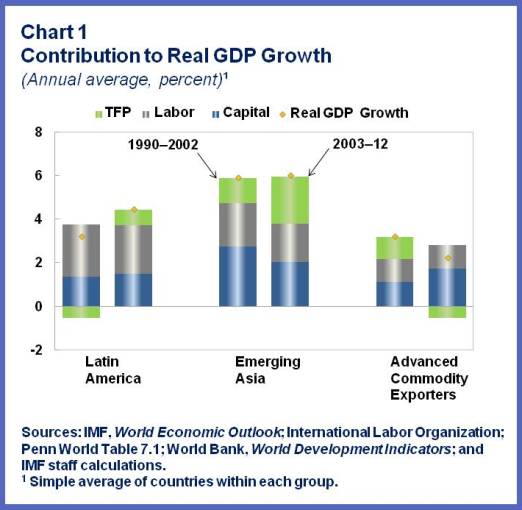

Increases in employment and the accumulation of capital, such as buildings and machinery, continue to be the main drivers of growth in Latin America. Together they explain 3¾ percentage points of annual GDP growth in 2003–12, compared with ¾ percentage points explained by improvements in the efficiency of the inputs of production (labor and capital), what economists typically refer to as total factor productivity (Figure 1). Employment has grown vigorously in the last decade and many countries are enjoying historically low unemployment rates. Investment in physical capital has also risen steadily amid favorable external financial conditions and high commodity prices.

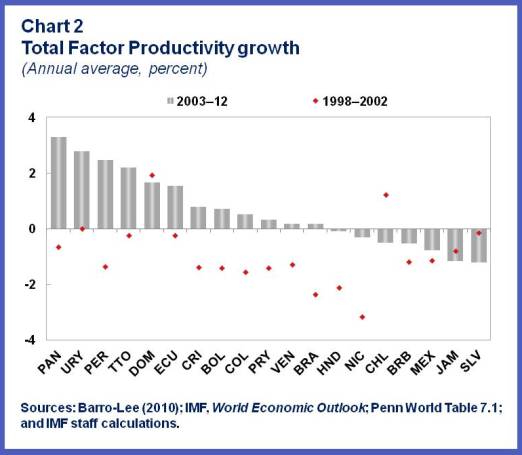

While factor accumulation remains the main driver of growth, the recent pickup is mainly explained by higher total factor productivity (Figure 1). After exhibiting declines in most of the region in previous decades, total factor productivity is on the rise (Figure 2). This is a typical development observed during good economic times, such as the one the region is now experiencing—that is, changes in productivity are highly correlated with those of output. But improvements in total factor productivity also reflect some structural (permanent) factors, such as the movement of economic activity away from the informal sector in Latin America, as productivity tends to be higher in the formal sector.

Sustaining recent strong growth remains unlikely

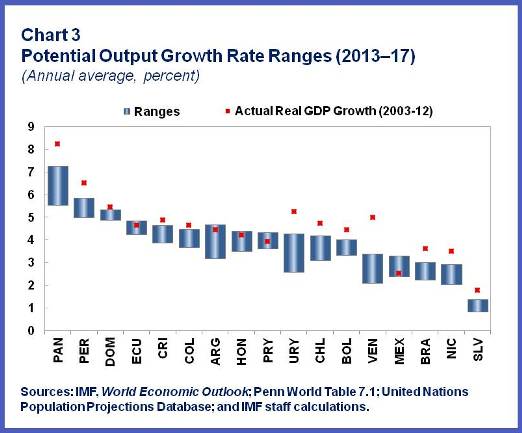

Our analysis suggests that sustaining the recent high growth rates will be more challenging. While the region has, on average, grown at 4½ percent during 2003–12, our estimates suggest that the average potential GDP growth rate in 2013–17 is closer to 3¼ percent. Indeed, the strong growth rates observed in recent years are higher than the potential GDP growth ranges in most countries (Figure 3). Potential output ranges vary significantly across countries. These often reflect differences in population aging trends, labor force participation rates, savings and investment in physical and human capital, natural resource endowments, productivity performance, and other country characteristics.

Why do we expect output growth to slow down in the coming years? First, growth of physical capital is expected to moderate somewhat, as low global interest rates that facilitated large capital flows to the region start to rise and commodity prices stabilize. In addition, the contribution of labor will likely be limited in the coming years by some natural constraints, including population aging, limited scope for further increases in labor force participation rates (including for women), and currently record low unemployment rates that would hinder strong employment growth in the future.

Productivity growth plays pivotal role

So, the strong growth momentum in the region is unlikely to be sustainable unless capital accumulation surges (for instance, supported by rising savings, which are still very low in the region), human capital increases significantly (the quality of education has ample room for improvement), or total factor productivity performance improves significantly. Indeed, total factor productivity performance—despite its recent improvement—remains weak compared with emerging Asia, explaining most of the growth differential vis-à-vis this region. Thus, fostering productivity growth remains a key challenge and priority for Latin America.

The causes of low productivity growth in the region are many and varied, and designing a policy agenda to unleash it is a difficult task. Policymakers should aim at policies that help reduce distortions in the allocation of resources and this typically entails country-specific measures.

Policies to be considered include: improving the business climate and enhancing competition; strengthening entry and exit regulation to facilitate the reallocation of resources to new and high-productivity sectors; improving infrastructure; promoting deeper and more efficient financial markets; enhancing research, development and innovation; and strengthening institutions to secure property rights and stamp out corruption.