(Version in Español)

Four years after the Lehman Brothers crisis, private companies in the largest and most financially integrated Latin American countries are doing relatively well, despite continuous bouts of global uncertainty. Like firms in other high-performing emerging markets in Asia, companies in Brazil, Chile, Colombia, Mexico, and Peru (the “LA5”) have benefited from abundant external financing, strong domestic credit, and generally robust demand growth.

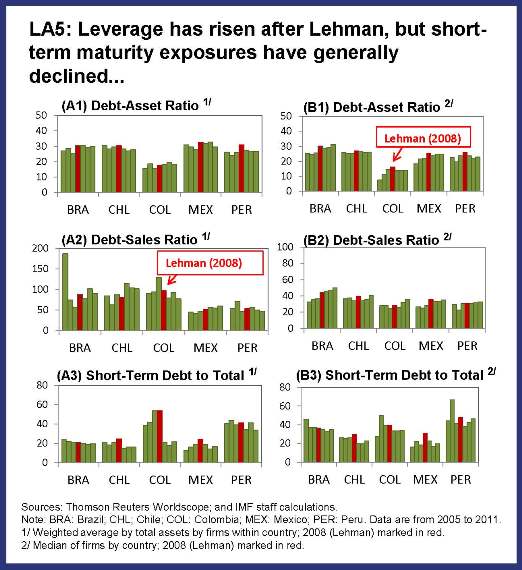

These favorable conditions have resulted in robust corporate profitability and valuation, reasonably contained debt ratios, and lower short-term maturity exposures than those observed in other emerging markets.

But some vulnerabilities are starting to build up.

Learning from Asia

Nearly 15 years ago, the failure of large private firms unleashed a deep economic and financial crisis in Asia, even though prior to the crisis their economic fundamentals were strong. Even today, this event still serves as a stark reminder of the fact that firms matter—as they can act as a source or a magnifier of adverse shocks.

The Asian experience also shows that the boom episode preceding the crisis gave rise to vulnerabilities in the corporate sector. When firms’ assets become overvalued, they can borrow too much based on inflated collateral. In addition, abundant capital inflows can raise foreign currency exposures in unhedged firms.

In light of this experience, gauging the financial strength of the corporate sector in the LA5 countries, especially given the still uncertain global environment, is important.

Looking at the data

But assessing the strength of a country’s corporate sector is not easy—especially because of significant data gaps. The best alternative is to use information available for a subset of large firms—those that are publicly traded, which have relatively stricter reporting standards. Using this sample can still provide valuable insights, since large firms tend to be “systemic”—that is, they are sufficiently large to impose severe costs on the wider economy once they become affected by adverse shocks.

Our recent study—based on publicly-traded firm-level balance sheet data—takes an in-depth look at the financial strength of private (nonfinancial) firms in the LA5 countries based on a range of indicators, such as debt burden, maturity exposure, liquidity, collateral, and profitability.

A more sobering picture

Data for firms for the LA5 countries suggest that some vulnerabilities may be creeping up. The “red flags” come from a hike in leverage—as measured by the debt-asset and debt-sales ratios of firms—since the Lehman crisis. The higher debt-sales ratios are especially stark for the wholesale trade and the transport and utilities sectors. Debt-asset ratios have risen as well, but they remain at more manageable levels.

Profitability has been moderating nearly across the board, as are the liquidity and collateral buffers. On the upside, LA5 firms in all sectors have improved markedly the maturity composition of their debt, taking advantage of the soft financing conditions they have been facing in recent years,

At the country level, the picture also shows a gradual pick up in the debt burden. In Brazil, Chile, and Colombia, averages for the debt-sales ratios have lingered around the 100 percent mark. Debt-asset ratios also have trended up since 2008, although they are at more reasonable levels. Risks are moderated by across-the-board reductions in the short-term maturity exposures. In most countries, firms have kept their liquidity buffers, but are reducing their holdings of collateral. Profitability has declined in Brazil and Chile, but picked up significantly in Colombia, Mexico, and Peru.

On balance, these rising debt ratios and moderating buffers imply that firms in LA5 countries are more vulnerable to a sudden stop in credit today than they were before the Lehman crisis. Specifically, if financing were to dry up sharply—making debt rollover difficult—the share of firms in the sample at risk of not being able to repay their debt on time would be equal or greater today than it was in 2007.

Keeping an eye on risks

What can be done to keep corporate vulnerability in check?

We find that greater availability of bank credit lessens vulnerability, although a rapid increase in borrowing from abroad can actually raise it. We also find that, on average, the probability that firms will be unable to generate enough cash flow to repay their debts increases when the currency depreciates. However, this vulnerability is greatly reduced in countries where the exchange rate regime is more flexible, since that flexibility entices firms to hedge and avoid excessive exchange rate bets.

The risks posed by abundant capital inflows to the corporate sector may be mitigated with macroprudential tools—such as measures targeted to moderate borrowing in foreign currency (say, through prudent loan-value ratios), or geared toward boosting provisions, capital buffers, and liquidity requirements in the domestic financial system. These tools can ensure that credit markets are resilient to sharp reversals in external funding and can continue to provide a healthy level of domestic credit to firms during times of global stress.

But more importantly, increasing the availability of data on the assets and liabilities of firms would be critical to monitor risks and adapt needed policies and regulations in a timely manner.