With Western Europe’s banks under pressure, where does this leave Europe’s emerging economies and their financial systems that are dominated by subsidiaries of these very same banks? There is little doubt that the era of generous parent-funding for subsidiaries is over. But parent bank deleveraging—selling off assets, raising capital, and reducing loans, including to their subsidiaries—need not translate into a reduction of bank credit in emerging Europe.

A credit crunch can be avoided as long as parent banks reduce exposures gradually and domestic deposits, other banks, and local financial markets fill the void. Policymakers should create the conditions for this to happen.

The ties that bind

The dependence of the banking systems in emerging Europe on Western European banks is well known:

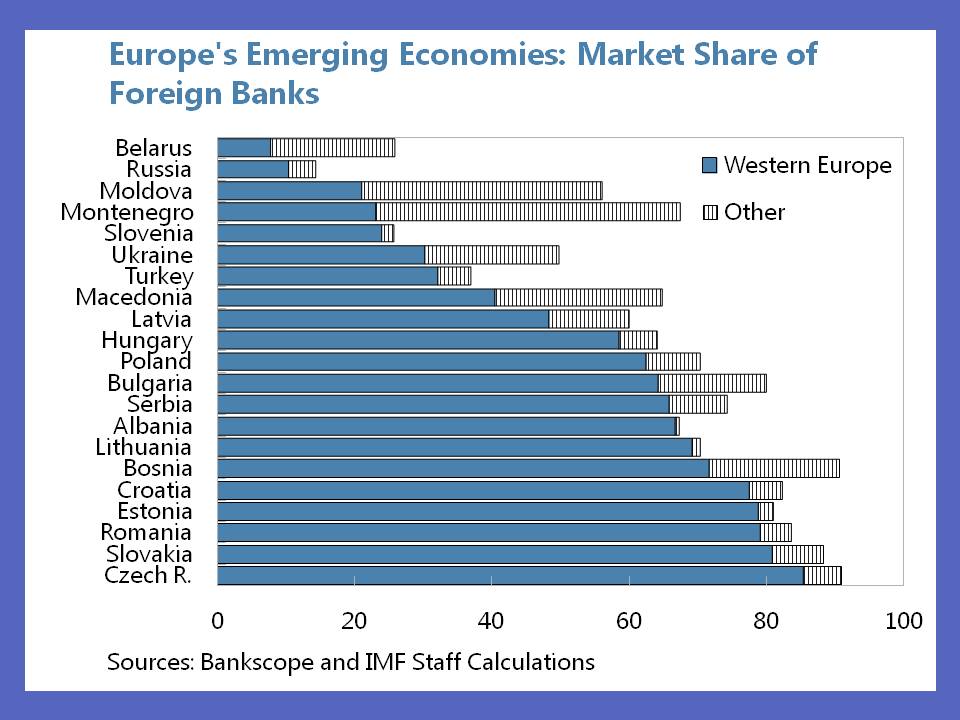

- Ownership— foreign banks control more than half of the banking systems in most of Central, Eastern, and Southeastern Europe. Their share exceeds 80 percent in Bosnia, the Czech Republic, Croatia, Estonia, Romania, and Slovakia. Only in Russia, Ukraine, Belarus, Moldova, Slovenia, and Turkey do they not dominate.

