The issue of rising income inequality is now at the forefront of public debate. There is growing concern as to the economic and social consequences of the steady, and often sharp, increase in the share of income captured by higher income groups.

While much of the discussion focuses on the factors driving the rise in inequality—including globalization, labor market reforms, and technological changes that favor higher-skilled workers—a more pressing issue is what can be done about it.

In our recent study we find that public spending and taxation policies have had, and are likely to continue to have, a crucial impact on income inequality in both advanced and developing economies.

In advanced economies, this is especially important given that the ongoing fiscal adjustment needs to be continued for many years to reduce public debt to sustainable levels. But it is equally important in developing economies where inequality is relatively high.

Income inequality in recent decades

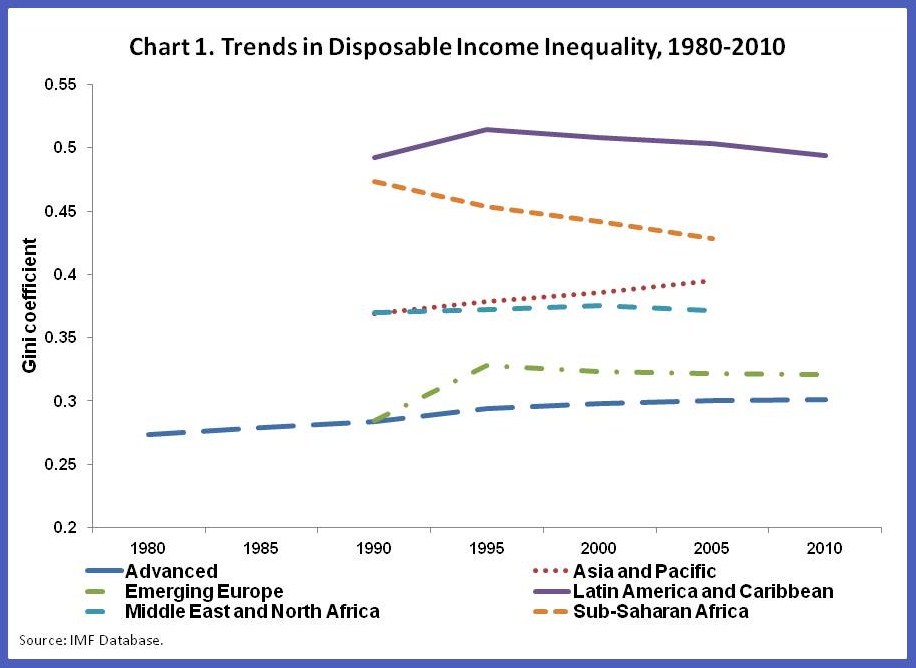

Our database on inequality trends in 150 advanced and developing countries shows that disposable income inequality (that is, after taxes and transfers) has increased in most advanced and many developing economies over recent decades (Chart 1). Inequality is measured by the Gini coefficient (which ranges from 0, when everyone has exactly the same income, to 1 when a single individual receives all the income of a society).

Even more striking is the large variation in average income inequality across regions.

Another striking trend has been the sharp increase in the share of income captured by the highest income groups since the early 1980s.

For example, in the United States, the share of market (that is, before taxes and transfers) income captured by the richest 10 percent surged from around 30 percent in 1980 to 48 percent by 2008. Similar trends have occurred in other advanced and also some developing economies.

Some experts have argued that such increases have been a major contributor to the recent financial crisis.

So what role has fiscal policy played in determining these trends?

A look at advanced economies

The good news is that taxes and public transfers have played a significant role in offsetting the increase in inequality.

Over the past two decades, fiscal policy decreased inequality by about one-third in OECD countries, with two-thirds of this decrease achieved through transfers such as child benefit and public pensions. The redistributive impact is even higher when in-kind transfers such as education and health are included.

The worrying news is that the distributive impact of fiscal policy has diminished since the mid-1990s.

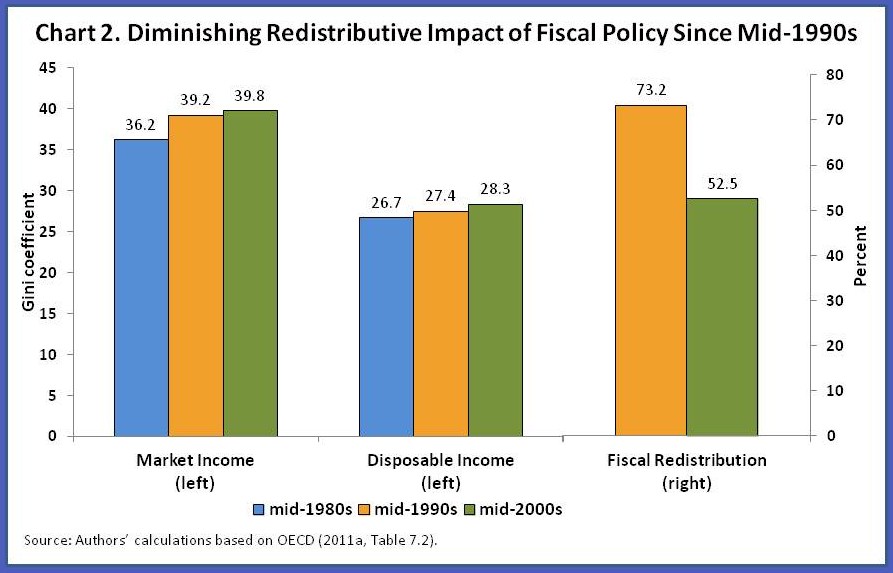

Chart 2 shows how market- and disposable-income inequality for working-age households have changed since the mid-1980s, with the difference between these capturing the redistributive impact of fiscal policy in each time period.

