If housing and labor market woes aren’t bad enough in the United States, they’re hurting Central America and the Caribbean too.

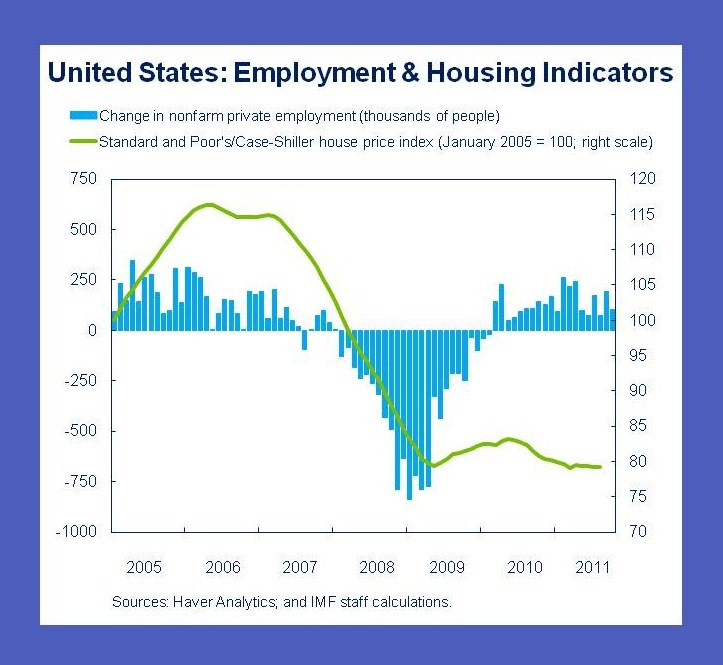

It has been five years since the U.S. housing bubble burst and three years since the onset of the global financial crisis. And still, in the world’s largest economy—which in the past quickly and vigorously recovered from downturns—jobs and output are barely growing. In fact, output is just 1.6 percent higher than a year ago, and almost 14 million people remain unemployed.

True, some of this lackluster economic performance reflects global factors, particularly the uncertainty surrounding the lingering European crisis, but also temporary factors related to the Japanese earthquake. However, on the domestic front, fragile household balance sheets and stubbornly high unemployment have been major factors impeding growth. This latter development is having negative spillovers on many Central American and Caribbean countries, where remittances and tourism flows from workers in the United States are important for their economies (see our most recent Regional Economic Outlook for Western Hemisphere).

Home Sweet Home: No More

American households have been feeling the impact of the battered housing market for a while now. Over 10 million (out of 74 million) homeowners have lost their

homes in foreclosures since the housing bubble burst and others have experienced unprecedented declines in home prices—down more than 30 percent from their peak. This has translated into a loss of over $6.5 trillion in real estate wealth since end-2006. And with the hit to wealth, and an uncertain outlook for house prices, consumers—in the past, the main engine of U.S. growth—have slowed spending considerably.

Looking for a Job? Wait in Line Please

U.S. consumers are also tightening their belts given the painfully high unemployment rate—stuck at around 9 percent—as well as falling real wages and elevated uncertainty about job prospects. Median household income has declined to its lowest level in more than a decade, and the poverty rate is now at a 17-year high, crimping consumer confidence. With more than 40 percent of the unemployed, or some 5.9 million people, out of work for six months or longer, and some 8.9 million working part-time involuntarily, this is more than cyclical: structural factors might also be at play.

Long-term unemployment is critical here; many unemployed workers may take longer to find jobs because their skills are no longer in demand or because they need to relocate to a different state with better job prospects; a long and slow process, especially in a paralyzed housing market. In fact, some of our earlier work finds that the unemployment rate might be 1¾ percentage points higher than in past “normal” times given skill mismatches and the housing market hurdles.

Sorry honey, no vacation for us!

Problems in both the housing and labor markets in the United States are having negative repercussions on its Central America and Caribbean neighbors, who are reliant on remittances and tourism from the United States.

With tourism being a luxury good, rather than an essential, Americans have slashed their tourism spending considerably—spending per tourist in the Caribbean is down to levels last seen in 2004.

Meanwhile, Hispanic immigrants have disproportionately suffered from the U.S. slowdown’s effect on remittances.

- the poverty rate for Hispanics is at a 13-year high;

- the median home equity of Hispanics has fallen by more than 50 percent since 2005; and

- unemployment among Hispanics is about 2¼ percentage points higher than the average, since they overwhelmingly work in sectors (construction, extraction, transportation, and services) that have been hardest hit by the financial crisis.

It is no surprise, therefore, that remittances to Central America fell from an average of 12½ percent of GDP in 2006 to about 10 percent in 2010.

When will it end?

Fixing the U.S. housing and labor market has been a daunting and challenging task, with most analysts now expecting an even more protracted recovery on both fronts, than say six months ago.

Given that the weak housing market has been a persistent impediment making a speedier U.S. recovery more difficult, a new initiative aimed at encouraging mortgage refinancing (so that borrowers can take advantage of historically low mortgage rates) has recently been unveiled.

This is a step in the right direction—given the negative impact of the weak housing market on the economy, forceful measures to expand mortgage modification and refinancing programs are urgently needed.

With expectations for a protracted U.S. recovery, more challenging days could lie ahead for countries in Latin America and the Caribbean highly reliant on remittances and tourism flows from the United States.

While U.S. labor and housing markets are expected to remain weak for some time, tourism dependent countries in the region could begin to attract more visitors by tapping other markets (for example, South America and Asia) and/or offering more competitive packages. Meanwhile, those reliant on remittances could work towards diversifying their export base away from advanced economies. While the results of these efforts will likely only materialize over the medium term, it is not too late to begin today.