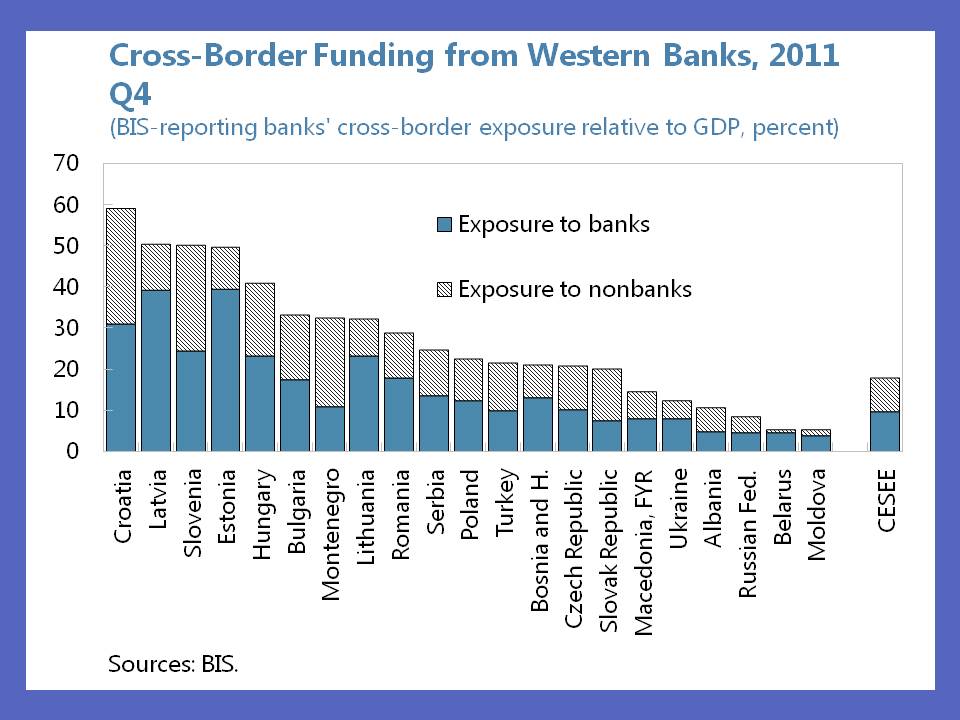

- Funding— foreign banks have lent up to 60 percent of GDP to countries in the region. The average stands at 27 percent of GDP. Roughly half of it is to banks, and direct cross-border lending to households and firms accounts for the rest.

Reflecting these close financial ties, whatever happens to Western Europe’s banks is keenly felt in emerging Europe.

When western banks felt flush in the years leading up to the crisis, they bankrolled much of the region’s credit-driven domestic demand boom. Not all countries with a large presence of foreign banks had a credit boom; the Czech Republic did not. When the global economic crisis hit in 2008, funding for the region came to an abrupt halt, and most countries fell into deep recessions.

With western banks now under pressure from the euro area crisis, is emerging Europe once again on the brink?

A closer look at developments in the second half of 2011 is instructive here. In this period, western banks were under intense funding pressures, before the European Central Bank provided relief by launching its 3-year refinancing operations. To cope, western banks reduced their funding to banks in the region by 8 percent. Yet, during the same period banks in Eastern Europe managed to attract substantial additional domestic deposits. The combined funding from both sources still grew in almost all countries, with the notable exceptions of Slovenia and Hungary.

[youtube http://www.youtube.com/watch?v=SdbEChoQC_U&w=560&h=315]

Plan for a rainy day and diversify

Countries need to do two things to mitigate the impact of possible future funding losses from western banks.

The first priority for policymakers is to promote stable domestic financial systems so that depositors continue to entrust their savings to banks that intermediate them effectively. Countries should maintain high standards for liquidity and capitalization, as well as sort out nonperforming loans, which are still high in much of the region. Developing additional funding sources, for example by promoting local currency financial markets, is also an important objective.

Second, countries need to be prepared for an escalation of financial tensions at home or abroad.

Frameworks for emergency support and bank resolution have been upgraded throughout the region—the main challenge now is to make sure that they would work smoothly in practice. Contingency planning, tight monitoring of banks, and close coordination between financial supervisors in the banks’ home and host countries are all critical.

No sudden moves

Policymakers also need to ensure that deleveraging remains orderly. Sudden large-scale exposure reductions of foreign banks would be difficult to compensate—and would also pose challenges for the balance of payments. Home and host country bank supervisors should work together in case a cross-border bank needs support or must be resolved.

They should keep each others’ interest in mind and avoid sudden and unilateral actions with adverse consequences for the other. This kind of coordination is at the heart of the latest initiative by officials, bankers, and regulators known as Vienna 2.0.

Given the tremendous credit boom many countries in emerging Europe went through between 2003 and 2008, some gradual and orderly deleveraging of western parent banks would not be a bad thing—it would help reduce the still high external debt in many countries.

But orderly and gradual are the key words. Europe’s emerging economies stand a good chance of leading a healthy life with deleveraging by parent banks, if policymakers and banks work together to keep the system on an even keel.