Whereas fiscal policy offset 73 percent of the 3 percentage point increase in market-income inequality up to the mid-1990s, it offset a much lower 53 percent of the increase up to the mid-2000s. Over the whole period, market-income inequality grew by twice as much as redistribution!

What’s responsible for the decreasing impact of fiscal policy?

We find that the reduction in the generosity of social benefits (particularly unemployment and social assistance benefits) and lower income tax rates, especially at higher income levels, have contributed most to the reduced impact of fiscal policy since 1990s.

This development is worrisome given the need for substantial fiscal consolidation in advanced economies in the coming years.

Indeed, in some countries, income distribution has already worsened since 2007 (for example, Ireland and Spain). However, fiscal policy can be used to mitigate the adverse impacts of consolidation by allowing automatic stabilizers (such as unemployment benefits) to work, protecting the most progressive social benefits, removing opportunities for tax avoidance and evasion, and increasing reliance on wealth and property taxes.

Role of fiscal policy in developing countries

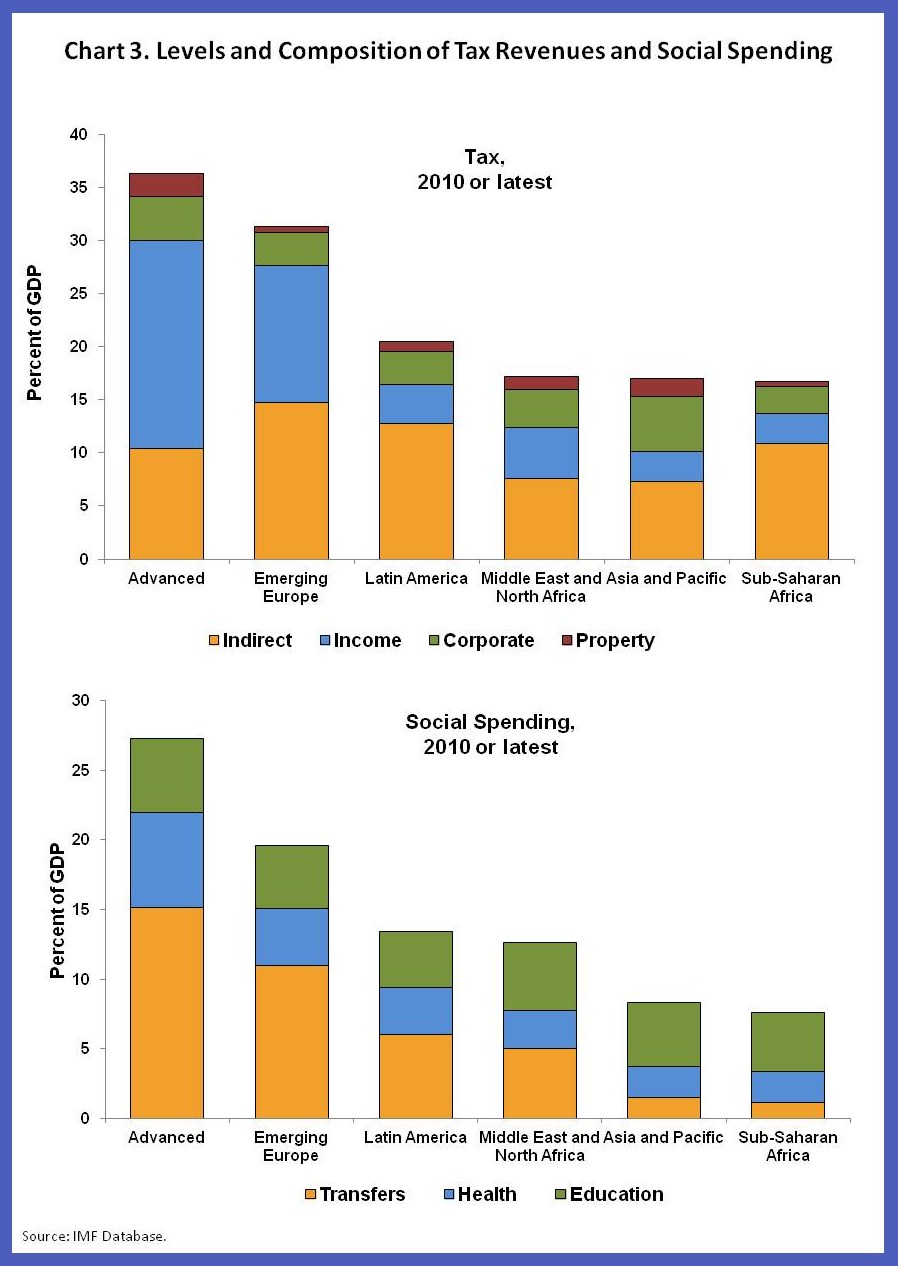

The increase in inequality in advanced countries pales into insignificance when compared to the gap in inequality between developing and advanced economies. Much of this higher income inequality can be explained by lower levels of taxation and public spending (Chart 3), as well as their greater reliance on less progressive tax and spending instruments.

So what can be done to change this?

On the tax side, the focus should be more on broadening tax bases rather than increasing tax rates, through reduced tax exemptions, closing loopholes and improving compliance.

However, continued tight revenue constraints and the large demands on these resources to finance development objectives means that greater emphasis will need to be placed on improving the progressivity of public spending through, for example, eliminating general price subsidies and better targeting of poverty programs to the most vulnerable.