When it comes to adjusting public spending, getting the balance right is important. Fiscal adjustment is taking place in economies around the world, but risks remain high. Bringing debt and deficits down to more moderate levels is important to easing risks.

From one perspective, the sooner this happens, the better.

But, slashing budgets too abruptly can impede the overall economic recovery. And if the recovery stalls, debt and deficits will rise, and so will unemployment.

According to our analysis, what is needed is a steady but gradual adjustment. So, as we’ve been saying at the IMF for a while now, the pace of adjustment needs to be appropriate—not too fast, not too slow, but just right, for countries where financing conditions allow.

Improving picture

Compared to six months ago, there has been some decline in risks. This is primarily because of progress in policy implementation, with progress being made particularly in Europe.

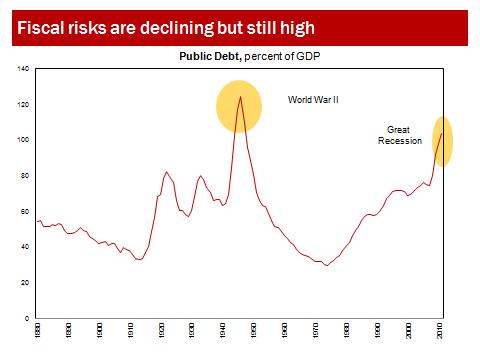

However, the risks remain very high, as underscored by continued market volatility, and by the fact that public debt is still on the rise. The chart below shows the public debt-to-GDP ratio over the last 130 years, on average, for the advanced economies. It shows advanced economies currently at a very high level— reached only once in the last 130 years, at the time of the Second World War.

So, the risks are still elevated in advanced economies. As the Fiscal Monitor underscores, the outlook is better in emerging economies, although they are still exposed to spillovers from advanced economies.

Altogether, fiscal adjustment is proceeding on average this year more or less at a pace that we regard as appropriate, taking into account the need to balance the different risks that countries are facing. In a few countries there would be room to reduce the pace of deficit reduction if the authorities wanted some extra insurance against downside risks to growth, but overall we think the pace of adjustment is broadly appropriate.

A closer look at the numbers

To get a sense of what’s really happening with deficits, it can be useful to look at the structural balance. This allows one to strip out the effects on the budget of faster or slower growth, as well as of one-time factors that may temporarily make the outturn look better or worse but that will not occur in future years. The change in the structural balance gives us a sense of how the deficit improved or worsened independent of cyclical and one-off factors.

In 2011, the change in the structural balance, country by country, amounted on average to 3/4 to 1 percentage points of GDP. More or less the same adjustment is taking place this year, 3/4 to 1 percent of GDP, on average.

The largest adjustment is observed in countries that are subject to market pressures. But except for Japan, which is still responding to the effects of the earthquake and Tsunami, all the advanced economies are reducing structural deficits. Notably, the United States and Germany, which are not subject to market pressure, are also adjusting over 2011–12 (and by about the same amount as each other).

So the adjustment is proceeding and will continue next year.

A long way to go

For some countries, a lot of progress will be made during 2012 and 2013. But for others, a lot will remain to be done in the following years to bring debt ratios down to pre-crisis levels. And even for countries that have already made substantial progress, the challenge will remain to maintain that progress for several years as debt ratios slowly come down.

What is needed in each country is a clear medium-term fiscal adjustment plan to reduce public debt over time. Some countries already have such plans in place. Others, like the United States and Japan, still have to clarify fully their plans to reduce public debt over the medium term. They need to do so soon. In the absence of such plans, which would help anchoring expectations, even more fiscal tightening may be needed than if there was a plan for a gradual adjustment.

For example, again, in the United States, in the absence of any additional measures the deficit will narrow in 2013 by about 3.5 percentage points of GDP, which will be the largest fiscal adjustment in a single year since 1947, when the deficit declined a lot because of the ending of military spending at the end of the War. The impact on growth of such a steep deficit decline in a very uncertain economic environment could be calamitous.

Pressures ease for emerging economies

Emerging economies saw considerable adjustment in 2011. The adjustment is virtually coming to an end in 2012, but we regard this as broadly appropriate, because on average the fiscal accounts of the emerging economies are not in such weak shape as those of advanced economies.

But emerging economies with high deficits and high debt will also have to continue the adjustment over time.

Key policy conclusions

First, fiscal adjustment must proceed at a steady pace, and one that is neither too fast nor too slow, if there is fiscal space.

- This means that if growth were to falter with respect to our current projections, countries should let the automatic stabilizers operate—like unemployment insurance or low-income tax credits. And if there is a loss of revenues because there is less growth, this loss of revenue should not be offset by further tightening measures that would make things more difficult.

- In an uncertain environment countries with fiscal space can consider also slowing the pace of fiscal adjustment to minimize downside risks to growth.

Second, a clear and credible medium-term fiscal adjustment plan is a key requirement for sustainable growth.

- Fiscal institutions can help through this process. The Fiscal Compact in Europe is a significant step in this regard.

- Further steps will have to be taken over the medium term in Europe toward a stronger form of fiscal federalism, better risk-sharing tools, progress on the issue of Eurobonds—these have been discussed a lot, but no decision has yet been taken. Eventually, also, there should be a stronger role for the EU budget, including addressing cyclical downturns in some regions. These are things that have to happen over the medium term. But the important element is that there is a plan and a shared consensus on what to do in these areas.

- Further reforms in fiscal institutions are also needed in other parts of the world. For example, the budget process in the United States is far from perfect. Reform in spending for pensions and health care is also crucial for long-term fiscal sustainability.

The impossible made possible

Bringing down public debt to the level where it was before the crisis may now seem almost impossible. But, the task will be greatly facilitated if countries grow faster over the longer run.

We have calculated that an increase in annual long-term economic growth of just a quarter of a percentage point could set in place a virtuous circle that would lead, after ten years, to a decline in the public debt-to-GDP ratio by 6 percentage points. This is because higher growth makes it easier to run a primary surplus and lowers the public debt-to-GDP ratio directly. This in turn lowers the interest rate, which in turn boosts economic growth.

If this virtuous circle between growth and reduction of public debt is activated, what many regard now as an almost impossible task, lowering public debt to where it was before the crisis, will look considerably easier.